PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766198

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766198

Automated Void Fill Dispensers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

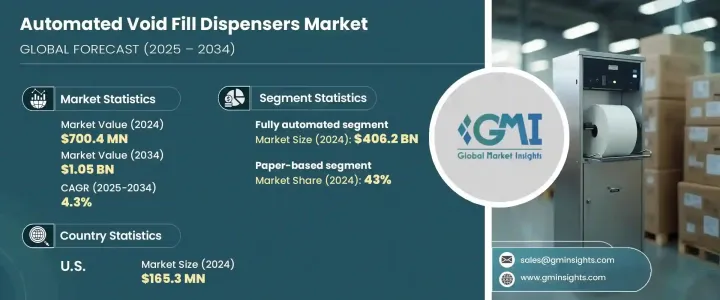

The Global Automated Void Fill Dispensers Market was valued at USD 700.4 million in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 1.05 billion by 2034. This growth is primarily driven by the rapid expansion of the e-commerce sector, which has heightened the demand for efficient and sustainable packaging solutions. Automated void fill dispensers play a crucial role by filling empty spaces in packages with cushioning materials such as paper, foam, or air-based products to protect items during shipping. These dispensers help manufacturers optimize material usage, reducing costs while improving packaging efficiency. Furthermore, the growing emphasis on eco-friendly packaging has accelerated the adoption of these machines, as they allow for precise dispensing that minimizes waste and supports compliance with environmental regulations globally

Technological advancements, such as the integration of AI and IoT, are revolutionizing machine performance by enabling real-time data monitoring, predictive maintenance, and seamless connectivity across production lines. These smart capabilities not only boost efficiency and accuracy but also reduce downtime and operational costs. As a result, these intelligent systems have become indispensable in modern, automated packaging facilities, where speed, precision, and adaptability are critical to meeting ever-growing demands and maintaining competitive advantage.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $700.4 Million |

| Forecast Value | $1.05 Billion |

| CAGR | 4.3% |

In 2024, the fully automated segment dominated the market, generating USD 406.2 million in revenue and is expected to grow at a CAGR of 4.7% through 2034. This segment's expansion is fueled by industries seeking labor-saving, efficient packaging solutions capable of handling high volumes. Fully automated dispensers precisely control material output, reducing waste and boosting sustainability efforts. Their growing adoption in smart warehouses and manufacturing plants is propelled by the integration of advanced automation technologies like AI and IoT, which improve overall productivity and operational efficiency.

The paper-based segment held a 43% share in 2024, generating significant revenue and is anticipated to grow at a CAGR of 4.5% during 2025-2034. Paper-based void fill dispensers are favored due to their recyclable nature and alignment with increasingly strict environmental standards. As regulations tighten, companies across the e-commerce and packaging industries are phasing out non-recyclable and toxic materials in favor of eco-friendly alternatives, making paper-based systems the preferred choice.

United States Automated Void Fill Dispensers Market held 79% share and generated USD 165.3 million in 2024. The country's focus on sustainability and eco-conscious manufacturing has driven strong demand for paper-based void fill solutions. Additionally, the shift toward smart factories and automation supports the uptake of fully automated dispensers equipped with smart features like AI-powered vision systems and IoT connectivity to boost efficiency and throughput in packaging operations.

Key players competing in the Global Automated Void Fill Dispensers Market include EcoEnclose, Ranpak, IPG, Papier Sprick, Storopack Hans Reichenecker, Crawford Packaging, HexcelPack, The Packaging Club, Pregis, Kite Packaging, Ashtonne Packaging, Omni Group, Fromm Packaging Systems, Zepak, and Sealed Air. To strengthen their market presence, leading companies are investing heavily in R&D to enhance machine accuracy, speed, and energy efficiency. They are focusing on integrating cutting-edge AI and IoT technologies to enable real-time monitoring, predictive maintenance, and seamless connectivity with other packaging systems. Strategic partnerships with packaging manufacturers and e-commerce companies help these players customize solutions for specific client needs. Furthermore, expanding product portfolios to include sustainable and recyclable void fill materials supports their commitment to environmental compliance. Offering training, after-sales support, and flexible financing options also helps companies build long-term client relationships and expand their footprint in emerging markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Packaging material type

- 2.2.4 Operation

- 2.2.5 Output capacity

- 2.2.6 End use industry

- 2.2.7 Distribution channel

- 2.3 CXO prospectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of e-commerce industry

- 3.2.1.2 Sustainability and environmental compliance

- 3.2.1.3 Integration with smart warehousing and industry 4.0

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial capital investment

- 3.2.2.2 Integration challenges with existing warehousing systems

- 3.2.2.3 Sustainability and over-packaging concerns

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Middle East and Africa

- 4.2.1.5 Latin America

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Million, Thousand Units)

- 5.1 Key trends

- 5.2 Semi-automated

- 5.3 Fully automated

Chapter 6 Market Estimates & Forecast, By Packaging Material Type, 2021 - 2034 ($Million, Thousand Units)

- 6.1 Key trends

- 6.2 Paper based

- 6.3 Foam based

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By Operation, 2021 - 2034 ($Million, Thousand Units)

- 7.1 Key trends

- 7.2 Integrated

- 7.3 Standalone

Chapter 8 Market Estimates & Forecast, By Output Capacity, 2021 - 2034 ($Million, Thousand Units)

- 8.1 Key trends

- 8.2 Up to 100 m/min

- 8.3 100 m/min - 200 m/min

- 8.4 Above 200 m/min

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Million, Thousand Units)

- 9.1 Key trends

- 9.2 Packaging

- 9.3 E-commerce

- 9.4 Electronics

- 9.5 Pharmaceutical

- 9.6 Consumer goods

- 9.7 Automotive

- 9.8 Others(furnishing and home goods, cosmetic and personal care, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Million, Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Million, Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Ashtonne Packaging

- 12.2 Crawford Packaging

- 12.3 EcoEnclose

- 12.4 Fromm Packaging Systems

- 12.5 HexcelPack

- 12.6 IPG

- 12.7 Kite Packaging

- 12.8 Omni Group

- 12.9 Papier Sprick

- 12.10 Pregis

- 12.11 Ranpak

- 12.12 Sealed Air

- 12.13 Storopack Hans Reichenecker

- 12.14 The Packaging Club

- 12.15 Zepak