PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766168

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766168

Carbon Fiber Wraps (Construction) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

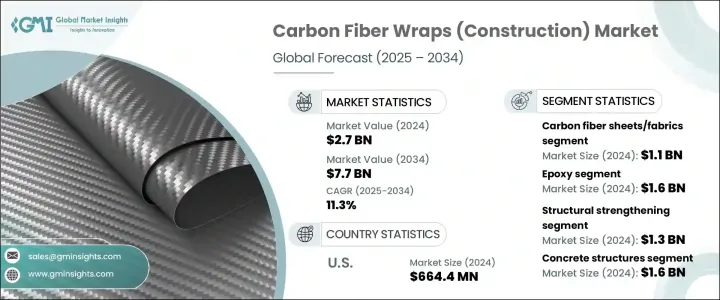

The Global Carbon Fiber Wraps (Construction) Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 11.3% to reach USD 7.7 billion by 2034. This robust growth is driven by the urgent need to strengthen and rehabilitate aging infrastructure across both developed and emerging economies. As countless bridges, buildings, and transportation networks deteriorate due to age, governments and private developers are increasingly turning to carbon fiber wraps as a more practical and less disruptive alternative to full-scale replacements. These wraps offer easier application, lower costs, and quicker turnaround, making them a favorable option for structural upgrades.

Their lightweight nature, corrosion resistance, and ability to deliver durable reinforcement without altering original architectural features make them especially suitable for limited-access or sensitive construction zones. In regions prone to seismic activity, the growing emphasis on earthquake preparedness has further boosted adoption, supported by updated regulatory frameworks. Carbon fiber wraps improve a structure's flexibility and resistance to shear forces, significantly enhancing its disaster resilience capabilities. These factors continue to drive steady market demand, especially in infrastructure retrofitting and structural rehabilitation sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 billion |

| Forecast Value | $7.7 billion |

| CAGR | 11.3% |

The carbon fiber sheets and fabrics segment generated USD 1.1 billion in 2024 and is projected to grow at a CAGR of 10.9% from 2025 to 2034. Within the fiber type category, these products dominate due to their ease of installation, high strength-to-weight ratio, and compatibility with various surfaces. Their ability to mold over complex geometries allows for uniform load distribution, making them ideal for reinforcing beams, columns, and slabs. This form is widely used in repair and retrofitting applications for both public and private infrastructure. Their versatility and adaptability position them as the preferred solution in structural enhancement projects.

The epoxy resin segment reached USD 1.6 billion in 2024 and is expected to grow at a CAGR of 11.6% during 2025-2034. Epoxy resins are the primary bonding agent for carbon fiber wraps, valued for their high tensile strength, chemical resistance, and excellent adhesion properties. Their compatibility with multiple structural substrates enhances the wrap's performance and long-term structural integrity. Epoxy's reliability in seismic retrofitting, structural reinforcement, and restoration projects continues to support its market leadership. Meanwhile, polyurethane and vinyl ester resins are gaining traction in applications that demand higher flexibility or superior corrosion resistance. Polyurethane is well-suited for dynamic environments where structures face variable loading and thermal conditions.

U.S. Carbon Fiber Wraps (Construction) Market was valued at USD 664.4 million in 2024 and is projected to grow at a CAGR of 11% through 2034. The surge in demand is fueled by continued investment in infrastructure renewal and strict compliance with modern safety and durability regulations. Federal and state-level initiatives aimed at strengthening bridges, highways, and public facilities have increased the adoption of advanced materials. Additionally, the integration of new materials in retrofitting and the presence of innovative construction companies further propel the market. The country's advanced engineering landscape also contributes to the rising use of carbon fiber wraps in both new and restoration projects.

Leading companies in the Global Carbon Fiber Wraps (Construction) Market include Mapei S.p.A., Mitsubishi Chemical Corporation, Sika AG, Teijin Limited, and Toray Industries, Inc. To reinforce their market positions, key players in the carbon fiber wraps (construction) sector are employing a combination of strategies. Companies are investing in R&D to improve resin compatibility, enhance bonding performance, and extend the lifespan of wrap materials. Strategic partnerships with construction firms and infrastructure contractors are also being formed to accelerate project deployment and boost market reach. Firms are expanding their product lines to include different fiber weaves and customized resin systems to suit varying structural requirements. In addition, many are emphasizing sustainability by developing environmentally friendly resins and promoting low-carbon construction practices. Training programs and technical support offerings are being expanded to help end-users adopt these systems efficiently.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Fiber type

- 2.2.3 Resin type

- 2.2.4 Application

- 2.2.5 Structure type

- 2.2.6 End use sector

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Fiber Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Carbon fiber sheets/fabrics

- 5.3 Carbon fiber tapes

- 5.4 Carbon fiber rods

- 5.5 Pre-cured carbon fiber laminates

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Resin Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Epoxy

- 6.3 Polyurethane

- 6.4 Vinyl ester

- 6.5 Polyester

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Structural strengthening

- 7.2.1 Flexural strengthening

- 7.2.2 Shear strengthening

- 7.2.3 Column confinement

- 7.2.4 Axial strengthening

- 7.3 Seismic retrofitting

- 7.4 Rehabilitation and repair

- 7.4.1 Corrosion damage repair

- 7.4.2 Impact damage repair

- 7.4.3 Fire damage repair

- 7.5 Blast protection

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Structure Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Concrete structures

- 8.3 Masonry structures

- 8.4 Steel structures

- 8.5 Timber structures

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By End Use Sector, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Bridges and highways

- 9.3 Buildings and structures

- 9.3.1 Commercial buildings

- 9.3.2 Residential buildings

- 9.3.3 Industrial buildings

- 9.4 Water and wastewater infrastructure

- 9.5 Marine structures

- 9.6 Historical and heritage structures

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East & Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East & Africa

Chapter 11 Company Profiles

- 11.1 Sika AG

- 11.2 Mapei S.p.A.

- 11.3 Fyfe Co. LLC (Aegion Corporation)

- 11.4 Simpson Strong-Tie Company Inc.

- 11.5 Master Builders Solutions (MBCC Group)

- 11.6 SGL Carbon SE

- 11.7 Toray Industries, Inc.

- 11.8 Mitsubishi Chemical Corporation

- 11.9 Teijin Limited

- 11.10 Hexcel Corporation

- 11.11 Structural Technologies, LLC

- 11.12 Composite Group Chelyabinsk

- 11.13 Chomarat Group

- 11.14 Owens Corning

- 11.15 Nippon Steel Chemical Co., Ltd.