PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766190

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766190

Aseptic Filling and Sealing Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

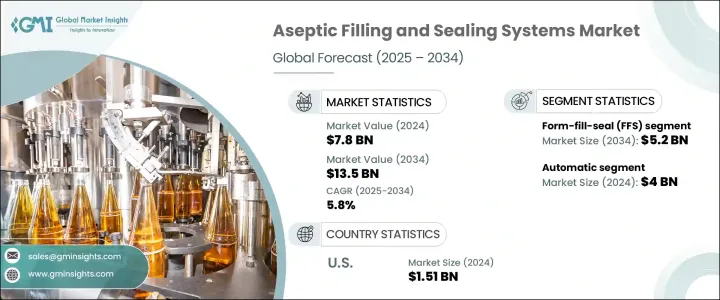

The Global Aseptic Filling and Sealing Systems Market was valued at USD 7.8 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 13.5 billion by 2034. This growth is largely driven by the increasing demand for complex biologics, personalized medicine, and sterile injectable therapies. Unlike traditional oral medications, biologics such as monoclonal antibodies require highly sterile environments due to their sensitivity to contamination. These therapies, often delivered via injection, need precise fill volumes and secure sealing, areas where aseptic systems offer a distinct advantage over traditional packaging methods.

The demand for contamination-free processing has led pharmaceutical manufacturers to adopt fully automated fill-finish environments, including isolator-based and Blow-Fill-Seal (BFS) systems. These advanced aseptic solutions help meet the strict sterility requirements mandated by global regulatory bodies, including the European Medicines Agency (EMA) and the U.S. FDA. In response, equipment manufacturers are focusing on modular aseptic systems that can cater to both large-scale production and small-batch needs. With stricter regulatory guidelines, particularly around injectable drugs, the industry is shifting towards integrated aseptic solutions to accommodate growing demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.8 Billion |

| Forecast Value | $13.5 Billion |

| CAGR | 5.8% |

The form-fill-seal (FFS) segment generated USD 2.8 billion in 2024, expected to reach USD 5.2 billion by 2034. FFS systems combine the processes of forming, filling, and sealing within a single automated unit, reducing the risk of microbial contamination. Their efficiency in high-speed production with minimal material waste makes them ideal for pharmaceutical and dairy applications, while also aligning with stringent regulatory requirements such as EU Annex 1 and FDA guidelines.

The automatic segment was the leading market segment in 2024 with USD 4 billion, capturing a 51.1% share. Automated systems minimize human intervention, which is a key factor in reducing contamination in sterile environments. These systems provide consistent cycle times, high-speed output, and precision in dosing and sealing, making them essential for both large-scale production and the growing demand for small-batch biologics. They also incorporate real-time monitoring and advanced analytics for quality control, further boosting their appeal in the market.

U.S. Aseptic Filling and Sealing Systems Market was valued at USD 1.51 billion in 2024, and it is projected to grow at a CAGR of 4.2% from 2025 to 2034. The rise in demand for fully automated aseptic systems is a key trend driving this growth, with manufacturers focusing on meeting the rigorous standards set by the FDA's 21st Century CGMP initiative. This initiative emphasizes the importance of science- and risk-based approaches to manufacturing, encouraging companies to adopt advanced technologies that enhance sterility and improve operational efficiency. Automated aseptic systems reduce human intervention, which is a significant source of contamination in sterile environments.

Key players in the Global Aseptic Filling and Sealing Systems Market include companies like Syntegon, OPTIMA, Coesia Group, Tetra Pak, and Serac Group. These firms have been adopting strategies to enhance their market position by investing in automation and developing modular aseptic solutions that cater to both high-volume and small-batch production. They are also focusing on compliance with evolving regulatory standards, ensuring their systems are capable of meeting strict sterility and safety guidelines. Additionally, strategic partnerships with contract development and manufacturing organizations (CDMOs) have enabled these companies to expand their reach and gain a foothold in emerging markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Packaging type

- 2.2.4 Technology

- 2.2.5 Scale of operation

- 2.2.6 Automation level

- 2.2.7 End use industry

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 – 2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 Filling machines

- 5.2.1 Linear fillers

- 5.2.2 Rotary fillers

- 5.2.3 Volumetric fillers

- 5.2.4 Gravity fillers

- 5.3 Sealing machines

- 5.3.1 Heat sealers

- 5.3.2 Ultrasonic sealers

- 5.3.3 Induction sealers

- 5.3.4 Others (Laser Sealers, etc.)

- 5.4 Integrated filling & sealing systems

Chapter 6 Market Estimates & Forecast, By Packaging Type, 2021 – 2034 (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Vials

- 6.2.1 Glass vials

- 6.2.2 Plastic vials

- 6.2.3 Pre-sterilized vials

- 6.3 Syringes

- 6.3.1 Prefilled syringes

- 6.3.2 Safety syringes

- 6.3.3 Auto-injectors

- 6.4 Cartridges

- 6.4.1 Insulin cartridges

- 6.4.2 Pen injector cartridges

- 6.4.3 Specialty drug cartridges

- 6.5 Ampoules

- 6.5.1 Glass ampoules

- 6.5.2 Plastic ampoules

- 6.6 Other containers

Chapter 7 Market Estimates & Forecast, By Technology, 2021 – 2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Blow-fill-seal (BFS)

- 7.3 Form-fill-seal (FFS)

- 7.4 Fill-seal (FS)

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Scale of Operation, 2021 – 2034, (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Small-scale systems

- 8.3 Medium-scale systems

- 8.4 Large-scale systems

Chapter 9 Market Estimates & Forecast, By Automation Level, 2021 – 2034, (USD Billion) (Units)

- 9.1 Key trends

- 9.2 Manual

- 9.3 Semi-automatic

- 9.4 Automatic

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021 – 2034, (USD Billion) (Units)

- 10.1 Key trends

- 10.2 Pharmaceutical & nutraceuticals industry

- 10.3 Food & beverage industry

- 10.4 Cosmetics & personal care

- 10.5 Others

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 U.K.

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 Saudi Arabia

- 12.6.3 South Africa

Chapter 13 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 13.1 AST, LLC

- 13.2 Aseptic Systems Co., Ltd.

- 13.3 Coesia Group

- 13.4 Cytiva

- 13.5 GEA Group AG

- 13.6 Groninger Holding GmbH & Co. KG

- 13.7 IMA Group

- 13.8 KHS GmbH

- 13.9 Krones AG

- 13.10 OPTIMA

- 13.11 PLUMAT

- 13.12 Serac Group

- 13.13 SIG Combibloc Group AG

- 13.14 Syntegon Technology GmbH

- 13.15 Tetra Pak International S.A.