PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766296

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766296

U.S. Direct-to-Consumer Genetic Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

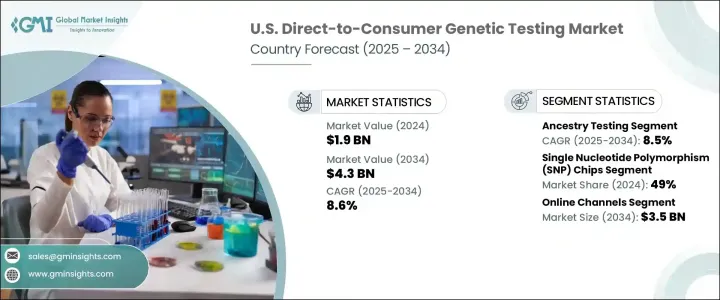

U.S. Direct-to-Consumer Genetic Testing Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 4.3 billion by 2034. This market is expanding rapidly, driven by rising consumer interest in personalized health solutions and the growing shift toward convenient, at-home testing options that eliminate the need for clinic visits. Health-conscious consumers are increasingly seeking insights into their genetic predispositions related to fitness, wellness, diet, and health risks, which has amplified the demand for DTC genetic services across the country.

People are becoming more proactive about understanding inherited conditions and wellness indicators, fueling the growth of this segment. The appeal of direct access to genetic data without the need for a healthcare provider is gaining momentum. Customers are attracted to simplified sample collection processes such as cheek swabs or saliva kits and digital platforms that deliver clear, actionable reports. These platforms provide detailed insights into ancestry, disease susceptibility, carrier status, and individual responses to various lifestyle factors, allowing users to make more informed personal health decisions based on their unique genetic makeup.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $4.3 Billion |

| CAGR | 8.6% |

In 2024, the ancestry-based genetic testing segment will grow at a CAGR of 8.5% through 2034. Consumers are increasingly seeking information about their heritage, familial roots, and ethnicity, making ancestry testing a top choice. This growing interest has led to expanded offerings through affordable home test kits and highly detailed ancestry reports. The demand for these tests has also been reinforced by ongoing technological improvements in genetic analysis, enhanced data accuracy, and broader access to genealogy platforms that allow individuals to connect with family members. Additionally, as more consumers become emotionally invested in understanding their lineage and cultural backgrounds, ancestry services are gaining strong traction in both urban and rural demographics across the country.

In terms of technology, the SNP segment dominated with a 49% share in 2024. Single nucleotide polymorphism testing remains the preferred technology in DTC genetic testing due to its broad application in health risk evaluation, fitness profiling, and ancestry mapping. It offers cost advantages, high scalability, and the ability to provide large volumes of genetic information efficiently. Continued development in SNP-based genotyping platforms, along with easier-to-understand user dashboards, has made this technology more accessible to consumers. Its adaptability in delivering precise data for various genetic markers has enhanced its relevance in personalized health reporting and secured its leadership in the U.S. market.

Major companies such as MyHeritage, Helix, Natera, Myriad, and Ancestry collectively held around 55% of the market share in 2024, underscoring their strong presence and influence. To strengthen their market foothold, key players in the U.S. direct-to-consumer genetic testing market are adopting strategic measures focused on product expansion, affordability, and customer engagement. These companies are launching more comprehensive test panels that combine ancestry, wellness, and disease risk insights in a single package. Many are also enhancing digital platforms with user-friendly dashboards that simplify genetic data interpretation. Investment in AI and machine learning is helping deliver more personalized insights.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Test type

- 2.2.2 Technology

- 2.2.3 Distribution channel

- 2.3 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising awareness in understanding genetic predispositions for health, ancestry, and traits.

- 3.2.1.2 Growing technology advancement in genomic sequencing

- 3.2.1.3 Increasing demand for personalized solutions based on genetic insights

- 3.2.1.4 Expanding accessibility of DTC- genetic solutions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Privacy and data security

- 3.2.2.2 Stringent regulatory challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of digital health platforms

- 3.2.3.2 Growing consumer awareness about the benefits of genetic testing

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 Future market trends

- 3.6 Value chain analysis

- 3.7 Reimbursement scenarios

- 3.8 Regulatory landscape

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Company market share analysis

- 4.5 Competitive positioning matrix

- 4.6 Key developments by market players

- 4.7 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Carrier testing

- 5.3 Predictive testing

- 5.4 Ancestry testing

- 5.5 Nutrigenomic testing

- 5.6 Pharmacogenomic testing

- 5.7 Skincare testing

- 5.8 Other test types

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Microarray-based testing

- 6.3 Single nucleotide polymorphism (SNP) chips

- 6.4 Whole genome sequencing (WGS)

- 6.5 Other technologies

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Online channels

- 7.3 Over-the-counter (OTC)

Chapter 8 Company Profiles

- 8.1 23andMe

- 8.2 Ancestry

- 8.3 Blueprint Genetics

- 8.4 Dante Lab

- 8.5 DNA Genotek

- 8.6 Easy DNA

- 8.7 Family Tree DNA (Gene By Gene)

- 8.8 Full Genome

- 8.9 Genesis Healthcare

- 8.10 Helix

- 8.11 HomeDNA

- 8.12 Identigene

- 8.13 Living DNA

- 8.14 MyHeritage

- 8.15 Pathway genomics

- 8.16 Tempus AI

- 8.17 The SkinDNA Company