PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766176

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766176

Hybrid Printing System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

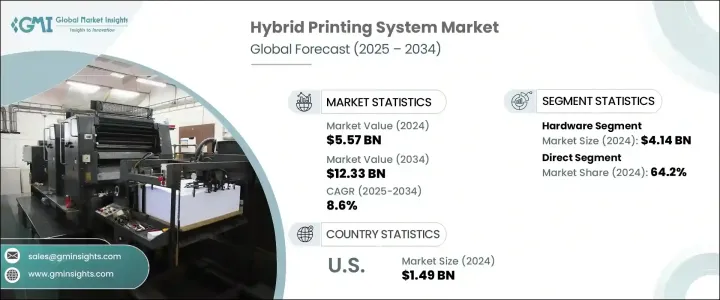

The Global Hybrid Printing System Market was valued at USD 5.57 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 12.33 billion by 2034. Demand for hybrid printing is rising across multiple sectors due to its ability to offer personalized, short-run, and high-speed printing, all while maintaining cost-effectiveness. Businesses in fast-paced industries like personal care, packaged goods, and beverages are turning to hybrid systems to meet real-time marketing demands with custom labeling and packaging. By merging traditional analog technologies such as flexographic or gravure printing with modern digital inkjet or toner systems, these solutions support flexible, high-volume production with reduced turnaround. This shift is redefining packaging workflows and enabling faster, higher-quality outputs.

The increasing popularity of online retail and smart packaging has also boosted the appeal of hybrid systems. E-commerce requires traceable, branded packaging that includes scannable and secure elements-functions that hybrid printers can handle with ease. These solutions enhance both product security and brand visibility. Beyond packaging, hybrid systems are being widely used in fashion, signage, and advertising, where rapid design changes and custom prints are routine. As these applications evolve, hybrid printing becomes a vital tool to meet complex printing requirements efficiently.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.57 Billion |

| Forecast Value | $12.33 Billion |

| CAGR | 8.6% |

The hardware component segment generated USD 4.14 billion in 2024 and is anticipated to grow at a CAGR of 8.5% through 2034. As the market for hybrid printing expands, manufacturers are investing heavily in robust and adaptable hardware systems capable of merging analog reliability with digital precision. Innovations in press architecture, ink management, and print heads are pushing boundaries to deliver enhanced quality and production efficiency. These upgrades are critical to meeting the evolving needs of sectors like textiles, packaging, and marketing, where uptime, speed, and accuracy are non-negotiable.

The direct sales channel segment accounted for 64.2% share in 2024 and is forecasted to grow at a CAGR of 8.4% between 2025 and 2034. This growth is attributed to the value buyers place on personalized service and deep technical guidance when purchasing complex systems like hybrid printers. Selling directly allows for tailored onboarding, maintenance plans, and easier integration between the software and hardware. The absence of intermediaries also streamlines communication, enhances support response time, and strengthens buyer relationships. Increasing use of digital platforms for product education and customer support is also reinforcing the appeal of direct-to-customer sales in this space.

United States Hybrid Printing System Market was valued at USD 1.49 billion in 2024 and is estimated to grow at a CAGR of 8.7% through 2034. The U.S. leads this regional segment due to its highly developed manufacturing sector, early adoption of new technologies, and increasing demand for efficient, customizable print solutions across varied fields like healthcare, consumer goods, and commercial printing. The presence of industry pioneers and strong R&D backing contributes to this leadership. Domestic businesses continue to implement automation tools, modular printing solutions, and AI-enhanced workflows, further supporting the country's dominance in hybrid printing innovation and implementation.

Top industry players include Fujifilm, HP (HP Indigo), Durst, Bobst, Konica Minolta, MPS Systems, Domino Printing Sciences, Nilpeter, Canon, Xeikon, Screen Graphic Solutions, Omet, EFI, Gallus (a Heidelberg company), Mark Andy. To stay competitive, companies in the hybrid printing system market are focusing on strategic product innovation and vertical integration. Many are expanding their global footprints by launching manufacturing and service facilities closer to demand centers. Firms are investing in user-friendly design improvements, advanced ink technologies, and scalable print modules. Partnerships with software vendors help improve workflow automation and cloud-based print management. Additionally, players are ramping up technical training and after-sales support programs to create long-term value for customers and build brand loyalty.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for short-run, customizable printing and high-speed operation

