PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766287

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766287

Europe BEV On-Board Charger Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

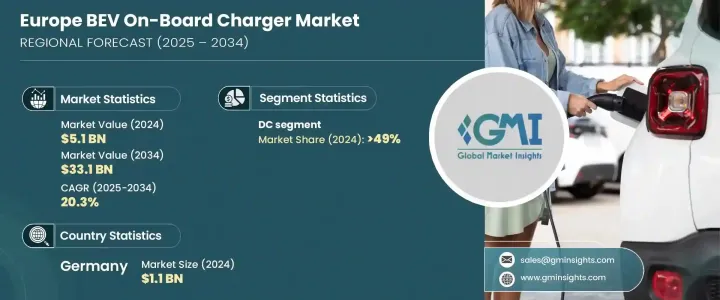

Europe BEV On-Board Charger Market was valued at USD 5.1 billion in 2024 and is estimated to grow at a CAGR of 20.3% to reach USD 33.1 billion by 2034. This growth is primarily driven by stringent government regulations, along with factors such as infrastructure development, technological advancements, and shifting consumer behavior. As the BEV market expands, the need for innovation in charging technology becomes crucial. Advances such as wireless charging, ultra-fast charging, and smart charging systems are significantly enhancing the efficiency and convenience of BEVs.

Regulations like the Alternative Fuels Infrastructure Regulation (AFIR) are further boosting the market. By 2025, each station within the Trans-European Transport Network (TEN-T) core network will need to have at least one high-power charger, with a full charging park by 2030. These initiatives are removing barriers for BEV owners, making charging facilities more accessible and effective. Moreover, sustainability mandates are pushing the industry to optimize the sourcing of materials and improve the lifecycle of BEV on-board chargers. The EU's Battery Regulation requires better traceability in supply chains and mandates the use of recycled materials, prompting the sector to become more eco-friendly by switching to aluminum wiring and using recycled components in manufacturing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $33.1 Billion |

| CAGR | 20.3% |

In 2024, the DC segment accounted for 49% share, a reflection of the growing demand for fast chargers. This surge is largely driven by the increasing adoption of electric vehicles, the growing need for faster charging solutions, and strong legislative backing for the expansion of advanced charging infrastructure throughout Europe.

The 11 kW to 22 kW range segment is gaining traction, especially in mid-range and premium electric vehicles, as it strikes an optimal balance between sustainability and faster charging times. These chargers offer quicker charging speeds while eliminating the need for a transition to DC fast-charging infrastructure. The increasing preference for mid-range chargers in the European market is directly influencing the growth of BEV on-board chargers, further contributing to the market's expansion.

Germany BEV On-Board Charger Market was valued at USD 1.1 billion in 2024. The European market is largely driven by countries like Germany, the UK, and Norway, thanks to the widespread availability of products and services for both commercial and residential users. Government policies and investments are also playing a significant role in driving market demand. Germany is heavily investing in EV charging infrastructure to support its transition to clean energy and reduce carbon emissions. The German government has already invested over USD 2.5 billion in EV charging infrastructure to achieve these goals.

The top companies dominating the Europe BEV On-Board Charger Market include: Valeo, Eaton Corporation, Powell Industries, Toyota Industries Corporation, and Kirloskar Electric Company, which together hold around 30% of the market share. To strengthen their market position, companies in the BEV on-board charger industry are focusing on product innovation, particularly in the development of faster and more efficient charging systems. By introducing wireless and ultra-fast charging solutions, they are meeting the growing demand for convenience and speed. Additionally, firms are emphasizing sustainability by incorporating recyclable materials and optimizing product life cycles. Collaborations with governments and other stakeholders in the electric vehicle ecosystem help them align with regulatory requirements and expand their market reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Industry Insights

- 2.1 Industry ecosystem analysis

- 2.2 Regulatory landscape

- 2.3 Industry impact forces

- 2.3.1 Growth drivers

- 2.3.2 Industry pitfalls & challenges

- 2.4 Growth potential analysis

- 2.5 Porter's analysis

- 2.5.1 Bargaining power of suppliers

- 2.5.2 Bargaining power of buyers

- 2.5.3 Threat of new entrants

- 2.5.4 Threat of substitutes

- 2.6 PESTEL analysis

Chapter 3 Competitive Landscape, 2025

- 3.1 Introduction

- 3.2 Company market share analysis, 2024

- 3.3 Strategic dashboard

- 3.4 Strategic initiatives

- 3.5 Competitive benchmarking

- 3.6 Innovation & technology landscape

Chapter 4 Market Size and Forecast, By Rating, 2021 - 2034 (USD Billion)

- 4.1 Key trends

- 4.2 < 11 kW

- 4.3 > 11 kW to 22 kW

- 4.4 > 22 kW

Chapter 5 Market Size and Forecast, By Current, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 AC

- 5.3 DC

Chapter 6 Market Size and Forecast, By Country, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Norway

- 6.3 Germany

- 6.4 France

- 6.5 Netherlands

- 6.6 UK

- 6.7 Sweden

Chapter 7 Company Profiles

- 7.1 Alfanar Group

- 7.2 AVID Technology Limited

- 7.3 Bell Power Solution

- 7.4 BorgWarner Inc.

- 7.5 BRUSA Elektronik AG

- 7.6 Current Ways Inc.

- 7.7 Delphi Technologies

- 7.8 Delta Energy Systems

- 7.9 Eaton Corporation

- 7.10 Ficosa International SA

- 7.11 Innolectric AG

- 7.12 Kirloskar Electric Company

- 7.13 Powell Industries

- 7.14 Stercom Power Solutions GmbH

- 7.15 STMicroelectronics

- 7.16 Toyota Industries Corporation

- 7.17 Valeo

- 7.18 Xepics Italia SRL