PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766169

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766169

Nerve Conduit, Nerve Wrap, and Nerve Graft Repair Product Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

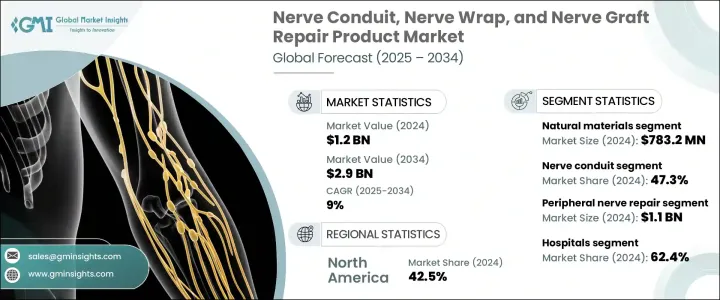

The Global Nerve Conduit, Nerve Wrap, and Nerve Graft Repair Product Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 9% to reach USD 2.9 billion by 2034. This market is driven by a growing number of peripheral nerve injuries, advances in biomaterials, an increasing preference for nerve-sparing solutions, and regulatory support for medical devices used in nerve repair. Peripheral nerve injuries, which occur outside of the brain and spinal cord, are on the rise due to factors such as accidents, trauma, surgeries, and an aging population. These injuries commonly affect the upper limbs and often lead to loss of motor or sensory function, pain, and long-term psychosocial impacts.

The growing frequency of road traffic accidents, workplace injuries, sports-related accidents, and penetrating trauma has significantly amplified the demand for surgical interventions involving nerve conduits, wraps, and grafts. These injuries often result in extensive damage to peripheral nerves, particularly in the limbs, where direct suturing becomes challenging due to the size or location of the nerve gap. In such cases, nerve repair products like conduits, wraps, and grafts offer an essential solution for restoring functionality and promoting nerve regeneration. Road traffic accidents have become a major contributor to peripheral nerve injuries, as the force of impact often leads to severe trauma in critical nerve pathways. Similarly, workplace injuries, including those in high-risk environments such as factories or construction sites, continue to be a leading cause of nerve damage, especially among manual laborers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.9 Billion |

| CAGR | 9% |

The nerve conduit segment held the largest share of 47.3% in 2024. Conduits are favored in clinical settings for their ease of use and ability to repair small to moderate nerve gaps. These devices provide a less invasive, tension-free alternative to autografts, which are more complex and often lead to complications at the donor site. Nerve conduits serve as channels that guide axons through nerve gaps, ensuring proper nerve regeneration. The growing adoption of conduits, especially for nerve gaps that are too small for grafts, has significantly driven market expansion.

The natural materials segment generated USD 783.2 million in 2024, driven by their superior compatibility with biological systems and their ability to enhance tissue integration. These materials play a critical role in facilitating optimal nerve regeneration, as they closely mimic the body's natural structure, promoting more effective healing than synthetic alternatives. Natural materials like collagen, decellularized extracellular matrices (ECM), and processed human allografts are preferred for their ability to create a conducive microenvironment for axonal growth.

U.S. Nerve Conduit, Nerve Wrap, and Nerve Graft Repair Product Market was valued at USD 461.1 million in 2024, driven by the high incidence of nerve injuries resulting from trauma care, plastic and reconstructive surgeries, orthopedic procedures, and road traffic accidents. The availability of FDA-approved nerve grafts, conduits, and wraps, coupled with favorable reimbursement policies for nerve repair, has helped drive the adoption of these products in hospitals and outpatient clinics across the country.

Leading companies in the Nerve Conduit, Nerve Wrap, and Nerve Graft Repair Product Market include Axogen, Axolotl Biologix, BioCircuit Technologies, Checkpoint Surgical, Collagen Matrix, Cook Group, Integra LifeSciences, KeriMedical, Medovent, Newrotex, Orthocell, Polyganics, Stryker Corporation, Synovis, and Toyobo. To strengthen their market position, companies in the nerve conduit, nerve wrap, and nerve graft repair sectors are focusing on expanding their product offerings and developing innovative solutions that cater to the evolving needs of patients with peripheral nerve injuries. Many companies are investing in research and development to improve the functionality and performance of nerve repair products, with an emphasis on biomaterials that enhance tissue integration and nerve regeneration. Additionally, strategic partnerships with hospitals and healthcare providers, along with collaborations with academic institutions, are helping companies advance their technological capabilities and clinical knowledge.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Treatment

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of peripheral nerve injuries

- 3.2.1.2 Advancements in biomaterials

- 3.2.1.3 Growing clinical preference for nerve-sparing alternatives

- 3.2.1.4 Supportive regulatory approvals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of product

- 3.2.2.2 Lack of clinical evidence for long term outcomes

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in next-generation bioengineered grafts

- 3.2.3.2 Rise in post-cancer resection and dental surgery

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Technology and innovation landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Pricing analysis

- 3.7.1 By Product type

- 3.7.2 By Region

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Nerve conduit

- 5.3 Nerve wrap

- 5.4 Nerve grafts

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Natural materials

- 6.3 Synthetic materials

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Peripheral nerve repair

- 7.3 Dental applications

- 7.4 Central nerve repair

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Academic research institutions

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Axogen

- 10.2 Axolotl Biologix

- 10.3 BioCircuit Technologies

- 10.4 Checkpoint Surgical

- 10.5 Collagen Matrix

- 10.6 Cook Group

- 10.7 Integra LifeSciences

- 10.8 KeriMedical

- 10.9 Medovent

- 10.10 Newrotex

- 10.11 Orthocell

- 10.12 Polyganics

- 10.13 Stryker Corporation

- 10.14 Synovis

- 10.15 Toyobo