PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766165

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766165

Broadcast Switchers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

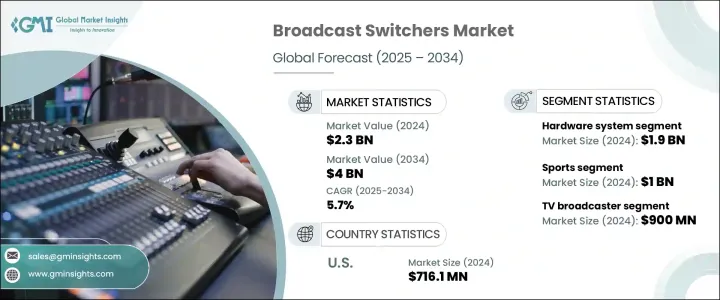

The Global Broadcast Switchers Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 4 billion by 2034. This growth is largely driven by the transformation in media consumption, particularly the rising demand for live, high-resolution video content and seamless multi-platform broadcasting experiences. As digital content delivery continues to evolve, the broadcast switchers industry is witnessing increased adoption of technologies that allow for higher performance, flexibility, and interoperability across diverse broadcasting environments.

One of the central forces propelling the market forward is the changing landscape of video production and delivery. As broadcasters adapt to fast-evolving viewer preferences, they are increasingly relying on switchers capable of supporting high-definition formats, remote production workflows, and hybrid environments. This includes the growing trend of cloud integration and IP-based switching systems that enable real-time, scalable video production across multiple devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $4 Billion |

| CAGR | 5.7% |

Broadcast switchers are essential in streamlining multi-source video inputs and delivering seamless transitions, effects, and live feeds, which are now expected even in lower-tier productions such as corporate webinars, online events, and educational broadcasts. The demand for compact, energy-efficient, and user-friendly switchers is also on the rise, particularly in mobile production setups and remote locations. Additionally, advancements such as AI-driven automation, real-time scene recognition, and intuitive user interfaces are playing a key role in enhancing the efficiency and accuracy of live content production.

The market is segmented by system into hardware and software. In 2024, hardware systems dominated the segment with a value of USD 1.9 billion. This dominance stems from the increasing preference for physical switchers that offer high processing power and durability, especially in high-pressure environments like outdoor broadcasts and live events. These systems are increasingly tailored to handle ultra-high-definition formats such as 4K and 8K, ensuring compatibility with the latest video standards. Compact, modular hardware units are becoming particularly important for on-the-go production, offering versatility in environments like OB vans, studio setups, and field shoots. Moreover, there's growing interest in hardware switchers that provide cost-effective solutions for small-scale operations, including religious events, academic sessions, and corporate streaming needs.

When examined by application, the sports category emerged as the largest contributor, accounting for USD 1 billion in 2024. This segment is experiencing significant momentum as demand intensifies for low-latency, multi-angle live broadcasts. Professional sports broadcasting increasingly requires switchers capable of handling multiple camera feeds simultaneously while supporting formats such as HDR and UHD for immersive viewing. The ability to switch between feeds efficiently and apply real-time graphics and transitions has become essential to meet modern audience expectations. These needs are pushing broadcast professionals to invest in advanced switchers that provide superior flexibility, quick response times, and uninterrupted output.

By end user, TV broadcasters led the market in 2024, with a valuation of USD 900 million. This leadership is due to the widespread shift toward high-definition and ultra-HD content delivery standards. Broadcasters are under pressure to modernize their production infrastructure to stay competitive against digital platforms, prompting greater investment in switchers that allow high-quality, real-time video manipulation. The deployment of automated switching systems is also rising, reducing reliance on manual operations and improving response times for live content such as news, weather, and talk shows. Advanced switchers are now central to creating dynamic, multi-source programming, enabling broadcasters to elevate production quality while catering to growing consumer expectations.

Geographically, the United States led the global market with USD 716.1 million in revenue in 2024. The country's dominance is fueled by high investments in broadcast infrastructure and the widespread adoption of advanced production tools. Local broadcasters and production companies are heavily focused on enhancing video quality, speed, and operational flexibility, driving demand for next-generation switchers that can operate across various platforms and resolutions. These tools are also instrumental in managing diverse content outputs, ensuring consistent quality for both traditional and digital audiences.

The competitive landscape of the broadcast switchers market is marked by a mix of established industry leaders and emerging players. The top four companies-Grass Valley, Sony Group Corporation, Blackmagic Design Pty. Ltd., and Ross Video Ltd.-collectively held around 40% of the global market share in 2024. These companies are actively developing IP-native and software-defined switchers to meet the demand for scalable and remotely managed workflows.

Investment in innovations like low-latency 8K switching, AI-powered production tools, and multi-platform output capabilities is a key focus for these market leaders. Additionally, manufacturers are integrating features such as real-time metadata tagging, scene recognition, and modular I/O configurations to cater to the diverse needs of professionals operating in studios, newsrooms, and live production settings. Features like touchscreen control surfaces, cloud sync, and AR support are becoming standard across many product lines to enable smarter and more interactive video production experiences.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for live broadcasting & streaming

- 3.3.1.2 Growing adoption of cloud-based broadcast solutions

- 3.3.1.3 Expansion of OTT platforms

- 3.3.1.4 Increasing investments in broadcast infrastructure

- 3.3.1.5 Rise of esports and gaming broadcasting

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial investment cost

- 3.3.2.2 Rapid technological changes

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By System, 2021 – 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Sports

- 6.3 News

- 6.4 Live entertainment

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Tv broadcasters

- 7.3 Cable & satellite providers

- 7.4 Production houses

- 7.5 Live event organizers

- 7.6 Educational institutions

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Blackmagic Design Pty. Ltd.

- 9.2 Broadcast Pix Inc.

- 9.3 Crestron Electronics, Inc.

- 9.4 Datavideo

- 9.5 FOR-A Company Limited.

- 9.6 Grass Valley

- 9.7 Panasonic Holdings Corporation

- 9.8 PureLink

- 9.9 Roland Corporation

- 9.10 Ross Video LTD.

- 9.11 Sony Group Corporation

- 9.12 tvONE