PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766188

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766188

Bioactive Glass Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

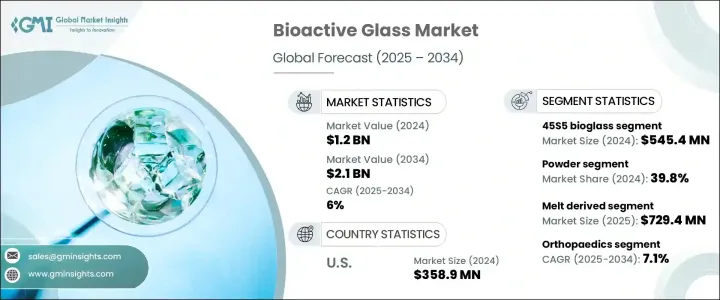

The Global Bioactive Glass Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 2.1 billion by 2034. This expansion is largely driven by the material's unique regenerative properties, particularly in the biomedical field, where bioactive glass interacts positively with biological tissues. Unlike traditional inert materials, bioactive glass promotes active regeneration of soft tissues and bones, offering benefits such as osteogenesis, angiogenesis, and antimicrobial activity. These qualities make it a key material in a wide range of clinical applications. In orthopedics, bioactive glass is increasingly used in bone grafts, spinal fusions, and trauma repair due to its ability to stimulate bone growth and integration.

In dentistry, it is employed in fillings, implants, and periodontal treatments. Moreover, its role in regenerative medicine, drug delivery systems, and tissue engineering continues to expand. The development of new manufacturing methods, such as sol-gel synthesis, melt-derived techniques, and additive manufacturing, has enabled the production of tailored bioactive glasses with customizable porosity, degradation rates, and ion release profiles, further enhancing their use in medical applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.1 Billion |

| CAGR | 6% |

In 2024, the bioactive glass segment from the S53P4 (BonAlive) segment was valued at USD 387.1 million and is expected to grow to USD 728.1 million by 2034. S53P4 is known for its osteoporosis and osteostimulative properties, making it highly effective in treating bone infections and chronic osteomyelitis. This bioactive glass composition assists in bone formation, even in the presence of pre-existing bacterial infections, and is commonly used in orthopedic surgeries, particularly where infection risks are high. The increasing adoption of bioactive glasses in Europe and North America has contributed to the segment's growth, especially as a bone substitute and antimicrobial agent.

The melt-derived bioactive glass segment is expected to grow at a CAGR of 6.2% through 2034. This type of bioactive glass is produced by melting raw materials, resulting in a more homogeneous and dense structure than conventional biomedicine glass. Melt-derived bioactive glass is especially useful in advanced tissue engineering, offering porous structures with enhanced bioactivity and surface area. This property is ideal for applications such as surface reactivity enhancement and coating applications, which can be achieved through scalable methods like flame spray synthesis, allowing the formation of nano-sized glass powders.

U.S. Bioactive Glass Market generated USD 358.9 million in 2024. The market in the U.S. is growing rapidly due to the rising demand for bioactive glass in medical and dental applications, particularly in bone regeneration and orthodontic implant coatings. Bioactive glass is essential in orthopedics, dentistry, and wound healing due to its excellent compatibility with bone tissue and its antibacterial properties. The increasing prevalence of osteoporosis, bone fractures, and dental disorders is further fueling market growth. Additionally, the growing awareness of patients and medical professionals about the benefits of less invasive treatments is driving adoption.

Prominent players in the Global Bioactive Glass Market include Mo-Sci Corporation, Stryker Corporation (and its subsidiary Ortho Vita, Inc.), SCHOTT AG, DePuy Synthes (Johnson & Johnson), and NovaBone Products, LLC. Key strategies implemented by companies in the bioactive glass market to strengthen their position include investing in R&D to develop innovative and customized bioactive glass formulations. These advancements allow companies to offer tailored products with specific properties like controlled ion release, enhanced bioactivity, and adjustable degradation rates.

