PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766351

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766351

Drug Screening Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

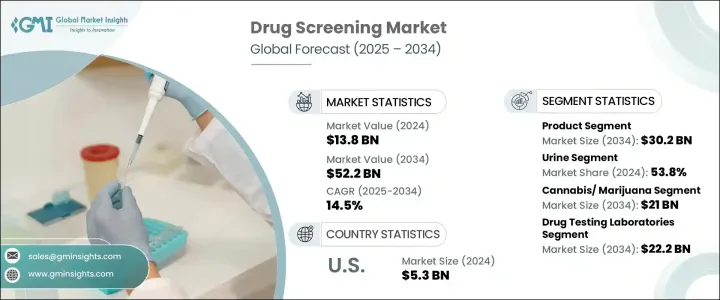

The Global Drug Screening Market was valued at USD 13.8 billion in 2024 and is estimated to grow at a CAGR of 14.5% to reach USD 52.2 billion by 2034. This growth can be attributed to an increasing focus on addressing substance abuse issues, advancements in drug testing technologies, and the rise of stricter policies in various sectors, including employment, sports, and healthcare. Governments worldwide are intensifying efforts to combat drug abuse, which is further spurring market demand for effective screening solutions.

Cutting-edge technologies like liquid chromatography-mass spectrometry (LC-MS) and immunoassays have significantly improved the accuracy and efficiency of drug screening processes. Moreover, the rise in accessibility to rapid screening kits and on-site testing devices is making the process more convenient and reducing the time required for results. This has made drug screening solutions indispensable for workplace safety and compliance, especially under regulations like the Drug-Free Workplace Act, which has become a driving force behind the market's expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.8 Billion |

| Forecast Value | $52.2 Billion |

| CAGR | 14.5% |

Drug screening involves testing biological samples such as blood, urine, hair, saliva, or sweat to detect drugs or their metabolites. The market encompasses a wide range of tools and services designed for drug detection, including testing devices such as immunoassay analyzers, chromatography systems, breath analyzers, oral fluid testing kits, and rapid test devices. Both laboratory and on-site screenings are common methods used in the industry.

The product segment accounted for the largest share of the market, valued at USD 8.1 billion in 2024. This segment includes essential tools such as immunoassay analyzers, chromatographic instruments, and breath analyzers, which are pivotal in delivering accurate and reliable results. Rapid testing devices are particularly in demand due to their portability, ease of use, and ability to provide immediate results, which makes them ideal for use in workplace and emergency testing scenarios. Consumables like sample collection kits, calibration kits, and control devices are also in high demand, as they are used frequently and require regular replenishment.

The urine-based drug testing segment held the largest share of 53.8% in 2024, with further growth anticipated during the forecast period. Urine testing remains the most widely used method due to its cost-effectiveness, reliability, and ability to detect a broad range of substances. Since metabolites are excreted in urine, it serves as an ideal sample for identifying recent drug use. Urine tests are commonly used for workplace drug testing, pre-employment screenings, and rehabilitation programs. Their non-invasive collection method and ability to detect substances like cannabinoids, opioids, amphetamines, and benzodiazepines make them indispensable in substance abuse management programs.

North America Drug Screening Market generated USD 5.9 billion in 2024 and is projected to reach USD 21.2 billion by 2034, growing at a CAGR of 14%. North America leads the market, driven by stringent regulatory requirements, technological innovations, and high awareness of workplace safety. The regulatory framework in the U.S., including mandates by the Department of Transportation (DOT) and the Substance Abuse and Mental Health Services Administration (SAMHSA), requires drug testing in various industries, including transportation, healthcare, and government.

Key players in the Global Drug Screening Market include companies such as Abbott, Agilent, Dragerwerk, Laboratory Corporation of America (LabCorp), Quest Diagnostics, Thermo Fisher Scientific, F. Hoffmann-La Roche, and Lifeloc Technologies. These companies collectively hold a substantial portion of the market share and are instrumental in driving innovation, regulatory compliance, and developing efficient drug testing technologies. To enhance their market position, companies in the drug screening market focus on several strategies. Leading players are heavily investing in research and development to innovate and improve the accuracy and speed of testing technologies. They are also expanding their product portfolios to cater to a wide range of industries, including healthcare, employment, and law enforcement. Strategic partnerships and collaborations with research institutions and other businesses are also being formed to expand their market reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Sample type

- 2.2.4 Drug type

- 2.2.5 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing drug and alcohol consumption

- 3.2.1.2 Presence of stringent laws to support drug screening

- 3.2.1.3 Growing availability of products and services for drug-of abuse testing

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Prohibition on workplace drug testing

- 3.2.2.2 Dearth of trained laboratory professionals

- 3.2.3 Market opportunities

- 3.2.3.1 Growing adoption of drug testing policies in workplaces

- 3.2.3.2 Rising awareness and policy enforcement in developing countries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology and innovation landscape

- 3.6 Gap analysis

- 3.7 Drug screening volume analysis, by product and service, 2024

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.7.4 Latin America

- 3.7.5 MEA

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company share analysis, by product and service

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Product

- 5.2.1 Analytical instruments

- 5.2.1.1 Immunoassay analyzers

- 5.2.1.2 Chromatographic analyzers

- 5.2.1.3 Breath analyzers

- 5.2.1.4 Oral fluid testing analyzers

- 5.2.2 Rapid testing devices

- 5.2.3 Consumables

- 5.2.1 Analytical instruments

- 5.3 Drug screening services

Chapter 6 Market Estimates and Forecast, By Sample Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Urine

- 6.3 Breath

- 6.4 Oral fluids

- 6.5 Hair

- 6.6 Other sample types

Chapter 7 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Cannabis/ marijuana

- 7.3 Opiods

- 7.4 Alcohol

- 7.5 Amphetamines

- 7.6 Other drug types

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Drug testing laboratories

- 8.3 Workplace

- 8.4 Hospitals

- 8.5 Law enforcement agencies

- 8.6 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott

- 10.2 Agilent

- 10.3 Alcohol Countermeasure Systems

- 10.4 Alfa Scientific Designs

- 10.5 Dragerwerk

- 10.6 Eurofins Scientific

- 10.7 F. Hoffmann-La Roche

- 10.8 Laboratory Corporation of America (LabCorp)

- 10.9 Lifeloc Technologies

- 10.10 Omega Laboratories

- 10.11 OraSure Technologies

- 10.12 PerkinElmer

- 10.13 Premier Biotech

- 10.14 Psychemedics

- 10.15 Quest Diagnostics

- 10.16 Shimadzu

- 10.17 Siemens Healthineers

- 10.18 Thermo Fisher Scientific