PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766270

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766270

Plant-Based Protein Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

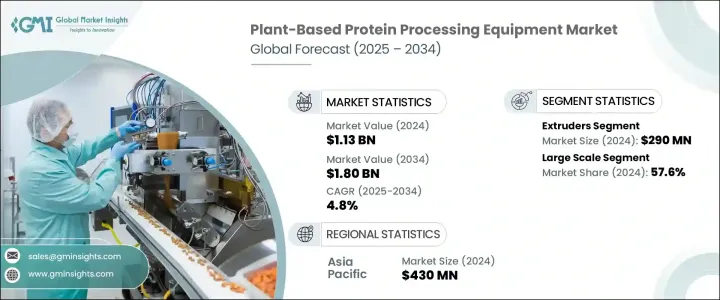

The Global Plant-Based Protein Processing Equipment Market was valued at USD 1.13 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 1.8 billion by 2034. Shifts in consumer behavior toward plant-forward diets, health-conscious living, and sustainability are fueling demand for plant-based foods, driving investment in technologies that extract functional proteins from legumes and grains. As food producers scale up their operations, they're seeking equipment capable of delivering efficiency, product consistency, and nutritional integrity. These trends are encouraging manufacturers to adopt specialized systems that meet the evolving processing requirements of diverse protein sources.

Increased consumer interest in meat alternatives is also influencing the expansion of manufacturing capabilities, particularly across global markets. However, despite the growing potential, the industry continues to face challenges due to the substantial capital investment needed to establish and maintain commercial-scale plants. Processes like extrusion, drying, fermentation, and texturization demand precision-engineered machinery that complies with strict hygiene and safety standards. For smaller companies, the costs associated with purchasing, installing, and upgrading this equipment often become a major hurdle. In developing regions, limited access to financial support and regulatory infrastructure further intensifies the challenge for new entrants and emerging firms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.13 Billion |

| Forecast Value | $1.8 Billion |

| CAGR | 4.8% |

Extrusion systems segment accounted for the largest share in 2024, with revenue of USD 290 million. These systems are essential in shaping textured plant proteins and analogs used in a variety of food applications. They process soy, wheat, and pea proteins into products that replicate the texture and mouthfeel of animal-based foods. With the ability to handle both high- and low-moisture extrusion methods, extruders provide adaptability for a wide array of plant-based food applications including snacks, patties, and protein-enriched products. Their versatility and production efficiency make them a core part of modern processing lines.

In 2024, the large-scale segment held 57.6% share. This growth reflects increased consumer demand for plant-derived proteins and the resulting pressure on producers to deliver consistent output at industrial volumes. Major manufacturers are upgrading their facilities with advanced equipment such as high-capacity dryers, homogenizers, separators, and extruders. These investments help enhance throughput, reduce manual labor, and ensure uniformity across production batches. High-output systems are vital in supporting large brands and retailers that require reliable supply chains for a wide range of protein-based products.

Asia Pacific Plant-Based Protein Processing Equipment Industry generated USD 430 million and held 38% share in 2024. The region benefits from both the cultural prevalence of plant proteins and strong agricultural output. Countries across Asia Pacific have long-standing dietary habits that incorporate soy and legume-based products, creating a solid base for the adoption of plant-based innovations. Rapid industrialization, combined with population-driven food demand and growing concerns about sustainability, are supporting the growth of processing equipment across this region. Favorable government support and new initiatives aimed at food innovation and self-sufficiency in protein sourcing are further accelerating market development in this region.

Major players in the Plant-Based Protein Processing Equipment Industry include Equinom, Clextral SAS, Hosokawa Micron B.V, Alfa Laval, Netzsch-Feinmahltechnik GmbH, Flottweg SE, Bepex International LLC, SPX FLOW Inc, Lyco Manufacturing, Koch Separation Solutions, ANDRITZ AG, Glatt Group, Coperion GmbH, GEA Group, and Buhler Group. To expand their market presence, companies in this space are prioritizing strategic investments in R&D and advanced automation technologies. Many are forming partnerships with food producers and startups to co-develop customized processing solutions that align with new product innovations. Global manufacturers are also increasing their footprint in emerging economies through localized production hubs and service networks. To meet demand scalability, leading firms are launching modular, energy-efficient systems that offer flexibility in handling various plant proteins.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for plant-based foods

- 3.2.1.2 Adoption of plant-based protein in various food products

- 3.2.1.3 Growth of startups focused on alternative proteins

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial capital investment

- 3.2.2.2 Complexity in scaling production

- 3.2.3 Opportunities

- 3.2.4 Supply chain optimization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By application

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Decanter and centrifuges

- 5.3 Grinders and crushers

- 5.4 Dryers

- 5.5 Extruders

- 5.6 Filtration systems

- 5.7 Packaging systems

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Production Capacity, 2021 – 2034 (USD Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Small and medium scale

- 6.3 Large scale

Chapter 7 Market Estimates and Forecast, By Protein Type, 2021 – 2034 (USD Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Soy protein

- 7.3 Pea protein

- 7.4 Wheat protein

- 7.5 Chickpea protein

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Powder

- 8.3 Isolates

- 8.4 Concentrates

- 8.5 Texturized products

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Alfa Laval

- 11.2 ANDRITZ AG

- 11.3 Bepex International LLC

- 11.4 Buhler Group

- 11.5 Clextral SAS

- 11.6 Coperion GmbH

- 11.7 Equinom

- 11.8 Flottweg SE

- 11.9 GEA Group

- 11.10 Glatt Group

- 11.11 Hosokawa Micron B.V

- 11.12 Koch Separation Solutions

- 11.13 Lyco Manufacturing

- 11.14 Netzsch-Feinmahltechnik GmbH

- 11.15 SPX FLOW Inc