PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766167

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766167

Europe Ride Sharing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

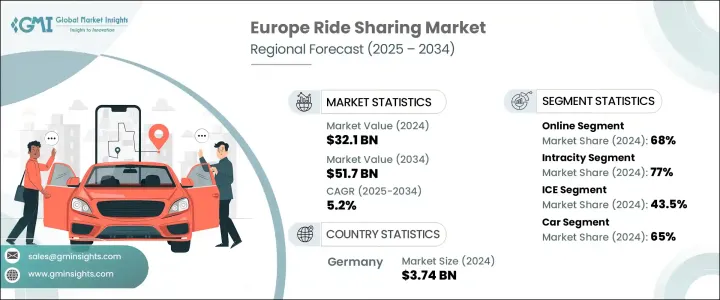

Europe Ride Sharing Market was valued at USD 32.1 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 51.7 billion by 2034. This growth is largely driven by urbanization, rising fuel prices, and heightened awareness of environmental issues. Moreover, the increasing use of smartphones and favorable government policies have played a crucial role in accelerating the adoption of ride-sharing services. As cities become more crowded, traditional car ownership is gradually being replaced by more flexible, on-demand transportation options. The younger demographic, including Millennials and Gen Z, values the convenience, affordability, and eco-friendliness that ride-sharing platforms offer. These consumers are increasingly opting for app-based services that align with their digital-first mindset, further accelerating the shift towards ridesharing in metropolitan areas.

The widespread availability of smartphones and improved digital literacy across Europe has made ride-sharing apps easily accessible to a broad range of users. Consumers can now book rides, track vehicles in real time, and make payments seamlessly through their smartphones. This has led to a surge in the number of users, particularly in urban areas, where ride-sharing services are expanding rapidly. App-based platforms such as Uber, Bolt, and BlaBlaCar are tapping into this growing trend by offering user-friendly services that cater to the evolving needs of consumers. With technology-driven solutions, real-time tracking, and secure payment options, these platforms are shaping the future of urban transportation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $32.1 Billion |

| Forecast Value | $51.7 Billion |

| CAGR | 5.2% |

The online segment, which held a 68% share in 2024, is expected to grow at a CAGR of 5.5% during 2025-2034. This dominance is attributed to the widespread use of smartphones and high-speed internet across Europe, which has made app-based ride-sharing the most preferred mode of transportation. Ride-sharing apps provide users with easy access to transportation, offering convenience and transparency through features such as GPS navigation, real-time updates, and payment security. Additionally, many ride-sharing companies offer loyalty programs and discounts to attract more users and encourage repeat business, further boosting the shift from traditional transport methods to digital services.

Intracity ride-sharing segment accounted for 77% share in 2024 and is anticipated to grow at a CAGR of 5% by 2034. Intracity ride-sharing has become increasingly popular due to urbanization and space limitations in densely populated cities. As public transportation options become overcrowded, shared mobility services are emerging as an attractive alternative. In major cities, the demand for short, frequent trips has led to a rise in the popularity of ride-hailing services. Additionally, strict environmental regulations in many European cities, such as low-emission zones and congestion charges, are encouraging residents to opt for shared transportation, further driving the growth of intracity ride-sharing.

Germany Ride Sharing Market held a 28.9% share and generated USD 3.74 billion in 2024. The country's strong economy, large population, and highly urbanized regions provide fertile ground for the growth of ride-sharing services. Germany's advanced infrastructure, high smartphone penetration, and regulatory support make it a central hub for innovation in the mobility sector. Moreover, Germany's automotive legacy, home to major car brands, is positioning the country as a leader in the development of electric and autonomous vehicle technologies, which is expected to enhance the appeal of ride-sharing in the region.

Key players in the Europe Ride Sharing Market include Lyft, Uber, BlaBlaCar, Bolt, Cabify, inDrive, and Wheely, which collectively held around 17% of the market share in 2024. To strengthen their market presence, companies in the Europe Ride-Sharing Industry are focusing on expanding their service offerings to meet evolving consumer needs. This includes developing more localized and efficient ride-hailing solutions, integrating electric vehicles (EVs) into their fleets, and implementing innovative technology to improve user experience. Many companies are prioritizing the development of eco-friendly transportation options with environmental concerns. Partnerships with municipalities and regulatory bodies are also key strategies for ensuring compliance with local regulations and securing a competitive edge.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Region

