PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766344

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766344

Industrial Hydraulic Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

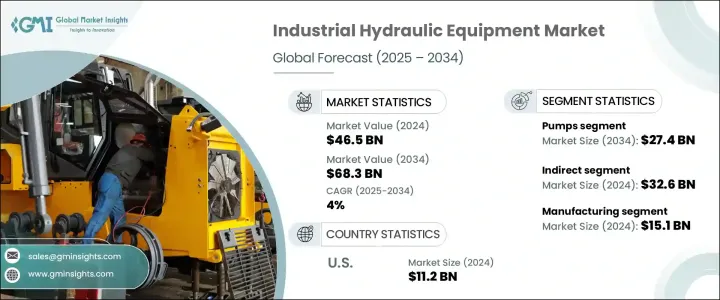

The Global Industrial Hydraulic Equipment Market was valued at USD 46.5 billion in 2024 and is estimated to grow at a CAGR of 4% to reach USD 68.3 billion by 2034. The growing adoption of Industry 4.0 across industrial facilities is driving a notable shift in how hydraulic systems are integrated and utilized. By incorporating intelligent components such as sensors, IoT-enabled modules, and AI-powered predictive technologies, manufacturers are enhancing the operational capabilities of hydraulic systems. These advanced solutions enable real-time tracking of essential parameters, including pressure, temperature, and fluid flow, which significantly improves predictive maintenance strategies, minimizes downtime, and boosts overall energy efficiency. As a result, modern electro-hydraulic systems now function seamlessly within fully automated industrial frameworks, establishing hydraulics as an essential pillar in the rise of smart manufacturing.

In emerging economies, rapid urban development is fueling a surge in demand for heavy-duty construction and earth-moving machinery. Hydraulic systems are indispensable in these machines, delivering the power and control required for operations under extreme conditions. As infrastructure projects expand globally, there is a continuous need for equipment such as cranes, excavators, and drilling systems. These machines depend on high-performance hydraulic systems for precision, reliability, and durability. In parallel, industries are increasingly focusing on sustainable alternatives that promote lower energy consumption and environmental safety. This trend is prompting innovation toward eco-efficient hydraulic solutions, which is expected to unlock new growth avenues in the years ahead.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $46.5 Billion |

| Forecast Value | $68.3 Billion |

| CAGR | 4% |

By product type, the market is segmented into pumps, cylinders, motors, valves, and others. Among these, the pump segment held the largest value share, estimated at USD 18.5 billion in 2024, and is projected to reach USD 27.4 billion by 2034. The widespread use of pumps stems from their fundamental role in converting mechanical energy into hydraulic power, which is vital across a variety of industrial applications. From assembly lines to lifting systems and material transport operations, pumps serve as the backbone of fluid power systems in both fixed and mobile industrial equipment. The increasing push for high-precision metering and energy conservation has led to the development of advanced technologies such as variable displacement pumps, which offer improved efficiency and dynamic control.

Consistent demand for hydraulic pumps is also supported by routine maintenance and part replacement cycles in active industrial environments. As older components reach the end of their service lives, businesses continue to invest in newer, more efficient hydraulic solutions that align with modern performance standards. The broader product segment, encompassing pumps, cylinders, motors, valves, and others, reached USD 32.6 billion in 2024 and is anticipated to grow at a CAGR of 3.4% during the forecast period.

Another factor contributing to the growth of this market is the expansion of indirect distribution channels. A growing number of authorized vendors, specialized dealers, and digital platforms are enhancing product accessibility across diverse industries and geographies. These distributors often bundle core hydraulic products with related engineering services such as fluid condition monitoring, filtration packages, and hydraulic fluid management systems. This all-in-one approach simplifies procurement and strengthens customer relationships. Additionally, on-ground technical support and real-time product demonstrations further reinforce confidence among industrial buyers, enabling distributors to maintain a resilient and competitive market presence.

When segmented by end-use industry, the market includes manufacturing, construction, forestry and agriculture, mining, oil and gas, marine, aerospace and aviation, and others. The manufacturing sector accounted for USD 15.1 billion in 2024 and is projected to grow at a CAGR of 4.5% through 2034. Hydraulics play a critical role in manufacturing operations, particularly in equipment used for material forming, metal shaping, and high-pressure mechanical tasks. As industries move toward fully automated production lines, hydraulic systems must deliver higher levels of responsiveness, energy management, and consistency. The push for automation has increased the demand for integrated hydraulic solutions that provide precise control, reduced cycle times, and lower operational costs.

Regionally, the United States led the North America industrial hydraulic equipment market, which was valued at USD 11.2 billion in 2024 and is forecast to expand at a CAGR of 3.8% through 2034. The country's robust industrial base and consistent investment in infrastructure development have made it a key contributor to regional market growth. Industries such as automotive manufacturing, building construction, and material handling continue to generate strong demand for hydraulic systems that offer reliability and intelligent automation features. The growing emphasis on digital control and smart electro-hydraulics is further fueling innovation across U.S.-based hydraulic equipment suppliers, who are increasingly scaling their operations to meet this demand.

Across the market landscape, companies are responding to evolving customer expectations by introducing technologically advanced, energy-efficient, and customizable hydraulic equipment. Integrating intelligent control features, IoT connectivity, and predictive maintenance capabilities has become a central strategy for meeting modern industrial demands. At the same time, stricter global energy and emissions standards are compelling manufacturers to adopt greener design principles. To stay competitive, businesses are not only diversifying their product lines but also forming strategic partnerships and acquisitions to expand their presence in specialized segments of mobile and industrial automation. This ongoing shift is reshaping the market, steering it toward more intelligent, efficient, and environmentally responsible hydraulic systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 End use industry

- 2.2.4 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory framework

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Pumps

- 5.3 Cylinder

- 5.4 Motors

- 5.5 Valves

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By End Use Industry, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Manufacturing

- 6.3 Construction

- 6.4 Forestry & agriculture

- 6.5 Mining

- 6.6 Oil & Gas

- 6.7 Marine

- 6.8 Aerospace & aviation

- 6.9 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Direct

- 7.3 Indirect

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034, ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 The U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 Saudi Arabia

- 8.6.2 UAE

- 8.6.3 South Africa

Chapter 9 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 9.1 Bosch Rexroth

- 9.2 Bucher Hydraulics

- 9.3 Caterpillar

- 9.4 Danfoss

- 9.5 Eaton

- 9.6 HAWE Hydraulik

- 9.7 Hitachi Construction Machinery

- 9.8 HYDAC International

- 9.9 Kawasaki Heavy Industries

- 9.10 Komatsu

- 9.11 KTI Hydraulics

- 9.12 KYB

- 9.13 Liebherr-International

- 9.14 Mitsubishi Heavy Industries

- 9.15 Parker-Hannifin