PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766281

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766281

Asia Pacific Pickup Trucks Accessories Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

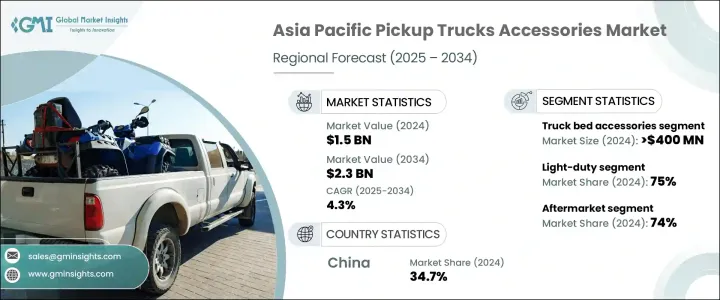

Asia Pacific Pickup Trucks Accessories Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 2.3 billion by 2034. The increasing popularity of outdoor recreational activities such as off-roading, camping, and adventure travel is driving the demand for pickup truck enhancements across the region. Vehicle owners are customizing their pickups with all-terrain components, rooftop storage solutions, and performance tires to suit both work and leisure lifestyles. The shift toward using trucks as multifunctional platforms is gaining momentum, especially among consumers interested in solo travel and exploration. This trend is being supported by evolving consumer behaviors and rising disposable incomes.

A surge in e-commerce and the expanding availability of accessories through digital channels have made it easier for buyers to explore and purchase a variety of aftermarket products. Augmented reality features in online platforms now allow users to visualize modifications on their vehicles before purchasing, offering a tailored and interactive shopping experience. The adoption of a direct-to-consumer approach has enabled brands to gather actionable customer insights and develop stronger loyalty programs. These technological shifts are accelerating competition, attracting new market entrants, and stimulating innovation across the accessory landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $2.3 Billion |

| CAGR | 4.3% |

Truck bed accessories generated USD 400 million in 2024, with high demand across the Asia Pacific region. Among these, tonneau covers remain a top-selling item due to their ability to offer both security and improved vehicle aerodynamics. Buyers are increasingly opting for soft and hard-folding variants that protect from theft and weather elements while contributing to better fuel economy. Technologically advanced versions that operate electronically or via remote control are gaining popularity in the higher-end segment. As pickup trucks continue to blend personal and professional use, tonneau covers serve as both functional and aesthetic enhancements. Growing availability through online marketplaces and dealerships is fueling further adoption. Manufacturers are now using lightweight composite materials like polymer blends and aluminum to boost ease of installation and design efficiency.

Light-duty pickups accounted for a 75% share in 2024. These trucks are increasingly being chosen for their versatility, especially in suburban and urban environments. Young professionals and small business owners are drawn to their balance of performance and practicality. Aesthetic customization, including chrome styling, integrated lighting, and sports accessories, is strong among these buyers. Compared to heavy-duty vehicles, light-duty pickups are easier to maneuver and more fuel-efficient, making them a preferred option in space-constrained urban areas. This dual-purpose use case has positioned them as a top choice for last-mile logistics and e-commerce delivery services, further increasing demand for tailored, technology-integrated accessories.

China Asia Pacific Pickup Truck Accessories Industry held a 34.7% share and generated USD 534.1 million in 2024. Relaxed restrictions on urban access for pickups have led to a surge in demand for multi-functional vehicle enhancements, appealing to both individual users and commercial buyers. Pickup trucks, which were once limited to rural or industrial zones, are now entering more cities across various tiers, prompting increased sales of covers, liners, and tech-based upgrades. With this shift, Chinese consumers are increasingly favoring accessories designed for comfort, efficiency, and safety. The rise in electric pickup offerings by local manufacturers is also contributing to market growth, especially as urban and small business consumers show rising interest in lightweight and energy-efficient upgrades.