- 1.3.2 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Business Model

- 2.2.3 Propulsion

- 2.2.4 Booking Mode

- 2.2.5 Commute

- 2.2.6 Ownership

- 2.2.7 Vehicle

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing urban congestion and limited parking space

- 3.2.1.2 Increase in smartphone penetration and digital literacy

- 3.2.1.3 Growing popularity among younger generations

- 3.2.1.4 Rise in adoption of electric vehicles in ride sharing fleets

- 3.2.1.5 Door-to-door services provide flexibility for busy consumers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High operational costs and price competition

- 3.2.2.2 Insufficient drivers during peak times

- 3.2.3 Market opportunities

- 3.2.3.1 Adoption of electric and sustainable fleets

- 3.2.3.2 Growth of peer-to-peer car sharing platforms

- 3.2.3.3 Increased demand for mobility-as-a-service (MaaS) platforms

- 3.2.3.4 Rising tourism and cross-border ride sharing

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Western Europe

- 3.4.2 Northern

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Mobile applications and on-demand booking

- 3.7.1.2 AI, machine learning, and predictive analytics

- 3.7.1.3 Cloud computing and scalable infrastructure

- 3.7.1.4 GPS and real-time mapping

- 3.7.2 Emerging technologies

- 3.7.2.1 Autonomous Vehicles (Robo-taxis)

- 3.7.2.2 Electric Vehicles (EVs) and Charging Infrastructure

- 3.7.2.3 Blockchain for decentralized platforms and secure transactions

- 3.7.2.4 Internet of Things (IoT) for vehicle monitoring and smart cities integration

- 3.7.1 Current technological trends

- 3.8 Price trends

- 3.8.1 By Region

- 3.8.2 By Vehicle

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Consumer behavior and usage patterns

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Western Europe

- 4.2.2 Eastern Europe

- 4.2.3 Northern Europe

- 4.2.4 Southern Europe

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Business Model, 2021 - 2034 ($Bn & Fleet Size)

- 5.1 Key trends

- 5.2 Peer-to-peer (P2P)

- 5.3 Business-to-business (B2B)

- 5.4 Business-to-customer (B2C)

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn & Fleet Size)

- 6.1 Key trends

- 6.2 ICE

- 6.3 CNG/LPG

- 6.4 Electric vehicles

Chapter 7 Market Estimates & Forecast, By Booking Mode, 2021 - 2034 (USD Million & Fleet Size)

- 7.1 Key trends

- 7.2 Online

- 7.3 Offline

Chapter 8 Market Estimates & Forecast, By Commute, 2021 - 2034 (USD Million & Fleet Size)

- 8.1 Key trends

- 8.2 Intracity

- 8.3 Intercity

Chapter 9 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Million & Fleet Size)

- 9.1 Key trends

- 9.2 Car

- 9.3 Motorcycle

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million & Fleet Size)

- 10.1 Key trends

- 10.2 Western Europe

- 10.2.1 Germany

- 10.2.2 Austria

- 10.2.3 France

- 10.2.4 Switzerland

- 10.2.5 Belgium

- 10.2.6 Luxembourg

- 10.2.7 Netherlands

- 10.2.8 Portugal

- 10.3 Eastern Europe

- 10.3.1 Poland

- 10.3.2 Romania

- 10.3.3 Czechia

- 10.3.4 Slovenia

- 10.3.5 Hungary

- 10.3.6 Bulgaria

- 10.3.7 Slovakia

- 10.3.8 Croatia

- 10.4 Northern Europe

- 10.4.1 UK

- 10.4.2 Denmark

- 10.4.3 Sweden

- 10.4.4 Finland

- 10.4.5 Norway

- 10.5 Southern Europe

- 10.5.1 Italy

- 10.5.2 Spain

- 10.5.3 Greece

- 10.5.4 Bosnia and Herzegovina

- 10.5.5 Albania

Chapter 11 Company Profiles

- 11.1 BlaBlaCar

- 11.2 Blacklane

- 11.3 Bolt

- 11.4 Cabify

- 11.5 Cityscoot

- 11.6 Cooltra

- 11.7 FreeNow

- 11.8 Gett

- 11.9 GoTo Global

- 11.10 GreenMobility

- 11.11 Heetch

- 11.12 inDrive

- 11.13 Lyft

- 11.14 Share Now

- 11.15 TIER Mobility

- 11.16 Ubeeqo

- 11.17 Uber

- 11.18 Via

- 11.19 Wheely

- 11.20 Zity