PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766174

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766174

Cultured Meat Bioreactors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

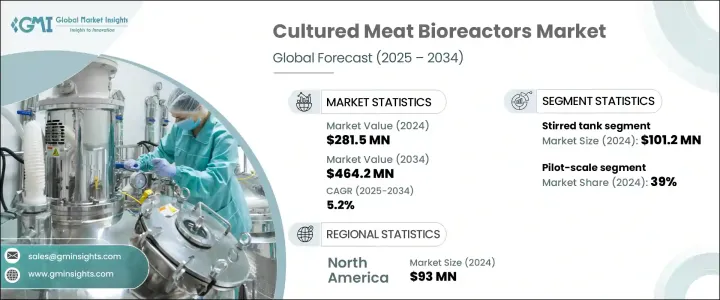

The Global Cultured Meat Bioreactors Market was valued at USD 281.5 million in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 464.2 million by 2034. This market plays a critical role in the cultivated meat sector by enabling large-scale production of lab-grown meat through sophisticated bioreactor systems. These bioreactors create carefully controlled environments for animal cell cultures, allowing meat production without the need for animal slaughter. Various bioreactor types, including stirred-tank, perfusion, airlift, and hollow-fiber systems, each provide distinct advantages in terms of scalability, nutrient delivery, and management of shear forces. Innovations in bioreactor design, cell culture media, and scaling methods have enhanced the cost-efficiency of cultured meat production.

As technology advances, production costs are expected to decline, making cultivated meat more affordable and accessible. Improved texture, flavor, and quality are also key factors that will boost consumer acceptance and drive market growth. Sustainability remains a major motivator, with cultured meat offering an eco-friendly and more ethical alternative to traditional meat production. Rising consumer interest in meat alternatives further fuels demand for this technology, though high initial capital and operating costs remain significant barriers, especially for startups. Establishing production requires specialized bioreactors capable of supporting cell growth at industrial scales.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $281.5 Million |

| Forecast Value | $464.2 Million |

| CAGR | 5.2% |

The stirred-tank bioreactor segment led the market in 2024, generating USD 101.2 million. Stirred-tank bioreactors are highly favored for their reliability and scalability, making them ideal for commercial-scale cell cultivation. With a strong track record in biopharmaceutical and fermentation applications, they present low technical risks to cultivated meat producers. These systems can scale from small laboratory sizes of 1-10 liters to industrial capacities exceeding 10,000 liters, offering vital flexibility for research, development, and full-scale manufacturing. This scalability is essential for companies aiming to commercialize cultured meat at competitive prices.

The pilot-scale segment held a 39% share in 2024. Since the cultured meat industry is transitioning from research to commercial production, pilot-scale bioreactors serve as a critical bridge. Many companies at the pre-commercial stage use pilot-scale systems to refine cell lines, optimize tissue engineering processes, and simulate large-scale production without the high costs associated with full-scale facilities. These bioreactors require lower capital investment, making them accessible to startups and firms working on regulatory approvals or business model development.

North America Cultured Meat Bioreactors Market accounted for USD 93 million in 2024. The United States has fostered a supportive environment for investors and companies involved in cultivated meat through clear regulations. Following government approval for marketing cultured chicken in 2023, the U.S. has become a global leader in commercial cultured meat sales, boosting investments in bioreactor technology and infrastructure. The region hosts some of the most advanced biotech and food tech companies specializing in bioreactor development and process innovation, supported by leading research institutions. Moreover, North American consumers, particularly millennials and Gen Z, show strong preferences for ethically produced, environmentally friendly food products, driving demand for cultured meat and encouraging companies to scale production and innovate bioreactor systems.

Leading companies operating in the Global Cultured Meat Bioreactors Industry include Merck KGaA, ABEC, Alfa Laval, Bioengineering AG, Esco Lifesciences Group, Sartorius AG, GEA, Infors HT, Eppendorf AG, INNOVA Bio-meditech, KBiotech GmBH, OLLITAL Technology, Pall Corporation, Solaris Biotech, and Vogtlin Instruments GmbH. Key strategies adopted by market leaders focus heavily on innovation and collaboration to boost their market positioning.

Companies invest extensively in research and development to improve bioreactor designs, optimize cell culture media, and enhance scalability for cost-effective production. Forming strategic partnerships with cultivated meat producers enables technology integration and process refinement. Firms also prioritize expanding production capacities and entering emerging markets to capitalize on rising demand. Emphasizing sustainability and ethical food production in marketing campaigns helps attract eco-conscious consumers. Additionally, players focus on regulatory compliance and securing intellectual property to safeguard innovations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Scale

- 2.2.4 Mode of Operation

- 2.2.5 Application

- 2.2.6 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sustainable protein

- 3.2.1.2 Technological advancements in bioreactor design

- 3.2.1.3 Growing investments in cultured meat startups

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital and operating costs

- 3.2.2.2 Complexity in scaling up production

- 3.2.3 Opportunities

- 3.2.4 Supply chain optimization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Million) (Units)

- 5.1 Key trends

- 5.2 Hollow fiber

- 5.3 Airlift reactor

- 5.4 Stirred tank

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Scale, 2021 – 2034 (USD Million) (Units)

- 6.1 Key trends

- 6.2 Lab-scale

- 6.3 Pilot-scale

- 6.4 Commercial-scale

Chapter 7 Market Estimates and Forecast, By Mode of Operation, 2021 – 2034 (USD Million) (Units)

- 7.1 Key trends

- 7.2 Batch

- 7.3 Fed-batch

- 7.4 Continuous

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million) (Units)

- 8.1 Key trends

- 8.2 Beef

- 8.3 Poultry

- 8.4 Pork

- 8.5 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Million) (Units)

- 9.1 Key trends

- 9.2 Cultured meat manufacturers

- 9.3 Contract manufacturing organizations

- 9.4 R&D organizations/Institutes

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million) (Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ABEC

- 11.2 Alfa Laval

- 11.3 Bioengineering AG

- 11.4 Eppendorf AG

- 11.5 Esco Lifesciences Group

- 11.6 GEA

- 11.7 Infors HT

- 11.8 INNOVA Bio-meditech

- 11.9 KBiotech GmBH

- 11.10 Merck KGaA

- 11.11 OLLITAL Technology

- 11.12 Pall Corporation

- 11.13 Sartorius AG

- 11.14 Solaris Biotech

- 11.15 Vogtlin Instruments GmbH