PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766245

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766245

Acute Coronary Syndrome Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

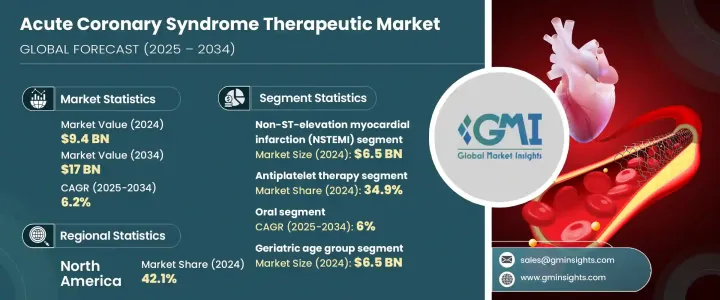

The Global Acute Coronary Syndrome Therapeutics Market was valued at USD 9.4 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 17 billion by 2034. The market expansion is primarily driven by the rising incidence of cardiovascular diseases, particularly acute coronary syndrome, which encompasses conditions such as ST-elevation myocardial infarction (STEMI), non-ST-elevation myocardial infarction (NSTEMI), and unstable angina. These conditions are among the leading causes of death worldwide, creating significant demand for advanced therapies. Technological innovations in drug delivery systems and the development of next-generation cardiovascular drugs are enhancing treatment options. Additionally, the growing trend of personalized medicine for ACS allows for more targeted treatments tailored to individual patient profiles.

The rise of combination therapies and extended-release formulations is improving both safety and effectiveness in treating ACS. Furthermore, efforts to enhance early detection and rapid diagnosis in emergency settings, along with government support for heart health initiatives, are also contributing to market growth. A strong emphasis on integrating various pharmacological treatments, including antiplatelets, anticoagulants, and beta-blockers, is helping to manage the condition more effectively. Pharmaceutical companies are focusing on expanding their reach through regional production, collaborations, and new drug development to meet the growing demand across both developed and emerging markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.4 Billion |

| Forecast Value | $17 Billion |

| CAGR | 6.2% |

The NSTEMI segment led the market in 2024 with a valuation of USD 6.5 billion, driven by the growing prevalence of this condition globally. NSTEMI, which results from partial blockage of coronary arteries, demands immediate medical intervention and is more common than STEMI, though it causes less damage to the heart. Factors like lifestyle-related risk factors and advancements in diagnostic tools, such as sensitive troponin assays and cardiac imaging, have increased the detection rates of NSTEMI, further driving the demand for targeted therapeutics for the condition.

The antiplatelet therapies segment held a 34.9% share in 2024. These therapies, including drugs like aspirin, clopidogrel, and ticagrelor, are commonly used to prevent platelet aggregation and thrombus formation, which are key causes of artery blockage in ACS. Their use is widespread due to clinical guidelines recommending dual antiplatelet therapy, especially for high-risk patients. The ongoing development of faster-acting and safer antiplatelet medications continues to expand their use across diverse patient populations.

U.S. Acute Coronary Syndrome Therapeutics Market was valued at USD 3.6 billion in 2024. The growing prevalence of ACS in the U.S. is driving demand for advanced treatment options. Public health initiatives addressing risk factors such as hypertension, obesity, and diabetes, as well as improving healthcare infrastructure, are contributing to market growth. Additionally, the widespread adoption of guideline-directed medical therapy is helping improve patient outcomes and reduce healthcare costs related to cardiac care.

Key players in the Global Acute Coronary Syndrome Therapeutics Market include Merck, Pfizer, AstraZeneca, Bristol Myers Squibb, Eli Lilly, Genentech (Roche), Sanofi, Janssen Pharmaceuticals, and Boehringer Ingelheim, among others. Companies in the acute coronary syndrome therapeutics market are strengthening their position through strategic investments in research and development of new drugs, especially those offering faster action and improved safety profiles. Many pharmaceutical firms are expanding their portfolios with combination therapies and personalized treatment options to address the unique needs of patients. Collaborations with healthcare providers and government initiatives are also a significant part of their strategy, enabling them to reach underserved markets. Additionally, companies are leveraging digital health technologies to improve patient monitoring and treatment adherence. Expanding regional manufacturing capabilities and securing regulatory approvals for novel therapies are also key strategies to maintain competitive advantage in both developed and emerging markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Drug class

- 2.2.4 Route of administration

- 2.2.5 Age group

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of cardiovascular diseases

- 3.2.1.2 Advancements in pharmacological treatments for ACS

- 3.2.1.3 Increasing emphasis on early diagnosis and emergency care

- 3.2.1.4 Growing aging population and recurrent events

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment costs and accessibility issues

- 3.2.2.2 Variability in clinical practice and adherence

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging markets with high cardiovascular burden

- 3.2.3.2 Public-private healthcare collaborations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Future market trends

- 3.6 Pricing analysis

- 3.7 Pipeline analysis

- 3.8 Consumer behaviour analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Non-ST-elevation myocardial infarction (NSTEMI)

- 5.3 ST-elevation MI (STEMI)

- 5.4 Unstable angina

Chapter 6 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Antiplatelet therapy

- 6.3 Anticoagulants

- 6.4 Beta blockers

- 6.5 Nitrates

- 6.6 Thrombolytics

- 6.7 Other medications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectables

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Adult

- 8.3 Geriatric

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Cardiology clinics

- 9.4 Ambulatory surgical centers

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AstraZeneca

- 11.2 Azurity Pharmaceuticals

- 11.3 Baxter Healthcare

- 11.4 Boehringer Ingelheim

- 11.5 Bristol Myers Squibb

- 11.6 Cipla

- 11.7 Eli Lilly

- 11.8 Genentech (Roche)

- 11.9 Intas Pharmaceuticals

- 11.10 Janssen Pharmaceuticals

- 11.11 Merck

- 11.12 Novartis

- 11.13 Pfizer

- 11.14 Ranbaxy Laboratories

- 11.15 Sanofi