PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766207

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766207

High Fat (>85%) Butter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

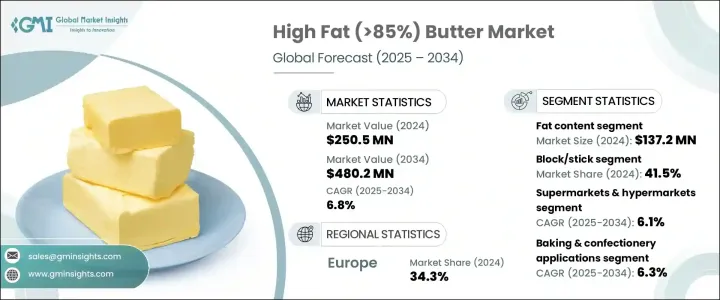

The Global High Fat (>85%) Butter Market was valued at USD 250.5 million in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 480.2 million by 2034. This steady growth is driven by a rising consumer preference for richer, more natural, and artisanal dairy products. High-fat butter, once limited to niche segments such as gourmet baking and fine dining, has now gained traction among health-conscious consumers following trends like low-carb and ketogenic diets. There is an emerging premium segment focused on clean-label, organically certified, and origin-verified butter produced through traditional churning methods.

Despite fluctuations in supply and price, the demand for indulgent, flavorful dairy items remains strong. Innovations in product offerings, increased awareness of fat's functional benefits, and growing global populations with high standards for quality and authenticity are all contributing to the market's expansion. Additionally, evolving retail strategies, greater access to emerging markets, and the rise of specialty food stores and e-commerce platforms support ongoing market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $250.5 Million |

| Forecast Value | $480.2 Million |

| CAGR | 6.8% |

The baking and confectionery segment is projected to grow at a faster pace, with a CAGR of 6.3%. Within the high-fat (>85%) butter market, baking and confectionery dominate application trends thanks to growing demand for superior texture, rich flavor, and consistent quality in premium pastries, cookies, and chocolates. Culinary uses are also on the rise, as chefs increasingly choose high-fat butter for sauteing, sauces, and boosting flavor profiles. Consumers seeking indulgent, creamy spreads and toppings are further driving this demand, while nutritional trends like keto and high-fat diets are expanding butter's role in dietary applications.

In 2024, the blocks and sticks segment accounted for a 41.5% share and is projected to grow at a CAGR of 6.4%, attracting a broader consumer base. These formats continue to dominate, especially in Western regions, due to their convenience, familiarity, and ease of measurement for cooking and baking. Urban health-conscious consumers particularly appreciate these soft, spreadable formats for their direct application on bread and crackers, combining convenience without compromising flavor.

Europe High Fat (>85%) Butter Market held a 34.3% share in 2024. This dominance is driven by the region's deep-rooted culinary heritage, where butter plays a vital role in traditional recipes and gourmet cooking. European consumers have a well-developed appreciation for high-quality dairy, prioritizing authenticity, rich flavor, and artisanal production methods. Additionally, widespread consumer education around premium and clean-label products fuels steady demand for high-fat butter across both retail and food service sectors. The presence of established dairy producers and a robust distribution network further strengthens Europe's position as a key player in this market, ensuring continuous availability of specialty butter products that meet the discerning tastes of its consumers.

Key players driving innovation and distribution in the High Fat (>85%) Butter Market include Ornua Co-operative Limited (Kerrygold), Arla Foods amba (Lurpak), Lactalis Group (President), Fonterra Co-operative Group (Anchor), and Gujarat Cooperative Milk Marketing Federation Ltd. (Amul). Danone S.A., Nestle S.A., The J.M. Smucker Company (Eagle Brand), Arla Foods, and Friesland Campina N.V. play influential roles in the condensed and evaporated milk segments.

