PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766166

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766166

Wrapping and Bundling Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

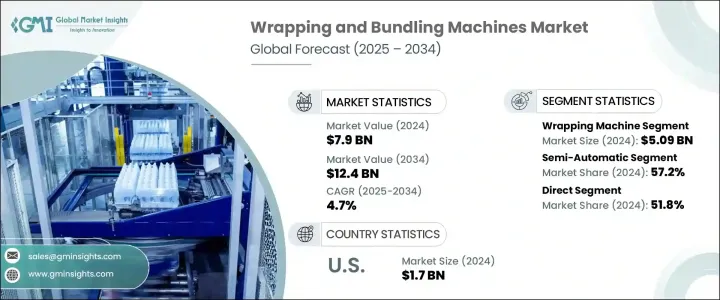

The Global Wrapping and Bundling Machines Market was valued at USD 7.9 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 12.4 billion by 2034. The rising focus on automation across various industries is one of the major drivers behind this market growth. As companies aim to boost operational efficiency, cut back on manual labor, and ensure packaging consistency, demand for these machines continues to grow. Industries dealing with high production volumes increasingly rely on automated systems to streamline operations, reduce error rates, and optimize long-term costs. These machines not only speed up the packaging process but also minimize downtime while addressing workforce shortages and wage pressures. With rising labor challenges and the need for streamlined, error-free packaging, automation becomes a key strategy for sustained productivity.

Modern wrapping and bundling systems are also integrating intelligent technologies such as sensors, data-driven monitoring, and compatibility with enterprise-level software. These features improve efficiency through real-time maintenance alerts, precision control, and analytics-driven operations. Adoption is spreading from developed to developing markets, where manufacturing upgrades are aligning with national growth agendas. As manufacturers deal with evolving compliance and hygiene regulations, advanced packaging equipment is increasingly seen as a strategic investment for long-term resilience and growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.9 Billion |

| Forecast Value | $12.4 Billion |

| CAGR | 4.7% |

The wrapping machine segment generated USD 5.09 billion in 2024 and is anticipated to grow at a CAGR of 5.4% from 2025 to 2034. Wrapping systems are outperforming bundling units in popularity due to their flexibility, broad application range, and ease of automation. These machines are essential for maintaining product condition, especially for items prone to spoilage or damage during transport. From small setups to large manufacturing plants, wrapping solutions can accommodate diverse product shapes, sizes, and packaging films, making them suitable for a wide array of production environments. Their scalability and adaptability are key factors supporting their market dominance.

The semi-automatic machines segment held a 57.2% share and are projected to grow at a CAGR of 5.8% through 2034. This segment appeals to businesses looking for a cost-effective, reliable transition from manual processes. These machines strike a perfect balance between affordability, functionality, and ease of use. They require less capital investment and minimal operator training while offering improved consistency over manual systems. Because of their adaptability to changing product lines and small-to-medium batch sizes, semi-automatic machines are commonly used in companies handling multiple packaging formats. Their widespread use in sectors with moderate automation needs makes them a vital bridge toward full automation adoption.

United States Wrapping and Bundling Machines Market with USD 1.7 billion in 2024 and is projected to grow at a CAGR of 6.1% from 2025 to 2034. Growth in this region is fueled by the shift toward high-efficiency automated systems across packaging operations. As businesses look to modernize operations, U.S.-based manufacturers are investing in upgraded, high-speed equipment aligned with safety regulations and smart manufacturing principles. The country's advanced infrastructure and integration of digital technologies further enhance its leadership position in the global landscape.

Top companies shaping this market include Tetra Laval Group, Adelphi Group, Robopac, Syntegon Technology, Ishida, Wulftec International, Omori Machinery, Krones, Signode Industrial Group, Coesia, Lantech, Multivac, Optima Packaging Group, nVenia, and Nichrome Packaging Solutions. To strengthen their market position, manufacturers are focusing on technological innovation and smart automation. They are developing machines with IoT capabilities, modular designs, and compatibility with digital factory systems to increase customer value. Many firms are localizing production to reduce supply chain risks and improve service delivery. Product diversification and customized solutions for specific industries are also driving long-term partnerships. Strategic mergers and acquisitions are helping companies expand their geographic reach and portfolio offerings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machine

- 2.2.3 Mode of operation

- 2.2.4 Material

- 2.2.5 Packaging type

- 2.2.6 End use industry

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for automation in packaging

- 3.2.1.2 Growth in e-commerce and logistics

- 3.2.1.3 Food & beverage and pharma industry growth

- 3.2.1.4 Sustainability and eco-friendly packaging trends

- 3.2.1.5 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment

- 3.2.2.2 Complex maintenance and downtime risk

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Machine

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code 842240)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.1.1 Industry structure and concentration

- 4.1.2 Competitive intensity assessment

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.3.1 Product positioning

- 4.3.2 Price-performance positioning

- 4.3.3 Geographic presence

- 4.3.4 Innovation capabilities

- 4.4 Strategic dashboard

- 4.4.1 Competitive benchmarking

- 4.4.1.1 Manufacturing capabilities

- 4.4.1.2 Product portfolio strength

- 4.4.1.3 Distribution network

- 4.4.1.4 R&D investments

- 4.4.2 Strategic initiatives assessment

- 4.4.3 SWOT analysis of key players

- 4.4.1 Competitive benchmarking

- 4.5 Future competitive outlook

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Wrapping machine

- 5.2.1 Stretch wrapping

- 5.2.2 Shrink wrapping

- 5.2.3 Other machines

- 5.3 Bundling machine

- 5.3.1 Shrink bundling machines

- 5.3.2 Film bundling machines

- 5.3.3 Strap bundling machines

- 5.3.4 Sleeve bundling machines

Chapter 6 Market Estimates & Forecast, By Mode of operation, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Automatic

- 6.3 Semi-automatic

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Plastic films

- 7.3 Biodegradable films

- 7.4 Paper-based wraps

- 7.5 Corrugated cardboard

Chapter 8 Market Estimates & Forecast, By Packaging Type, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Primary packaging

- 8.3 Secondary packaging

- 8.4 Tertiary packaging

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Food & beverage

- 9.3 Pharmaceuticals

- 9.4 Personal care & cosmetics

- 9.5 Consumer electronics

- 9.6 Textiles

- 9.7 Logistics & warehousing

- 9.8 Chemicals

- 9.9 Industrial goods

- 9.10 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Adelphi Group

- 12.2 Coesia

- 12.3 Ishida

- 12.4 Krones

- 12.5 Lantech

- 12.6 Multivac

- 12.7 Nichrome Packaging Solutions

- 12.8 nVenia

- 12.9 Omori Machinery

- 12.10 Optima Packaging Group

- 12.11 Robopac

- 12.12 Signode Industrial Group

- 12.13 Syntegon Technology

- 12.14 Tetra Laval Group

- 12.15 Wulftec International