Key players active in the Asia Pacific Pickup Truck Accessories Industry include Mahindra & Mahindra, Mountain Top Industries, ARB 4x4 Accessories, Toyota TRD (Toyota Racing Development), Foton Motor, RealTruck, LINE-X LLC, Aeroklas, EGR Group, and Sammitr Group. To reinforce their market positions, companies operating in the Asia Pacific pickup truck accessories space are embracing direct-to-consumer models to gather valuable user insights and tailor offerings. Investments in digital transformation, including AR-powered e-commerce platforms, are enhancing customer engagement and driving conversion rates. Manufacturers are focusing on lightweight, modular designs using advanced materials to simplify installation and improve functionality. Product innovation around tech-integrated solutions like smart lighting, storage automation, and security systems is key to meeting evolving consumer expectations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation statistics

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Vehicle

- 2.2.4 Sales channel

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for outdoor recreation and overlanding

- 3.2.1.2 Expansion of E-commerce and direct-to-consumer sales

- 3.2.1.3 Technological advancements and customization trends

- 3.2.1.4 Infrastructure development and commercial vehicle demand

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory and safety compliance challenges

- 3.2.2.2 Proliferation of low-quality counterfeit products

- 3.2.3 Market opportunities

- 3.2.3.1 Electrification driving demand for lightweight and smart accessories

- 3.2.3.2 Expansion in rural and tier-2/tier-3 markets

- 3.2.3.3 OEM-backed accessory programs and personalization

- 3.2.3.4 E-commerce and direct-to-consumer (D2C) expansion

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Truck bed accessories

- 5.2.1 Tonneau covers

- 5.2.2 Bed liners

- 5.2.3 Toolboxes

- 5.2.4 Bed racks and extenders

- 5.2.5 Tailgate seals & mats

- 5.3 Exterior accessories

- 5.3.1 Grille guards & bull bars

- 5.3.2 Bumpers

- 5.3.3 Running boards & nerf bars

- 5.3.4 Fender flares

- 5.3.5 Bug deflectors

- 5.3.6 Light bars & auxiliary lighting

- 5.4 Interior accessories

- 5.4.1 Floor mats

- 5.4.2 Seat covers

- 5.4.3 Dashboard covers

- 5.4.4 Infotainment systems

- 5.4.5 Storage organizers

- 5.5 Performance accessories

- 5.5.1 Suspension & lift kits

- 5.5.2 Air intakes

- 5.5.3 Exhaust systems

- 5.5.4 Tuners & programmers

- 5.5.5 Braking systems

- 5.6 Towing & hauling accessories

- 5.6.1 Trailer hitches

- 5.6.2 Tow hooks

- 5.6.3 Weight distribution systems

- 5.6.4 Brake controllers

- 5.7 Wheels & tires

- 5.7.1 Off-road tires

- 5.7.2 Custom wheels/rims

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Million, Units)

- 6.1 Key trends

- 6.2 Light-duty

- 6.3 Heavy-duty

Chapter 7 Market Estimates & Forecast, By Sales channel, 2021 - 2034 (USD Million, Units)

- 7.1 Key trends

- 7.2 OEM (Original equipment manufacturer)

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Million, Units)

- 8.1 Key trends

- 8.2 Individual consumers

- 8.3 Commercial users

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million, Units)

- 9.1 Key trends

- 9.2 China

- 9.3 India

- 9.4 Japan

- 9.5 Australia

- 9.6 South Korea

- 9.7 Singapore

- 9.8 Thailand

- 9.9 Malaysia

- 9.10 Indonesia

- 9.11 Vietnam

- 9.12 Rest of Asia Pacific

Chapter 10 Company Profiles

- 10.1 Aeroklas

- 10.2 ARB 4x4 Accessories

- 10.3 Bushranger 4x4 Gear

- 10.4 Carryboy

- 10.5 EGR Group

- 10.6 Flexiglass

- 10.7 Foton Motor

- 10.8 Guangzhou Winway Auto Accessories

- 10.9 Ironman 4x4

- 10.10 KG Mobility

- 10.11 Lechang Xindongsui Auto Accessories

- 10.12 LINE-X

- 10.13 Mahindra & Mahindra

- 10.14 Mountain Top Industries

- 10.15 RealTruck

- 10.16 Sammitr Group

- 10.17 Tata Motors

- 10.18 Toyota TRD

- 10.19 Truck Hero

- 10.20 UD Trucks