PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766234

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766234

Modular Machine Platforms Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

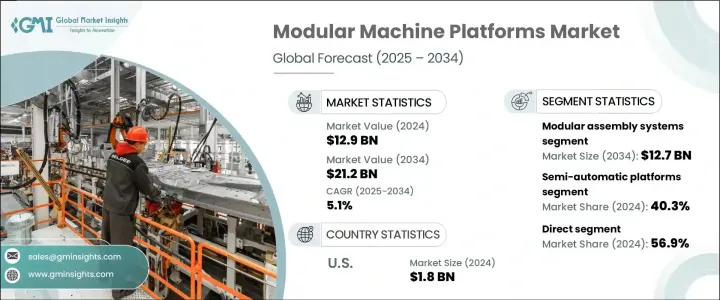

The Global Modular Machine Platforms Market was valued at USD 12.9 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 21.2 billion by 2034. This market is expanding rapidly due to the increasing demand for customizable, scalable, and reconfigurable machinery across modern manufacturing sectors. Modular machine platforms offer companies the ability to streamline production by allowing faster adaptation to product design changes and batch production needs without significant downtime or retooling. These solutions are vital for manufacturers in sectors like electronics, consumer goods, and industrial machinery that need to keep pace with evolving customer demands and mass customization trends.

As more industries prioritize lean processes and just-in-time workflows, modular solutions are becoming integral to achieving productivity and cost-efficiency goals. These platforms also support the goals of Industry 4.0, helping manufacturers integrate smart systems and increase automation without committing to full overhauls. North America, Europe, and Asia-Pacific continue to drive global adoption, supported by strong industrial automation ecosystems and increasing pressure to improve production agility.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.9 Billion |

| Forecast Value | $21.2 Billion |

| CAGR | 5.1% |

The modular assembly systems segment generated USD 8.2 billion in 2024 and is forecasted to grow to USD 12.7 billion by 2034. These systems are highly valued for their ability to adapt quickly to different product types and sizes using modular, interchangeable units. Their scalable nature helps reduce costly downtimes and minimizes the need for reengineering, making them particularly effective in fast-moving sectors. Their popularity is closely linked to lean manufacturing initiatives and efficiency-focused production models aimed at reducing waste and improving response times.

The semi-automatic platforms segment captured 40.3% share in 2024 and is projected to grow at a CAGR of 4.5% through 2034. These platforms combine human input with mechanized functions, creating a balanced solution for manufacturers who require manual oversight for quality-sensitive or custom production tasks. Their appeal lies in lower upfront investment compared to fully automated systems while offering significant improvements in output and consistency. These systems also appeal to regions where labor skills and availability are moderate, offering an ideal middle ground between manual work and full automation.

United States Modular Machine Platforms Market was worth USD 1.8 billion in 2024 and is expected to register a CAGR of 5.7% through 2034. The U.S. maintains its leadership in the North American region due to its highly advanced automation infrastructure and high demand from industrial sectors like aerospace, automotive, and high-tech manufacturing. The country's ongoing commitment to reshoring and adopting smart manufacturing principles supports the accelerated deployment of modular systems designed to enable flexible production. North America continues to serve as a hub for early technology adoption, driven by significant investment in R&D and growing industrial digitization.

Key players leading the Modular Machine Platforms Industry include ABB Ltd., Beckhoff Automation, Mitsubishi Electric, ATS Automation, Bosch Rexroth, Siemens AG, B&R Industrial Automation, Staubli International AG, Yaskawa Electric Corporation, KUKA AG, Schunk GmbH, FlexLink Systems, Rockwell Automation, Festo AG & Co. KG, and Universal Robots. To reinforce their market position, major companies are focusing on integrating digital technologies such as IoT, AI, and data analytics into modular systems to improve functionality and performance. They are also expanding their product portfolios to offer plug-and-play modular units that allow rapid configuration and minimal disruption during system upgrades.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Modularity level

- 2.2.4 Operation

- 2.2.5 Application

- 2.2.6 End use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Modular assembly systems

- 5.3 Modular robotics platforms

- 5.4 Modular CNC machines

- 5.5 Modular packaging machines

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Modularity level, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Fixed modular platforms

- 6.3 Flexible modular platforms

- 6.4 Reconfigurable machine systems (RMS)

Chapter 7 Market Estimates & Forecast, By Operation, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual modular platforms

- 7.3 Semi-automatic platforms

- 7.4 Fully automatic platforms

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Assembly

- 8.3 Material handling

- 8.4 Inspection & testing

- 8.5 Machining

- 8.6 Packaging

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Electronics and semiconductors

- 9.4 Food and beverage

- 9.5 Pharmaceuticals

- 9.6 Consumer goods

- 9.7 Aerospace and defense

- 9.8 Logistics and warehousing

- 9.9 Others (textile, printing, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 UAE

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 ABB Ltd.

- 12.2 ATS Automation

- 12.3 B&R Industrial Automation

- 12.4 Beckhoff Automation

- 12.5 Bosch Rexroth

- 12.6 Festo AG & Co. KG

- 12.7 FlexLink Systems

- 12.8 KUKA AG

- 12.9 Mitsubishi Electric

- 12.10 Rockwell Automation

- 12.11 Schunk GmbH

- 12.12 Siemens AG

- 12.13 Staubli International AG

- 12.14 Universal Robots

- 12.15 Yaskawa Electric Corporation