PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766222

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766222

Plastic Processing Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

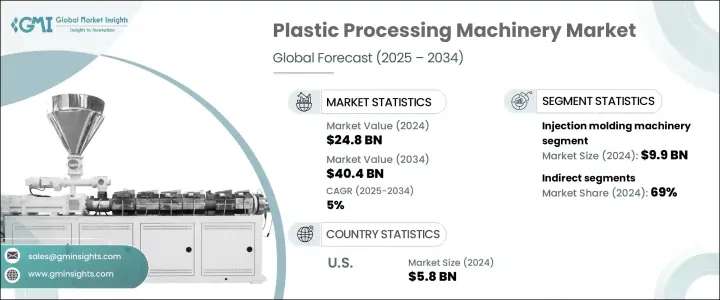

The Global Plastic Processing Machinery Market was valued at USD 24.8 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 40.4 billion by 2034. The expansion of industries like automotive, packaging, construction, and consumer goods is driving this growth. Manufacturers are increasingly required to produce lighter, more sustainable, and customized plastic packaging, which demands advanced machinery. Additionally, the automotive sector is increasingly relying on engineered plastics to reduce vehicle weight, improve fuel efficiency, and decrease emissions. Growing urbanization and rising disposable incomes are also increasing plastic product consumption in housing, electronics, and food packaging.

In response to these trends, the plastic processing machinery market is evolving with a greater focus on automation, smart manufacturing, and sustainability. Companies are prioritizing energy-efficient and eco-friendly production methods, and there's rising demand for machinery that can quickly adapt to new molds, materials, and production volumes. As consumers demand more personalized products, the market is shifting towards equipment that offers flexibility and can handle a wide variety of polymers at different production scales. With rapid technological advances, businesses must meet the changing needs of industries that require innovation and diverse product ranges.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.8 Billion |

| Forecast Value | $40.4 Billion |

| CAGR | 5% |

The injection molding machinery segment, valued at USD 9.9 billion in 2024, is the largest and is anticipated to grow at a CAGR of 4.8% from 2025 to 2034. Injection molding machinery is in high demand across industries like automotive, packaging, electronics, medical devices, and consumer goods due to its versatility and ability to mass-produce high-quality, precise plastic components. This technology remains the most cost-effective and scalable option for producing intricate parts with complex geometries.

The indirect distribution segment represented a 69% share in 2024 and is expected to maintain a CAGR of 4.8% from 2025 to 2034. This distribution channel plays a critical role in emerging markets and smaller enterprises, providing logistical support, handling import regulations, and offering after-sales service. In regions like Asia, Latin America, and parts of Africa, indirect channels are vital for market penetration.

United States Plastic Processing Machinery Market was valued at USD 5.8 billion in 2024 and is expected to grow at a CAGR of 5.5% from 2025 to 2034, driven by strong demand across key sectors like automotive, healthcare, aerospace, and consumer goods. Increased domestic manufacturing due to reshoring initiatives and government incentives are fueling this growth. The adoption of advanced and sustainable technologies, along with the resurgence of domestic production, is boosting demand for lightweight and cost-effective plastic components.

Key players in the Global Plastic Processing Machinery Market include Sumitomo Heavy Industries, ENGEL AUSTRIA, KraussMaffei Group, ARBURG, Husky Injection Molding Systems, The Japan Steel Works, Coperion, Reifenhauser Group, Battenfeld-Cincinnati, Davis-Standard, Chen Hsong Holdings Limited, Milacron, Nissei Plastic Industrial, Haitian International Holdings, and WITTMANN BATTENFELD. To strengthen their presence and market position, companies in the plastic processing machinery market are focusing on several strategic initiatives. These include investing in research and development to create more energy-efficient, eco-friendly, and high-performance machinery. They are also expanding their product portfolios to cater to emerging industries and meet the demand for customized solutions. Furthermore, companies are forming strategic partnerships with distributors and resellers to expand their reach, especially in emerging markets where local support is crucial.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Plastic type

- 2.2.4 End use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Injection molding machinery

- 5.3 Blow molding machinery

- 5.4 Extrusion machinery

- 5.5 Thermoforming machinery

- 5.6 3d plastic printers

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Plastic Type, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Commodity plastics

- 6.3 Engineering plastics

- 6.4 High-performance plastics

- 6.5 Auxiliary building spaces

- 6.6 Recycled plastics

- 6.7 Others (biodegradable plastics, etc.)

Chapter 7 Market Estimates & Forecast, By Operation, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Semi-Automatic

- 7.4 Automatic

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Packaging

- 8.3 Consumer products

- 8.4 Construction

- 8.5 Automotive

- 8.6 Healthcare

- 8.7 Electronics

- 8.8 Others (aerospace, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 ARBURG

- 11.2 Battenfeld-Cincinnati

- 11.3 Chen Hsong Holdings Limited

- 11.4 Coperion

- 11.5 Davis-Standard

- 11.6 ENGEL AUSTRIA

- 11.7 Haitian International Holdings

- 11.8 Husky Injection Molding Systems

- 11.9 KraussMaffei Group

- 11.10 Milacron

- 11.11 Nissei Plastic Industrial

- 11.12 Reifenhauser Group

- 11.13 Sumitomo Heavy Industries

- 11.14 The Japan Steel Works

- 11.15 WITTMANN BATTENFELD