To strengthen their market position, companies in the high-fat butter sector are prioritizing product innovation, focusing on clean-label and organic certifications to meet growing consumer demands for transparency and quality. They are expanding their flavor portfolios by introducing infused butter with herbs, spices, and probiotics to capture niche culinary and health-focused segments. Marketing efforts emphasize the authentic, artisanal nature of their products, connecting with consumers seeking premium, natural dairy options. Strategic partnerships with specialty retailers and online platforms enhance accessibility and consumer reach. Furthermore, investments in sustainable sourcing and production practices are improving brand reputation while aligning with environmental concerns. These combined strategies allow companies to build loyalty and tap into expanding global markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 By fat content

- 5.2.1 85-90% fat content

- 5.2.2 90-95% fat content

- 5.2.3 95%+ fat content (Anhydrous Milk Fat/Butter Oil)

- 5.3 By flavor profile

- 5.3.1 Salted

- 5.3.2 Unsalted

- 5.3.3 Cultured/Fermented

- 5.3.4 Flavored & Infused

Chapter 6 Market Estimates and Forecast, By Form, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Block/Stick

- 6.3 Spreadable

- 6.4 Clarified/Ghee

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Source, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Conventional

- 7.3 Organic

- 7.4 Grass-Fed

- 7.5 Specialty animal sources

- 7.5.1 Buffalo

- 7.5.2 Goat

- 7.5.3 Sheep

- 7.5.4 Others

Chapter 8 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Blocks/Sticks

- 8.3 Tubs & Containers

- 8.4 Bulk packaging

- 8.5 Specialty & Gift packaging

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Supermarkets & Hypermarkets

- 9.3 Specialty & gourmet stores

- 9.4 Online retail

- 9.4.1 E-commerce platforms

- 9.4.2 Direct-to-consumer websites

- 9.4.3 Subscription services

- 9.5 Foodservice industry

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 Culinary Applications

- 10.2.1 Cooking & Sauteing

- 10.2.2 Sauces & Emulsions

- 10.2.3 Other culinary uses

- 10.3 Baking & Confectionery

- 10.3.1 Pastries & laminated dough

- 10.3.2 Cakes & Cookies

- 10.3.3 Confectionery products

- 10.4 Spreads & toppings

- 10.4.1 Bread & toast

- 10.4.2 Crackers & savory items

- 10.4.3 Other spread applications

- 10.5 Dietary & nutritional applications

- 10.5.1 Ketogenic diet

- 10.5.2 Bulletproof coffee & beverages

- 10.5.3 Other dietary uses

- 10.6 Industrial applications

- 10.6.1 Food manufacturing

- 10.6.2 Cosmetics & personal care

- 10.6.3 Other industrial uses

- 10.7 Others

Chapter 11 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million) (Kilo Tons)

- 11.1 Key trends

- 11.2 Household/Retail consumers

- 11.3 Food service industry

- 11.3.1 Fine dining restaurants

- 11.3.2 Bakeries & patisseries

- 11.3.3 Hotels & catering

- 11.3.4 Other foodservice establishments

- 11.4 Food processing industry

- 11.4.1 Bakery & confectionery manufacturers

- 11.4.2 Ready meals & prepared foods

- 11.4.3 Other food processors

- 11.5 Others

Chapter 12 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 Saudi Arabia

- 12.6.2 South Africa

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Kerrygold (Ornua Co-operative Limited)

- 13.2 Lurpak (Arla Foods amba)

- 13.3 President (Lactalis Group)

- 13.4 Anchor (Fonterra Co-operative Group)

- 13.5 Amul (Gujarat Cooperative Milk Marketing Federation Ltd.)

- 13.6 Land O'Lakes, Inc.

- 13.7 Organic Valley

- 13.8 Straus Family Creamery

- 13.9 Vermont Creamery (Land O'Lakes, Inc.)

- 13.10 Isigny Sainte-Mere

- 13.11 Plugra (Dairy Farmers of America)

- 13.12 Valio Ltd.

- 13.13 Finlandia Cheese, Inc. (Valio Ltd.)

- 13.14 Meggle Group GmbH

- 13.15 Gourmet Food Holdings (Pepe Saya)