PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766328

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766328

Medical Cold Chain Storage Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

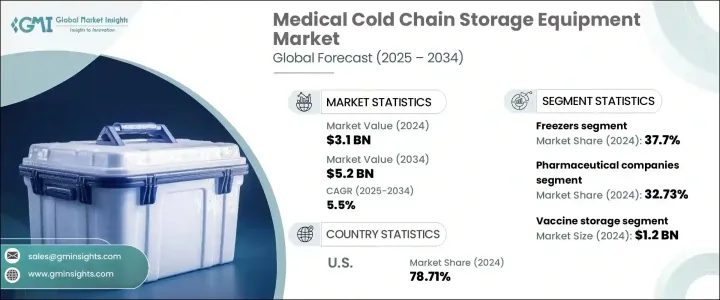

The Global Medical Cold Chain Storage Equipment Market was valued at USD 3.1 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 5.2 billion by 2034. The market is witnessing significant momentum due to the growing reliance on temperature-controlled logistics for sensitive pharmaceutical products. As global healthcare supply chains become more complex, the demand for reliable, secure, and efficient cold chain solutions continues to rise. Pharmaceuticals such as biologics, cell therapies, and vaccines require consistent low-temperature environments to maintain efficacy and safety throughout transportation and storage. Regulatory agencies worldwide are also enforcing stricter temperature-control guidelines, which drives the adoption of high-performance refrigeration systems.

With increasing supply chain challenges, industry participants are integrating advanced technologies, including temperature indicators, intelligent sensors, and real-time data loggers, to ensure quality assurance across the entire cold chain. Furthermore, the adoption of smart cooling systems, automation tools, and eco-conscious refrigerants is becoming a standard, enabling companies to align with global sustainability mandates while remaining compliant with environmental regulations. The integration of remote monitoring, IoT capabilities, and predictive analytics has greatly enhanced operational transparency and performance in cold chain management. The ongoing investment in digital infrastructure, combined with international immunization initiatives and expanded access to life-saving treatments, is further accelerating the need for medical cold storage systems across various healthcare segments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 5.5% |

In terms of product type, freezers led the global market in 2024, accounting for 37.7% of total revenue, and are projected to register a CAGR of 6% from 2025 to 2034. Their growing use is driven by the need to store critical healthcare products such as vaccines, drugs, and laboratory samples at specific low temperatures. These systems are widely regarded for their stability and ability to function efficiently under diverse environmental conditions. The demand is also supported by the need for compliance with industry regulations, as freezers equipped with accurate temperature controls and alarm mechanisms are considered essential in medical logistics. Their adaptability in handling varying volumes makes them suitable for use in different environments, including hospitals, pharmaceutical manufacturing units, and diagnostic laboratories. Multipurpose features such as dual compartments and energy-efficient designs also contribute to their widespread preference.

Based on end-user analysis, pharmaceutical companies held a 32.73% share of the market in 2024 and are anticipated to expand at a CAGR of 5.8% through 2034. These companies operate under strict temperature requirements to store and transport vaccines, biologics, and clinical research materials. Adherence to international standards for temperature control is non-negotiable, especially when dealing with sensitive or experimental compounds. Maintaining an uninterrupted cold chain is critical for product viability and shelf life. As production volumes increase, pharmaceutical firms require scalable and compliant storage systems that reduce the risk of spoilage and optimize inventory management. These capabilities not only help in meeting regulatory requirements but also enhance operational efficiency, encouraging further investment in advanced cold storage equipment.

In terms of applications, vaccine storage dominated the global market in 2024, generating USD 1.2 billion in revenue. It is expected to grow at a CAGR of 5.8% from 2025 to 2034. Vaccines must be stored within a narrow temperature range to retain their potency, making dedicated cold chain systems essential. Global efforts to improve vaccination access and awareness continue to boost demand for vaccine storage equipment. Real-time monitoring technologies, coupled with high-performance refrigeration units, ensure consistent temperature control during transit and storage. This application segment remains a cornerstone of the medical cold chain industry due to the critical role vaccines play in public health.

Regionally, the United States led the global market in 2024, accounting for 78.71% of North America's total share, with revenue reaching USD 800 million. The country benefits from a robust healthcare infrastructure and a highly regulated pharmaceutical logistics environment. Investments in innovative storage technologies and end-to-end supply chain visibility tools have made the US a leader in cold chain management. Additionally, the presence of major healthcare logistics providers and a high concentration of pharmaceutical manufacturing facilities contribute to regional dominance. Stringent regulations from US agencies have also pushed companies to deploy advanced cold storage systems that offer energy efficiency and real-time compliance tracking.

Key companies operating in the global medical cold chain storage equipment market include Binder, Azenta, Cardinal Health, Darwin Chambers, Carebios Biological Technology, Elanpro, Haier Biomedical, Farrar, Hoshizaki America, Memmert, Philipp Kirsch, Kendall Cold Chain System, Summit Appliances, Roemer Industries, and Thalheimer Kuhlung. These players continue to invest in product innovation and digital solutions to meet evolving market demands and maintain a competitive edge.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collections methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 By region

- 2.2.2 By equipment type

- 2.2.3 By temperature range

- 2.2.4 By capacity

- 2.2.5 By technology

- 2.2.6 By application

- 2.2.7 By end use

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for biologics and vaccines

- 3.2.1.2 Stringent regulatory compliance

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial capital investment

- 3.2.2.2 Infrastructure gaps in emerging markets

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Equipment type

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (84186990)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger & acquisitions

- 4.6.2 Partnership & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Refrigerators

- 5.1.1 Laboratory refrigerators

- 5.1.2 Blood bank refrigerators

- 5.1.3 Pharmacy refrigerators

- 5.1.4 Chromatography refrigerators

- 5.2 Freezers

- 5.2.1 Ultra-low temperature freezers

- 5.2.2 Plasma freezers

- 5.2.3 Shock freezers

- 5.3 Cryogenic storage systems

- 5.3.1 Liquid nitrogen storage systems

- 5.3.2 Vapor phase storage systems

- 5.4 Cold rooms

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Temperature Range, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 2°C to 8°C

- 6.2 -20°C to -40°C

- 6.3 -40°C to -80°C

- 6.4 Below -80°C

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Small (up to 300 liters)

- 7.2 Medium (300-700 liters)

- 7.3 Large (above 700 liters)

Chapter 8 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Compressor-based systems

- 8.2 Absorption-based systems

- 8.3 Thermoelectric-based systems

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Vaccine storage

- 9.3 Blood & blood products storage

- 9.4 Biological sample storage

- 9.5 Drug & pharmaceutical storage

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 Hospitals & clinics

- 10.3 Pharmaceutical companies

- 10.4 Research laboratories

- 10.5 Blood banks

- 10.6 Pharmacies

- 10.7 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Azenta Inc.

- 12.2 Binder

- 12.3 Cardinal Health

- 12.4 Carebios Biological Technology

- 12.5 Darwin Chambers

- 12.6 Elanpro

- 12.7 Farrar

- 12.8 Haier Biomedical

- 12.9 Hoshizaki America

- 12.10 Kendall Cold Chain System

- 12.11 Memmert

- 12.12 Philipp Kirsch

- 12.13 Roemer Industries

- 12.14 Summit Appliances

- 12.15 Thalheimer Kuhlung