- 3.2.1.2 Integration of analog and digital technologies

- 3.2.1.3 Growth in e-commerce and smart packaging

- 3.2.1.4 Expanding use in various industries

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Technical complexity and integration issues

- 3.2.2.2 Maintenance and operational costs

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code - 8443)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.1.1 Industry structure and concentration

- 4.1.2 Competitive intensity assessment

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.3.1 Product positioning

- 4.3.2 Price-performance positioning

- 4.3.3 Geographic presence

- 4.3.4 Innovation capabilities

- 4.4 Strategic dashboard

- 4.4.1 Competitive benchmarking

- 4.4.1.1 Manufacturing capabilities

- 4.4.1.2 Product portfolio strength

- 4.4.1.3 Distribution network

- 4.4.1.4 R&D investments

- 4.4.2 Strategic initiatives assessment

- 4.4.3 SWOT analysis of key players

- 4.4.1 Competitive benchmarking

- 4.5 Future competitive outlook

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Conventional printing

- 5.3 Non-Impact printing

Chapter 6 Market Estimates & Forecast, By Component, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Hardware

- 6.3 Software

- 6.4 Services

Chapter 7 Market Estimates & Forecast, By Automation Level, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Manual hybrid printing systems

- 7.3 Semi-automated hybrid printing systems

- 7.4 Fully automated hybrid printing systems

Chapter 8 Market Estimates & Forecast, By Ink Type, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 UV-based ink

- 8.3 Solvent-based ink

- 8.4 Aqueous ink

- 8.5 Latex ink

- 8.6 Dye sublimation ink

Chapter 9 Market Estimates & Forecast, By Substrate Type, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Paper

- 9.3 Plastic films

- 9.4 Foils

- 9.5 Textiles/Fabrics

- 9.6 Glass

- 9.7 Others (Metal sheets, Corrugated boards/Cardboard)

Chapter 10 Market Estimates & Forecast, By Technology, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 LED UV hybrid printing

- 10.3 Conventional UV hybrid printing

- 10.4 Flexo-inkjet hybrid

- 10.5 Flexo-toner hybrid

- 10.6 Screen-DTG (Direct to Garment) hybrid

- 10.7 Screen-DTF (Direct to Film) hybrid

- 10.8 Offset-inkjet hybrid

- 10.9 Offset-toner hybrid

- 10.10 Additive-subtractive hybrid

- 10.11 Multi-material hybrid systems

Chapter 11 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Labels

- 11.3 Flexible packaging

- 11.4 Folding cartons

- 11.5 Corrugated packaging

- 11.6 Marketing materials

- 11.7 Books and publications

- 11.8 Fashion textiles

- 11.9 Home textiles

- 11.10 Other (Security printing, Glass printing)

Chapter 12 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 FMCG

- 12.3 Pharmaceutical

- 12.4 Textile and apparel

- 12.5 Automotive

- 12.6 Electronics

- 12.7 Other (Retail and E-commerce)

Chapter 13 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 13.1 Key trends

- 13.2 Direct

- 13.3 Indirect

Chapter 14 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 14.1 Key trends

- 14.2 North America

- 14.2.1 U.S.

- 14.2.2 Canada

- 14.3 Europe

- 14.3.1 Germany

- 14.3.2 UK

- 14.3.3 France

- 14.3.4 Italy

- 14.3.5 Spain

- 14.4 Asia Pacific

- 14.4.1 China

- 14.4.2 India

- 14.4.3 Japan

- 14.4.4 South Korea

- 14.4.5 Australia

- 14.4.6 Indonesia

- 14.4.7 Malaysia

- 14.5 Latin America

- 14.5.1 Brazil

- 14.5.2 Mexico

- 14.6 MEA

- 14.6.1 Saudi Arabia

- 14.6.2 UAE

- 14.6.3 South Africa

Chapter 15 Company Profiles

- 15.1 Bobst

- 15.2 Canon

- 15.3 Domino Printing Sciences

- 15.4 Durst

- 15.5 EFI

- 15.6 Fujifilm

- 15.7 Gallus (a Heidelberg company)

- 15.8 HP (HP Indigo)

- 15.9 Konica Minolta

- 15.10 Mark Andy

- 15.11 MPS Systems

- 15.12 Nilpeter

- 15.13 Omet

- 15.14 Screen Graphic Solutions

- 15.15 Xeikon