PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766195

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766195

AAC (Autoclaved Aerated Concrete) Blocks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

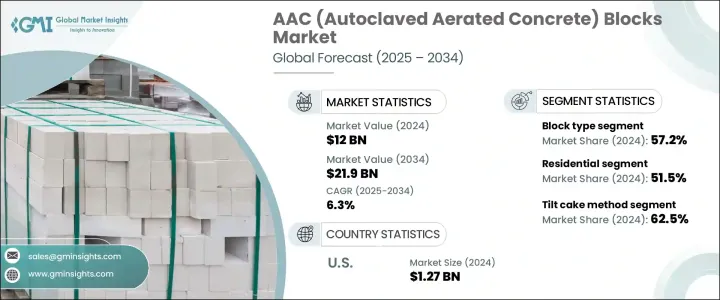

The Global AAC (Autoclaved Aerated Concrete) Blocks Market was valued at USD 12 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 21.9 billion by 2034. This market is expanding steadily as demand increases for building materials that reduce environmental impact. AAC blocks are recognized for being lightweight, sustainable, and made using safe, natural raw materials and industrial waste-making them a green alternative to conventional bricks. Their production process consumes around 30% less energy than red clay bricks, contributing to significantly lower carbon emissions. In fast-growing economies like India, these materials are gaining momentum as they support national sustainability goals and align with energy-efficient construction norms.

The thermal insulation offered by AAC blocks helps prevent excess indoor heat, reducing reliance on cooling systems. This contributes to lower power usage, cost savings, and environmental benefits. Energy efficiency standards backed by government agencies in countries such as India further encourage AAC adoption in real estate and public infrastructure. Rapid urban growth, ongoing infrastructure development, and a shift toward environmentally sound construction under smart city initiatives are all fueling market expansion. AAC blocks are also preferred for being easy to transport and install, reducing construction time and labor.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12 Billion |

| Forecast Value | $21.9 Billion |

| CAGR | 6.3% |

In terms of product type, block variants dominated the market with a 57.2% share in 2024. Standard-sized blocks are widely used in both residential and commercial construction due to their favorable balance of cost, weight, and insulation. For larger-scale projects, jumbo blocks are increasingly used to reduce the number of joints and speed up wall installation. Complementary shapes like lintels and U-blocks are becoming more prevalent as value-added solutions for structural support and conduit passage, often eliminating the need for additional formwork.

Production methods are another key factor in the AAC market. The tilt cake method led with a 62.5% market share in 2024. This method involves partially curing the mix before cutting the blocks vertically, allowing high-volume output and optimal vertical space usage. It remains the most established method in the industry, ideal for scalability. However, it may create additional material waste due to trimming and requires more manual input than newer automated techniques.

United States AAC (Autoclaved Aerated Concrete) Blocks Market held 85% share in 2024, with a valuation of USD 1.27 billion. The country's growth is tied to robust infrastructure development and a surge in demand for green construction alternatives. Domestic production capacity is expanding to meet this demand and reduce reliance on imported materials, ensuring better market access and delivery efficiency. This has further strengthened the position of AAC as a key material in the US construction sector.

Major companies shaping the Global AAC (Autoclaved Aerated Concrete) Blocks Market include Aercon AAC, H+H International A/S, CSR Limited (Hebel), ACICO Industries Company, and Xella Group. These players remain competitive through innovation, expanding footprints, and strong distribution strategies. To boost their market presence, AAC block manufacturers are focusing on strategic moves such as capacity expansion, plant setup in high-demand regions, and entering joint ventures with construction firms. Many companies are enhancing their manufacturing technologies to reduce waste and improve product consistency. Innovation in block design to cater to specific building functions, and efforts to promote AAC in regulatory and green building frameworks, are also becoming critical strategies. Additionally, educating contractors and architects about the benefits of AAC blocks supports wider adoption across both emerging and mature markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Raw Material

- 2.2.4 Application

- 2.2.5 End use industry

- 2.2.6 Production process

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for sustainable construction materials

- 3.2.1.2 Energy efficiency and thermal insulation benefits

- 3.2.1.3 Rapid urbanization and infrastructure development

- 3.2.1.4 Lightweight properties and construction speed advantages

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Raw material price fluctuations

- 3.2.2.2 Transportation costs and logistics

- 3.2.2.3 Skilled labor shortages

- 3.2.2.4 Regional building code compliance

- 3.2.3 Market opportunities

- 3.2.3.1 Green building certification programs

- 3.2.3.2 Technological advancements in manufacturing

- 3.2.3.3 Expansion in emerging markets

- 3.2.3.4 Prefabricated and modular construction growth

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Block type

- 5.2.1 Standard blocks

- 5.2.2 Jumbo blocks

- 5.2.3 Lintel blocks

- 5.2.4 U-shaped blocks

- 5.2.5 Others

- 5.3 Size

- 5.3.1 Small (Up to 400mm Length)

- 5.3.2 Medium (400-600mm Length)

- 5.3.3 Large (Above 600mm Length)

Chapter 6 Market Estimates and Forecast, By Raw Material, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Cement

- 6.3 Lime

- 6.4 Fly Ash

- 6.5 Silica sand/quartz sand

- 6.6 Aluminum powder

- 6.7 Gypsum

- 6.8 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Wall construction

- 7.2.1 External walls

- 7.2.2 Internal walls

- 7.2.3 Partition walls

- 7.3 Roof insulation

- 7.4 Floor elements

- 7.5 Lintels

- 7.6 Cladding panels

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Residential construction

- 8.2.1 Single-family homes

- 8.2.2 Multi-family buildings

- 8.2.3 Affordable housing projects

- 8.3 Commercial construction

- 8.3.1 Office buildings

- 8.3.2 Retail spaces

- 8.3.3 Hotels and hospitality

- 8.3.4 Educational institutions

- 8.3.5 Healthcare facilities

- 8.4 Industrial construction

- 8.4.1 Manufacturing plants

- 8.4.2 Warehouses

- 8.4.3 Others

- 8.5 Infrastructure development

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Production Method, 2021 – 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Tilt cake method

- 9.3 Flat cake method

- 9.4 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 ACICO Industries Company

- 11.2 Aercon AAC

- 11.3 AKG Gazbeton

- 11.4 Biltech Building Elements Limited

- 11.5 Broco Industries

- 11.6 Buildmate Projects Pvt. Ltd

- 11.7 CSR Limited (Hebel)

- 11.8 Eastland Building Materials Co., Ltd.

- 11.9 H+H International A/S

- 11.10 JK Lakshmi Cement Ltd.

- 11.11 Magicrete Building Solutions Pvt. Ltd.

- 11.12 Solbet Sp. z o.o

- 11.13 UAL Industries Limited

- 11.14 Xella Group