PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766185

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766185

Electric Vehicle Bearings Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

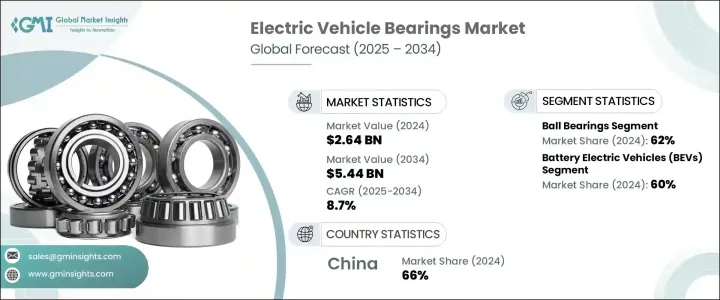

The Global Electric Vehicle Bearings Market was valued at USD 2.64 billion in 2024 and is estimated to grow at a CAGR of 8.7% to reach USD 5.44 billion by 2034. The rising shift toward electric mobility is accelerating the need for advanced bearing technologies that enhance the efficiency, durability, and performance of electric drivetrains. Market expansion is largely driven by rising demand for energy-efficient, low-friction components that can withstand high loads and contribute to prolonged vehicle and battery life. With the growing adoption of EVs across major automotive regions, demand for specialized bearings designed to address the unique mechanical and thermal stresses of electric vehicles is increasing rapidly.

Governments worldwide are reinforcing this transition with financial incentives and tighter environmental regulations, prompting automakers to prioritize lightweight, precision-engineered bearing solutions. Additionally, the rising production of premium electric vehicles is fueling the demand for ultra-reliable, noise-reducing components that deliver seamless and refined driving experiences. As EV drivetrain architectures evolve-incorporating multi-speed systems and integrated e-axles-bearing suppliers are required to offer high-performance solutions capable of operating in demanding environments. In response, leading manufacturers continue to push design innovation to meet the growing expectations of the automotive sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.64 Billion |

| Forecast Value | $5.44 Billion |

| CAGR | 8.7% |

In 2024, the ball bearings category led the EV bearings market with a dominant 62% share and is expected to expand at a CAGR exceeding 9.8% during the forecast timeline. The segment holds its position due to its ability to support high-volume manufacturing, maintain consistent quality, and meet the demanding operational needs of electric drivetrains. Known for offering minimal friction and maximum reliability, ball bearings are widely integrated into various EV components, including electric motors, transmissions, and wheel hubs. As original equipment manufacturers (OEMs) accelerate the rollout of next-gen vehicle systems-spanning electrification, ADAS, and infotainment technologies-automakers increasingly seek advanced engineering services and components tailored to their unique performance and durability needs.

Battery electric vehicles (BEVs) accounted for a 60% share in 2024, securing the leading segment share. BEVs are fundamentally reshaping the electric vehicle bearings landscape by requiring high-precision components that support enhanced energy efficiency, high-speed operation, and noise minimization. The nature of BEV systems demands bearings that can handle greater thermal fluctuations and extended operating cycles while maintaining optimal performance. As BEVs continue to gain popularity globally, bearing manufacturers are investing in the development of advanced solutions that meet the evolving technical specifications of high-speed electric motors and ensure long-term product reliability.

Asia Pacific Electric Vehicle Bearings Market held a 66% share and generated USD 939.7 million in 2024. As a global leader in EV production and export, China benefits from strong policy support, an expanding supply chain, and a rapidly growing number of domestic automakers. Local bearing manufacturers are responding to this demand by ramping up R&D and scaling production of high-performance bearing solutions tailored for high-efficiency electric drivetrains. The country's active involvement in advancing bearing technologies underscores its position as a central player in the global EV bearings market.

The key companies driving innovation and competition in the Global Electric Vehicle Bearings Industry include Schaeffler, SKF, JTEKT, NTN, Nachi-Fujikoshi, NSK, and Timken. To strengthen their market foothold, electric vehicle-bearing manufacturers are adopting several focused strategies. These include heavy R&D investment to develop high-speed, low-friction, and thermally stable bearing technologies optimized for electric drivetrains. Companies are also forging long-term partnerships with automakers to co-develop custom solutions, aligning with the shift toward integrated e-mobility platforms. Expanding manufacturing footprints in key EV markets, particularly across Asia and North America, is another key approach. In addition, firms are enhancing product portfolios by offering compact, lightweight, and durable designs that meet evolving drivetrain architectures while improving energy efficiency and extending service intervals.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing global adoption of electric vehicles supported by government incentives

- 3.2.1.2 Advancements in lightweight and smart bearing technologies improve efficiency and durability

- 3.2.1.3 Expansion of EV manufacturing in emerging markets

- 3.2.1.4 Integration of predictive maintenance through sensor-enabled bearings.

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial costs

- 3.2.2.2 Complex installation and maintenance

- 3.2.3 Market opportunities

- 3.2.3.1 Surging global EV production

- 3.2.3.2 R&D and co-development with OEMs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By component

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Cost breakdown analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Ball bearings

- 5.3 Roller bearings

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Battery electric vehicles (BEVs)

- 6.3 Plug-in hybrid electric vehicles (PHEVs)

- 6.4 Hybrid electric vehicles (HEVs)

- 6.5 Fuel cell electric vehicles (FCEVs)

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Steel bearings

- 7.3 Ceramic bearings

- 7.4 Polymer bearings

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEMs

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Bearing Size, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Small bearings

- 9.3 Medium bearings

- 9.4 Large bearings

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 ILJIN

- 11.2 BRK

- 11.3 C&U Group

- 11.4 Fersa

- 11.5 IKO Nippon Thompson

- 11.6 JTEKT

- 11.7 Luoyang LYC Bearing

- 11.8 MinebeaMitsumi

- 11.9 Nachi-Fujikoshi

- 11.10 NBC

- 11.11 NMB Technologies

- 11.12 NSK

- 11.13 NSK-Warner

- 11.14 NTN

- 11.15 RBC Bearings

- 11.16 Schaeffler

- 11.17 SKF

- 11.18 The Timken

- 11.19 THK

- 11.20 ZWZ