PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766266

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766266

Hopper Feeding System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

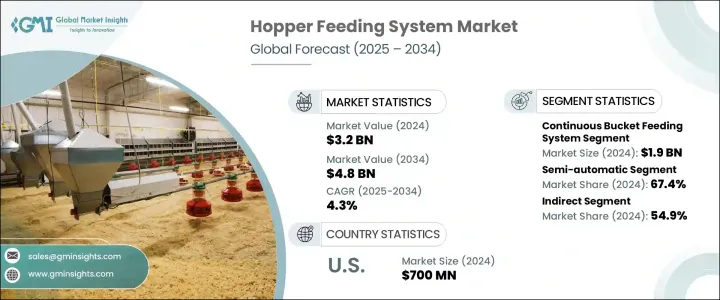

The Global Hopper Feeding System Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 4.8 billion by 2034. As industrial automation becomes increasingly widespread across sectors, the demand for efficient material handling solutions is growing rapidly. Hopper feeding systems are emerging as key components in this transformation, offering automated and streamlined mechanisms for feeding bulk materials without manual intervention. With growing emphasis on productivity and operational consistency, industries are integrating these systems into their production lines to minimize downtime and human error. These systems have become especially important in sectors where maintaining material flow with high precision is essential for quality control and operational continuity.

Modern hopper feeding systems, equipped with sensors and computer controls, enable seamless material dosing and integration with automated equipment such as mixers, conveyors, and packaging systems. By facilitating uninterrupted material transfer and offering real-time control, these systems help companies maintain a high level of operational efficiency and reduce material waste. Their compatibility with various process automation setups makes them an attractive investment for manufacturers focusing on optimizing throughput and maintaining regulatory compliance. With rising labor costs and increasing demand for consistent quality, hopper feeding systems are becoming a strategic asset in process manufacturing environments globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $4.8 Billion |

| CAGR | 4.3% |

In terms of product type, the market is segmented into continuous and intermittent bucket feeding systems. Among these, the continuous bucket feeding system segment accounted for USD 1.9 billion in 2024 and is projected to register a CAGR of 4.7% through 2034. These systems are designed to deliver material at a constant rate, making them ideal for automated operations that rely on steady input, such as in the production of powders, granules, and pellets. Their ability to maintain uninterrupted flow aligns with the needs of high-volume manufacturing setups. Moreover, their adaptability to intelligent controls and full integration into digital production environments further enhance their appeal for companies prioritizing automation and scalability.

When categorized by mode of operation, the market is divided into semi-automatic and fully automatic systems. In 2024, the semi-automatic segment led the market with a 67.4% share and is expected to grow at a CAGR of 3.7% during the forecast period. These systems strike a balance between manual effort and automation, offering a practical solution for small and medium-sized enterprises. Their affordability and ease of use make them particularly suitable for operations that don't require full automation but still seek to improve process consistency and reduce labor dependency. Due to their lower cost and reduced maintenance requirements, semi-automatic hopper feeding systems are widely adopted in markets where budget constraints limit access to fully automated technology. Their growing popularity can be linked to the global expansion of SMEs, which make up the majority of businesses worldwide.

The market is also segmented by distribution channel into direct and indirect sales. The indirect distribution segment dominated in 2024, accounting for 54.9% of total revenue, and is anticipated to grow at a CAGR of 4.8% between 2025 and 2034. Indirect channels such as authorized distributors, resellers, and system integrators play a vital role in reaching a broader customer base. These intermediaries often possess deep knowledge of local market dynamics, technical requirements, and regulatory environments, enabling them to provide tailored solutions and superior support. Their established networks help manufacturers expand their reach without significant investment in direct sales infrastructure, making indirect sales a highly effective go-to-market strategy.

Regionally, the United States held a significant share in the North American hopper feeding system market, with a valuation of USD 700 million in 2024. The country is witnessing steady growth in demand due to its advanced industrial infrastructure and rising adoption of automation technologies. Regulatory standards around manufacturing efficiency and workplace safety are also pushing industries toward automated solutions like hopper feeding systems. The increasing adoption of smart factory frameworks and digitalized production systems further supports market growth, as companies look to improve precision and reduce operational disruptions. With a solid industrial base and a proactive shift toward intelligent automation, the U.S. continues to lead the region's market for hopper feeding systems.

Key players shaping the global hopper feeding system market landscape include Eriez Manufacturing, Coperion, Festo, GEA Group, Hapman, Gericke, K-Tron, Novatec, Piab, Movacolor, Schenck Process, Spiroflow, Thayer Scale-Hyer Industries, Simatek Bulk Systems, and Volkmann. These companies are focused on innovation, product development, and strategic distribution partnerships to expand their market presence and cater to evolving industry demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Mode of operation

- 2.2.4 End use

- 2.2.5 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth in industrial automation

- 3.2.1.2 Increasing demand for accurate and continuous feeding

- 3.2.1.3 Expansion of food and pharmaceutical sectors

- 3.2.1.4 Customization and modular design demand

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Complex integration with existing systems

- 3.2.2.2 High initial investment costs

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 – 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Continuous bucket feeding systems

- 5.3 Intermittent bucket feeding systems

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021 – 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Semi-automatic

- 6.3 Fully automatic

Chapter 7 Market Estimates & Forecast, By End Use, 2021 – 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Agriculture

- 7.3 Food industrial

- 7.4 Chemical industrial

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Coperion

- 10.2 Eriez Manufacturing

- 10.3 Festo

- 10.4 GEA Group

- 10.5 Gericke

- 10.6 Hapman

- 10.7 K-Tron

- 10.8 Movacolor

- 10.9 Novatec

- 10.10 Piab

- 10.11 Schenck Process

- 10.12 Simatek Bulk Systems

- 10.13 Spiroflow

- 10.14 Thayer Scale-Hyer Industries

- 10.15 Volkmann