PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766355

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766355

Jaw Crushers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

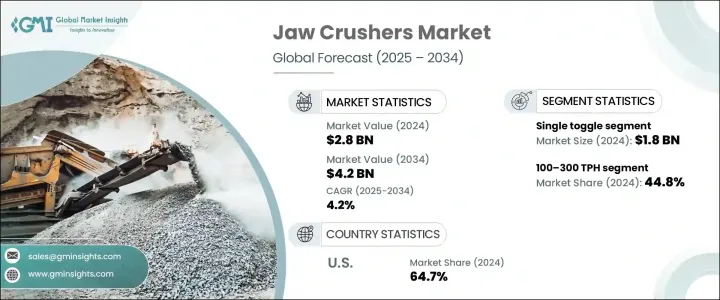

The Global Jaw Crushers Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 4.2 billion by 2034. This growth is attributed to rising activities in mining, quarrying, and ongoing infrastructure projects worldwide. Jaw crushers are widely used for breaking down rocks, ores, and minerals into smaller pieces, making them ideal for primary material reduction. Their rugged construction and compatibility with a wide range of materials make them indispensable for heavy-duty applications. With the expansion of mining operations focused on extracting key metals and minerals, the demand for efficient crushing equipment continues to rise steadily.

Expanding urban areas and major infrastructure initiatives, such as new transportation networks and urban development efforts, are directly increasing the demand for aggregates, supporting higher adoption of jaw crushers. As construction sectors across several regions accelerate, environmentally conscious alternatives like hybrid-powered crushers are gaining popularity. These models offer the benefit of lower emissions and energy efficiency, aligning with Sustainable Development Goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $4.2 Billion |

| CAGR | 4.2% |

In 2024, the single toggle segment led the market with a valuation of USD 1.8 billion. These crushers are favored for their straightforward design, cost-efficiency, and reliable operation. Unlike their double-toggle counterparts, single-toggle units have fewer moving parts, which makes them simpler to manufacture and maintain. They also consume less energy, making them suitable for smaller operations and ideal for use in mobile setups, particularly for civil works and demolition tasks. The reduced operational cost and enhanced usability contribute to their widespread preference among contractors.

The 100-300 TPH capacity segment represented 44.8% share in 2024, capturing strong interest due to its optimal balance between performance and affordability. This output range offers versatility, allowing use across medium-sized construction projects and aggregate production. These crushers are capable of processing tough materials such as recycled concrete and hard rock efficiently, which appeals to both contractors and mining operators who require consistent production without the investment needed for higher-capacity units. Their practical footprint and energy efficiency also support their deployment across multiple sectors, including housing, roadwork, and industrial construction.

United States Jaw Crushers Market accounted for a 64.7% share in 2024. The country's leadership in infrastructure development and a strong foundation in the mining sector are key growth drivers. The steady pace of roadwork, real estate expansion, and public infrastructure programs creates consistent demand for aggregates, which directly supports jaw crusher sales. Furthermore, advancements in crushing technology and an industry-wide push toward cleaner equipment have led to the growing use of hybrid and electric-powered crushers. These developments not only comply with regulatory requirements but also enhance machine efficiency.

Prominent companies active in the Global Jaw Crushers Market include Metso Outotec, Caterpillar, Thyssenkrupp AG, Komatsu, McLanahan, Retsch GmbH, Astec Industries, TKIL Industries, Powerscreen, Sandvik AB, Weir Group, SBM, Kleemann, Blue Group, and Terex Corporation. Leading manufacturers are focusing on innovation by developing jaw crushers with enhanced energy efficiency, noise reduction, and lower maintenance requirements. Many are investing in electric and hybrid-powered models to meet rising demand for sustainable machinery. Expanding manufacturing capabilities and establishing regional distribution centers allow companies to reduce lead times and improve service support. Strategic partnerships with construction and mining firms help secure long-term supply contracts and market penetration. Several players are also integrating IoT and automation technologies into their crushers to offer advanced monitoring, predictive maintenance, and performance optimization.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Capacity

- 2.2.4 Power

- 2.2.5 Application

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Infrastructure development and urbanization

- 3.2.1.2 Growth in mining and quarrying operations

- 3.2.1.3 Increased demand for aggregates

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial capital and operating costs

- 3.2.2.2 Environmental regulations

- 3.2.3 Opportunities

- 3.2.4 Technological advancements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Single toggle

- 5.3 Double toggles

Chapter 6 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Up to 100 TPH

- 6.3 100–300 TPH

- 6.4 Above 300 TPH

Chapter 7 Market Estimates and Forecast, By Power, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Diesel

- 7.3 Electric

- 7.4 Hybrid

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Manufacturing

- 8.3 Construction

- 8.4 Mining

- 8.5 Demolition

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Astec Industries

- 11.2 Blue Group

- 11.3 Caterpillar

- 11.4 Kleemann

- 11.5 Komatsu

- 11.6 McLanahan

- 11.7 Metso Outotec

- 11.8 Powerscreen

- 11.9 Retsch GmbH

- 11.10 Sandvik AB

- 11.11 SBM

- 11.12 Thyssenkrupp AG

- 11.13 Terex Corporation

- 11.14 TKIL Industries

- 11.15 Weir Group