Companies are also focusing on expanding their product portfolios to meet the growing demand in emerging markets and regions with high medical needs. Additionally, strategic partnerships and collaborations with academic institutions, healthcare providers, and other industry leaders are helping companies enhance their market presence. Furthermore, players are increasing their investments in marketing and educational campaigns to raise awareness about the advantages of bioactive glass, which is expected to drive adoption across various medical fields.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Composition

- 2.2.3 Form

- 2.2.4 Method

- 2.2.5 Application

- 2.2.6 End use

- 2.2.7 Property

- 2.3 Tam analysis, 2025-2034

- 2.4 Cxo perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By composition

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (hs code) (note: the trade statistics will be provided for key countries only

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Composition, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 45S5 bioglass

- 5.3 S53p4 (bonalive)

- 5.4 13-93 bioactive glass

- 5.5 58S bioactive glass

- 5.6 70S30c bioactive glass

- 5.7 Phosphate-based bioactive glass

- 5.8 Borate-based bioactive glass

- 5.9 Other compositions

Chapter 6 Market Estimates and Forecast, By Form 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder

- 6.3 Granules & particles

- 6.4 Scaffolds & porous structures

- 6.5 Coatings

- 6.6 Fibers & meshes

- 6.7 Composites

- 6.8 Other forms

Chapter 7 Market Estimates and Forecast, By Method, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Melt-derived

- 7.3 Sol-gel

- 7.4 Flame spray synthesis

- 7.5 Microwave processing

- 7.6 3d printing/additive manufacturing

- 7.7 Other processing methods

Chapter 8 Market Estimates and Forecast, By Application 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Orthopedics

- 8.2.1 Bone grafts & substitutes

- 8.2.2 Bone void fillers

- 8.2.3 Spinal fusion

- 8.2.4 Trauma repair

- 8.2.5 Other orthopedic applications

- 8.3 Dentistry

- 8.3.1 Dental fillings

- 8.3.2 Dental implants

- 8.3.3 Periodontal treatment

- 8.3.4 Endodontic materials

- 8.3.5 Other dental applications

- 8.4 Tissue engineering & regenerative medicine

- 8.4.1 Bone tissue engineering

- 8.4.2 Soft tissue engineering

- 8.4.3 Drug delivery systems

- 8.4.4 Other tissue engineering applications

- 8.5 Wound healing

- 8.6 Cosmetics & personal care

- 8.7 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Hospitals & clinics

- 9.2 Dental clinics

- 9.3 Ambulatory surgical centers (ascs)

- 9.4 Research & academic institutions

- 9.5 Medical device manufacturers

- 9.6 Pharmaceutical & biotechnology companies

- 9.7 Other end use

Chapter 10 Market Estimates and Forecast, By Property, 2021 - 2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 Osteoconductivity

- 10.3 Antimicrobial activity

- 10.4 Angiogenic properties

- 10.5 Biodegradability

- 10.6 Other properties

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of MEA

Chapter 12 Company Profiles

- 12.1 3M Company

- 12.2 Artoss, Inc.

- 12.3 Berkeley Advanced Biomaterials Inc.

- 12.4 Biomatlante

- 12.5 Biomin Technologies Ltd.

- 12.6 Biovision GmbH

- 12.7 BonAlive Biomaterials Ltd.

- 12.8 Cambioceramics B.V.

- 12.9 Cerapedics, Inc.

- 12.10 Curasan AG

- 12.11 Dentsply Sirona Inc.

- 12.12 DePuy Synthes (Johnson & Johnson)

- 12.13 Ferro Corporation

- 12.14 GC Corporation

- 12.15 Matexcel

- 12.16 Medtronic plc

- 12.17 Mo-Sci Corporation

- 12.18 Nippon Electric Glass Co., Ltd.

- 12.19 Noraker

- 12.20 NovaBone Products, LLC

- 12.21 Orthovita, Inc. (Stryker)

- 12.22 Pulpdent Corporation

- 12.23 SCHOTT AG

- 12.24 Septodont

- 12.25 Stryker Corporation

- 12.26 Synergy Biomedical, LLC

- 12.27 TheraMetrics AG

- 12.28 Wuxi Jinxin Science & Technology Co., Ltd.

- 12.29 Zimmer Biomet Holdings, Inc.