PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766219

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766219

Conductive Polymers (PEDOT, PANI) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

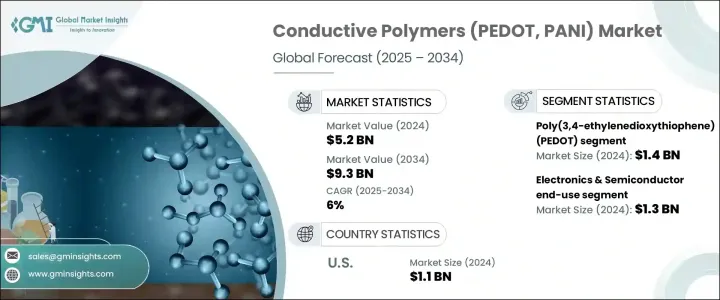

The Global Conductive Polymers (PEDOT, PANI) Market was valued at USD 5.2 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 9.3 billion by 2034. Market expansion is closely tied to infrastructure development, government spending, and broader industrial output, which continue to act as macroeconomic growth catalysts. The steady rise in global manufacturing and urbanization contributes to a robust demand curve for conductive materials. These trends align with international industry reports and illustrate how global demand, while influenced by data and projections, is also shaped by broader economic shifts. The continued progress in processing technologies has lowered production costs and boosted efficiency, driving market competitiveness.

At the same time, environmental policy regulations have prompted cleaner production practices and recycling across supply chains. This transition is creating new opportunities for sustainable growth. The rising middle class in emerging markets adds further momentum, boosting demand for electronics, transportation, and energy storage solutions-all key end-user sectors. While supply chain challenges persist globally, adaptive frameworks, automation, and technical innovation are enabling the market to grow steadily throughout the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.2 billion |

| Forecast Value | $9.3 billion |

| CAGR | 6% |

The polyaniline (PANI) segment generated notable revenues in 2024 due to its adaptable conductivity and resilience under varying environmental conditions. The polymer has seen approximately 10% annual growth in demand from corrosion protection and sensor-based applications, driven by increased activity across industrial and transportation sectors. Looking ahead, the market is expected to maintain this upward trend as demand accelerates. Other polymer types still face constraints due to complex processing challenges and limited scalability. This points to a need for innovation to improve compatibility, integration, and structural stability in large-scale use.

In 2024, the inherently conductive polymers (ICPs) segment stood at USD 2.3 billion and is anticipated to grow at a 6.1% CAGR through 2034. The rising use of conductive polymer composites-especially Polymer-Metal and Polymer-Carbon combinations-is driving demand due to their enhanced mechanical performance and conductivity. Annual demand for carbon-based composites has reportedly grown by 20%, largely fueled by adoption in the automotive and energy storage industries. These composites gain strength from both their polymer matrices and conductive fillers, creating highly versatile materials for next-gen applications.

Germany Conductive Polymers (PEDOT, PANI) Market held a sizeable share in 2024, due to its strong focus on integrating sustainable polymer composites alongside cutting-edge manufacturing practices. The push toward greener production is aligned with strict environmental policies. Imports of conductive polymers into the region have seen a 12% annual increase, largely to meet the rising demand from automotive and aerospace manufacturers. This highlights how local industries are shifting toward advanced, eco-friendly materials in compliance with EU sustainability mandates.

Key players dominating the Global Conductive Polymers (PEDOT, PANI) Market include Heraeus Holding and Sigma-Aldrich (operating under its parent group, Merck), both of which possess strong product portfolios and established market influence that contribute significantly to ongoing industry expansion. Companies operating in the conductive polymers market are focusing on a mix of innovation, vertical integration, and regional expansion to reinforce their market presence. Leading firms are investing in R&D to advance polymer processing methods, enhance electrical properties, and develop composites that meet evolving industrial standards. Partnerships with end-use industries-especially in electronics, automotive, and energy storage-allow companies to co-develop application-specific materials. Firms are also strengthening their global distribution channels and securing raw material access to reduce supply chain vulnerabilities. Sustainability is another major strategic pillar, with several companies developing recyclable polymers and implementing green manufacturing techniques.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Conduction mechanism

- 2.2.4 Application

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Poly(3,4-ethylenedioxythiophene) (PEDOT)

- 5.2 Polyaniline (PANI)

- 5.3 Polypyrrole (PPy)

- 5.4 Polythiophene (PTh)

- 5.5 Other conductive polymers

Chapter 6 Market Estimates & Forecast, By Conduction Mechanism, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Inherently conductive polymers (ICPs)

- 6.3 Conductive polymer composites (CPCs)

- 6.3.1 Polymer-carbon composites

- 6.3.2 Polymer-metal composites

- 6.3.3 Other composites

- 6.4 Organic mixed ionic-electronic conductors (OMIECs)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Anti-static packaging

- 7.3 Capacitors

- 7.4 Batteries

- 7.5 Sensors

- 7.6 Organic light-emitting diodes (OLEDs)

- 7.7 Solar cells

- 7.8 Actuators

- 7.9 Electrochromic devices

- 7.10 Electromagnetic interference (EMI) shielding

- 7.11 Printed circuit boards (PCBs)

- 7.12 Supercapacitors

- 7.13 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Electronics & semiconductor

- 8.3 Energy

- 8.4 Healthcare & biomedical

- 8.5 Automotive

- 8.6 Aerospace & defense

- 8.7 Textiles & wearables

- 8.8 Industrial

- 8.9 Packaging

- 8.10 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Agfa-Gevaert N.V.

- 10.2 Celanese Corporation

- 10.3 Merck KGaA

- 10.4 Solvay S.A.

- 10.5 3M Company

- 10.6 SABIC

- 10.7 Covestro AG

- 10.8 Henkel AG & Co. KGaA

- 10.9 Heraeus Holding GmbH

- 10.10 PolyOne Corporation (Avient Corporation)

- 10.11 Rieke Metals, LLC

- 10.12 RTP Company

- 10.13 Lubrizol Corporation

- 10.14 Asbury Carbons

- 10.15 Sigma-Aldrich Corporation (Merck Group)

- 10.16 Panipol Oy

- 10.17 Polyone Corporation

- 10.18 Premix Group

- 10.19 Hyperion Catalysis International

- 10.20 Ormecon GmbH