PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766200

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766200

Outsourced Semiconductor Assembly and Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

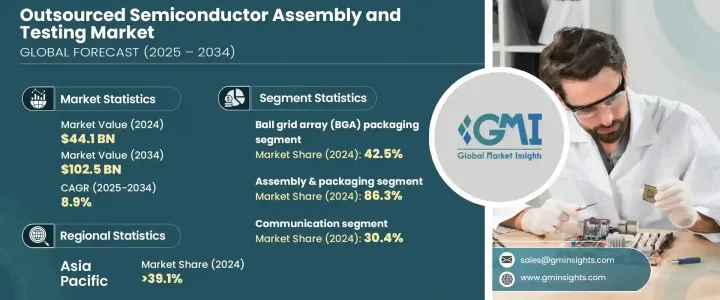

The Global Outsourced Semiconductor Assembly and Testing Market was valued at USD 44.1 billion in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 102.5 billion by 2034. This growth is primarily driven by the expansion of the consumer electronics sector, which includes smartphones, wearables, and smart home devices, as well as the increasing demand for cost-effective and specialized packaging and testing solutions. As the electronics industry continues to miniaturize devices and enhance performance, there is a growing need for OSAT services to ensure product reliability and efficiency.

With the complexity of modern semiconductor packaging and testing, more companies are outsourcing these operations to manage the high costs associated with in-house production. This trend has led to significant investments in OSAT infrastructure, especially as the demand for these services continues to rise across multiple industries. The growing focus on cost optimization has led many semiconductor companies, including major industry leaders, to rely on outsourcing assembly and testing services.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $44.1 Billion |

| Forecast Value | $102.5 Billion |

| CAGR | 8.9% |

By outsourcing these essential functions, semiconductor manufacturers can avoid significant capital expenses associated with in-house operations. These expenses often include building or expanding facilities, purchasing expensive equipment, and employing large teams of specialized workers. Outsourcing allows companies to redirect resources toward core R&D, product development, and other high-priority areas while reducing the complexity and overhead involved in managing in-house assembly lines.

The assembly and packaging segment was valued at USD 38.2 billion in 2024, with projections indicating a robust growth rate of 9.1% CAGR. This segment is particularly driven by advancements in artificial intelligence (AI), high-performance computing, and other innovative semiconductor technologies that demand specialized packaging and testing services. As semiconductor devices become increasingly complex and miniaturized, the need for highly sophisticated assembly and packaging solutions continues to rise. The integration of advanced packaging techniques, such as 3D packaging, system-in-package (SiP), and multi-chip modules (MCM), has become critical to ensuring the reliability and performance of cutting-edge devices, thereby driving growth in this sector.

The consumer electronics segment was valued at USD 11.3 billion in 2024 and is estimated to grow at a CAGR of 10.2%. This growth is fueled by the increasing demand for smaller, more efficient, and highly functional electronic devices. With the continuous evolution of mobile phones, tablets, wearables, and other portable gadgets, manufacturers are relying heavily on outsourced semiconductor assembly and testing services to meet the rigorous demands of miniaturization and performance. As these devices become more compact and sophisticated, they require advanced packaging solutions that ensure high performance, thermal management, and enhanced reliability.

U.S Outsourced Semiconductor Assembly and Testing Market generated USD 10.7 billion in 2024 with a CAGR of 9.2%. The U.S. government is making efforts to bolster domestic semiconductor production through initiatives like the CHIPS Act, aimed at reducing reliance on global supply chains and boosting local manufacturing. Major companies are receiving significant investments to enhance their packaging and testing capabilities, reinforcing the U.S. as a key player in the OSAT market.

Prominent companies in the Outsourced Semiconductor Assembly and Testing Market include ASE Technology Holding Co. Ltd, Amkor Technology Inc., ChipMOS Technologies Inc., Powertech Technology Inc., and King Yuan Electronics Co. Ltd. To strengthen their presence in the outsourced semiconductor assembly and testing market, companies are investing heavily in state-of-the-art technologies and advanced infrastructure. Many OSAT providers are focusing on increasing their capabilities in high-end packaging solutions to cater to the growing demand for sophisticated semiconductor products. Strategic partnerships and collaborations with semiconductor companies are also pivotal for expanding service offerings and improving operational efficiency. Additionally, companies are embracing automation to streamline production processes, minimize costs, and enhance quality control.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and Definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.3.1 Supply-side impact

- 3.2.1.3.1.1 Price volatility

- 3.2.1.3.1.2 Supply chain restructuring

- 3.2.1.3.1.3 Production cost implications

- 3.2.1.3.2 Demand-side impact

- 3.2.1.3.2.1 Price transmission to end markets

- 3.2.1.3.2.2 Market share dynamics

- 3.2.1.3.2.3 Consumer response patterns

- 3.2.1.3.1 Supply-side impact

- 3.2.1.4 Key companies impacted

- 3.2.1.5 Strategic industry responses

- 3.2.1.5.1 Supply chain reconfiguration

- 3.2.1.5.2 Pricing and product strategies

- 3.2.1.5.3 Policy engagement

- 3.2.1.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Expansion of 5G infrastructure

- 3.3.1.2 Advancements in automotive electronics

- 3.3.1.3 Proliferation of consumer electronics

- 3.3.1.4 Demand for cost-effective manufacturing solutions

- 3.3.1.5 Miniaturization and advanced packaging technologies

- 3.3.2 Pitfalls and challenges

- 3.3.2.1 Stringent quality and reliability standards

- 3.3.2.2 High capital investment requirements

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 Pestel analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market estimates and forecast, by Service Type, 2021 – 2034 (USD million)

- 5.1 Key trends

- 5.2 Assembly & Packaging

- 5.3 Testing

Chapter 6 Market estimates and forecast, by Packaging Type, 2021 – 2034 (USD million)

- 6.1 Key trends

- 6.2 Ball grid array (BGA) packaging

- 6.3 Chip scale packaging (CSP)

- 6.4 Stacked die packaging

- 6.5 Multi chip packaging

- 6.6 Quad Flat and Dual-inline Packaging

Chapter 7 Market estimates and forecast, by Application, 2021 – 2034 (USD million)

- 7.1 Key trends

- 7.2 Communication

- 7.3 Consumer electronics

- 7.4 Automotive

- 7.5 Computing and networking

- 7.6 Industrial

- 7.7 Others

- 7.8 Services

Chapter 8 Market estimates and forecast, by Region, 2021 – 2034 (USD million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company profiles

- 9.1 ASE Technology Holding Co. Ltd

- 9.2 Amkor Technology Inc.

- 9.3 Powertech Technology Inc.

- 9.4 ChipMOS Technologies Inc.

- 9.5 King Yuan Electronics Co. Ltd

- 9.6 Formosa Advanced Technologies Co. Ltd

- 9.7 Jiangsu Changjiang Electronics Technology Co. Ltd

- 9.8 UTAC Holdings Ltd

- 9.9 Lingsen Precision Industries Ltd

- 9.10 Tongfu Microelectronics Co.

- 9.11 Chipbond Technology Corporation

- 9.12 Hana Micron Inc.

- 9.13 Integrated Micro-electronics Inc.

- 9.14 Tianshui Huatian Technology Co. Ltd