PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766203

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766203

Thermal Transfer Printer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

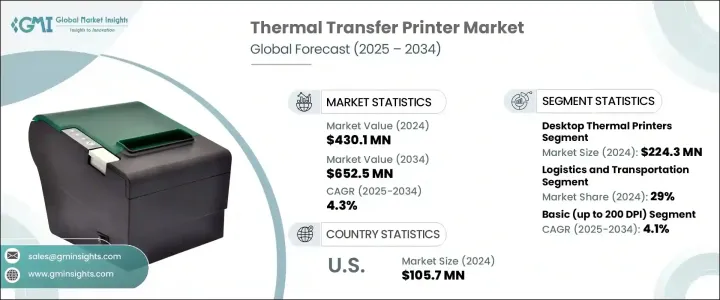

The Global Thermal Transfer Printer Market was valued at USD 430.1 million in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 652.5 million by 2034. This growth is fueled by the rising need for reliable, long-lasting labeling solutions and continued advancements in printing technologies. As businesses prioritize efficient labeling systems, the demand for smart thermal transfer printers is climbing. Recent innovations such as cloud printing, mobile connectivity, and wireless setup are enhancing usability and driving wider adoption. Emerging heat-activated, inkless printing methods are also reshaping the market by eliminating traditional ink needs. Meanwhile, the shift toward sustainability is driving the development of environmentally friendly ribbon alternatives that reduce ecological impact. Manufacturers are actively investing in greener options using renewable, biodegradable materials to replace petroleum-based plastics, aligning with broader corporate responsibility goals.

These trends are not only improving functionality but also aligning thermal printing technology with environmental regulations and evolving customer expectations. Manufacturers are now placing greater emphasis on sustainable product development by introducing biodegradable ribbons, recyclable components, and energy-efficient printing systems. In response to stricter compliance standards, companies are integrating low-emission technologies and adopting greener production processes to reduce their carbon footprint. At the same time, users are demanding printers that offer more than just performance-they want smart, connected, and eco-conscious devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $430.1 Million |

| Forecast Value | $652.5 Million |

| CAGR | 4.3% |

The desktop thermal printers segment generated USD 224.3 million in 2024 and is forecast to grow at a 4.1% CAGR. Their increasing popularity is linked to compact designs, wireless compatibility, and user-friendly features. Widely adopted in sectors such as healthcare, logistics, and retail, these printers support efficient operations while optimizing space. Businesses prefer multifunctional solutions capable of handling multiple media types and sizes, improving workflow flexibility, and minimizing equipment footprint.

The logistics and transportation segment represented a 29% share in 2024 and is projected to grow at a 4.7% CAGR through 2034. These industries rely heavily on thermal transfer printers to create durable, scannable labels for tracking and shipping. High-resolution, long-lasting labels are critical for supply chain management, as they withstand environmental stress and constant handling. Mobile printing capabilities are also gaining popularity, enabling on-demand label production during deliveries and at distribution points. This portability enhances accuracy and speed across logistics workflows, supporting real-time inventory control and seamless operations.

United States Thermal Transfer Printer Market held an 83% share and generated USD 105.7 million in 2024. This leadership position is driven by the growing need for durable labeling solutions in fast-paced industries and the rapid development of e-commerce. With the rise in direct-to-customer fulfillment, there's a higher requirement for printed shipping labels, barcodes, and packaging identifiers, all of which are produced efficiently with thermal transfer printers. U.S. companies are embracing these technologies to meet high-volume demands with speed and reliability.

Leading players contributing to the growth of the Global Thermal Transfer Printer Industry include APS Group, Domino Printing, SATO America, Markem-Imaje, Linx Printing Technologies, Videojet Technologies, Weber Packaging Solutions, PrintJet, Brother, Hanin (HRPT), Kite Packaging, DNP Group, Brady, Hellermann Tyton, and TE Connectivity. To solidify their positions in the global thermal transfer printer market, companies are executing strategies centered on innovation, customization, and sustainability. They are developing smart printers with cloud-based printing, remote access, and seamless mobile integration to cater to tech-savvy users and boost operational convenience. Key players are also launching sustainable products like biodegradable ribbons to reduce environmental impact and appeal to eco-conscious buyers. Additionally, manufacturers are enhancing product flexibility by offering modular, compact designs suitable for varied industry applications.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Color printing capability

- 2.2.4 Print speed

- 2.2.5 Print quality

- 2.2.6 Usage

- 2.2.7 End use industry

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code – 84433290)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Million, Thousand Units)

- 5.1 Key trends

- 5.2 Desktop thermal printers

- 5.3 Mobile thermal printers

- 5.4 Industrial thermal printers

Chapter 6 Market Estimates & Forecast, By Color Printing Capability, 2021 - 2034 ($Million, Thousand Units)

- 6.1 Key trends

- 6.2 Single color

- 6.3 Multi color

Chapter 7 Market Estimates & Forecast, By Print Speed, 2021 - 2034 ($Million, Thousand Units)

- 7.1 Key trends

- 7.2 Slow (Up to 150 mm/sec)

- 7.3 Medium (200 mm/sec)

- 7.4 Fast (300 mm/sec)

- 7.5 Ultra-fast (400 mm/sec)

Chapter 8 Market Estimates & Forecast, By Print Quality, 2021 - 2034 ($Million, Thousand Units)

- 8.1 Key trends

- 8.2 Basic (up to 200 DPI)

- 8.3 Semiprofessional (up to 300 DPI)

- 8.4 Professional (up to 600 DPI)

Chapter 9 Market Estimates & Forecast, By Usage, 2021 - 2034 ($Million, Thousand Units)

- 9.1 Key trends

- 9.2 Card and badge printers

- 9.3 Barcodes

- 9.4 Labels

- 9.5 Receipts

- 9.6 Tags

- 9.7 Wristbands

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Million, Thousand Units)

- 10.1 Key trends

- 10.2 Manufacturing

- 10.3 Logistics and transportation

- 10.4 Healthcare

- 10.5 Retail

- 10.6 Government

- 10.7 Others (hospitality etc.)

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Million, Thousand Units)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Indirect sales

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Million, Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 APS Group

- 13.2 Brady

- 13.3 Brother

- 13.4 DNP Group

- 13.5 Domino Printing

- 13.6 Hanin (HRPT)

- 13.7 Hellermann Tyton

- 13.8 Kite Packaging

- 13.9 Linx Printing Technologies

- 13.10 Markem-Imaje

- 13.11 PrintJet

- 13.12 SATO America

- 13.13 TE Connectivity

- 13.14 Videojet Technologies

- 13.15 Weber Packaging Solutions