PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766356

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766356

Gyratory Crushers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

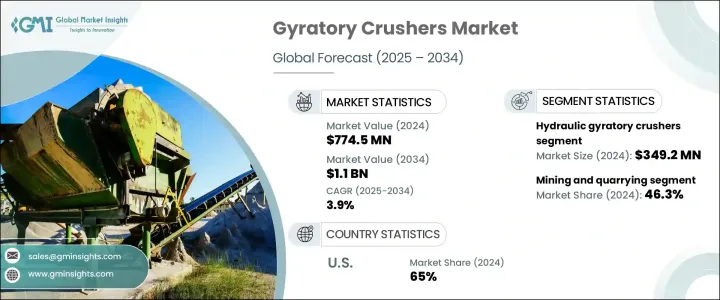

The Global Gyratory Crushers Market was valued at USD 774.5 million in 2024 and is estimated to grow at a CAGR of 3.9% to reach USD 1.1 billion by 2034. Rising demand for minerals and aggregates, particularly in developing countries, is driving mining firms to ramp up production. Gyratory crushers play a central role in this expansion, as they offer high-capacity ore processing capabilities. These machines are essential for crushing large volumes of raw material efficiently and are increasingly sought after with advancements in extraction technology. Infrastructure growth and rapid urbanization are significantly increasing the need for construction aggregates.

As large-scale projects such as bridges, highways, and commercial developments take shape, crushing systems capable of producing aggregates from hard rocks become indispensable. Innovations in crusher design, including automation, wear-resistant components, and energy-saving systems, are improving machine performance, safety, and overall operational output. The integration of smart features is enhancing reliability while reducing unplanned downtime, aligning with evolving industry needs for scalable and efficient material processing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $774.5 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 3.9% |

In 2024, the hydraulic gyratory crushers segment generated USD 349.2 million, driven by offering advanced capabilities in heavy-duty material processing. These systems are widely used in industries requiring large-scale ore reduction, such as copper and iron extraction, and are designed to handle extremely abrasive feedstocks like granite. Equipped with hydraulics, they streamline critical functions such as adjustment, maintenance, and overload response. This not only simplifies usage but also boosts machine safety and uptime. Operators can easily adjust crusher settings in real time to maintain consistent output and optimize throughput. Hydraulic systems also enable fast chamber clearing and part replacements, minimizing interruptions and enhancing productivity without the need for manual labor.

The mining and quarrying segment accounted for 46.3% market share in 2024. This segment benefits significantly from gyratory crushers due to the volume and hardness of the materials processed. These machines are the preferred choice for the primary crushing of hard minerals such as copper, iron, limestone, and granite. Their robust construction and high throughput capabilities make them ideal for operations that require continuous, large-scale material handling. Gyratory crushers ensure efficiency in reducing the size of raw ore, supporting downstream processes with consistent feedstock.

United States Gyratory Crushers Market held a 65% share in 2024, led by expansion in the mining and quarrying sectors. The machines are widely applied in processing aggregates like crushed stone, gravel, and sand due to their high output and reliability. Continuous development of crushers featuring integrated automation and hydraulic controls has enhanced performance while lowering maintenance demands. These advancements are crucial in improving the equipment lifecycle and reducing operational costs. Furthermore, the growing push for infrastructure development, including roads and urban expansion projects, is fueling the need for large-capacity crushers that meet the demands of heavy aggregate production.

Major manufacturers shaping the Global Gyratory Crushers Market include ThyssenKrupp AG, TAKRAF GmbH, Weir Group, Shanghai SANME Mining Machinery Corp Ltd, FLSmidth & Co. A/S, Earthtechnica, XCMG, AGICO Cement Machinery Co Ltd, The Makuri Group, Shunda Mining Group Co Ltd, Terex Corporation, Sandvik AB, Metso Outotec, CITIC Heavy Industries Co., Ltd., and Propel Industries. Industry leaders are strengthening their market position through strategic product innovation, focusing on automation, energy efficiency, and digital integration.

Manufacturers are investing in R&D to develop crushers with smart control systems, allowing real-time performance monitoring and adaptive processing. Expansion of production capacity in emerging regions enables faster delivery and localized support. Companies are also enhancing after-sales services such as predictive maintenance and remote diagnostics to build long-term relationships with clients. Partnerships with mining and construction firms help co-develop customized crushing solutions tailored to specific site conditions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Capacity

- 2.2.4 Power

- 2.2.5 Mobility

- 2.2.6 Application

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand in mining and quarrying

- 3.2.1.2 Infrastructure development

- 3.2.1.3 Expansion of cement and aggregate industries

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital and maintenance costs

- 3.2.2.2 Availability of alternatives

- 3.2.3 Opportunities

- 3.2.4 Technological advancements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Million) (Units)

- 5.1 Key trends

- 5.2 Standard Crushers

- 5.3 Hydraulic Crushers

- 5.4 Jaw Gyratory Crushers

Chapter 6 Market Estimates and Forecast, By Capacity, 2021 – 2034 (USD Million) (Units)

- 6.1 Key trends

- 6.2 Up to 1000 TPH

- 6.3 1001–2000 TPH

- 6.4 Above 2000 TPH

Chapter 7 Market Estimates and Forecast, By Power, 2021 – 2034 (USD Million) (Units)

- 7.1 Key trends

- 7.2 Electric

- 7.3 Hybrid

Chapter 8 Market Estimates and Forecast, By Mobility, 2021 – 2034 (USD Million) (Units)

- 8.1 Key trends

- 8.2 Stationary

- 8.3 Mobile

Chapter 9 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million) (Units)

- 9.1 Key trends

- 9.2 Aggregate Manufacturing

- 9.3 Mining and Quarrying

- 9.4 Recycling

- 9.5 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million) (Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AGICO Cement Machinery Co Ltd

- 11.2 CITIC Heavy Industries Co., Ltd.

- 11.3 Earthtechnicia

- 11.4 FLSmidth & Co. A/S

- 11.5 Metso Outotec

- 11.6 Propel Industries

- 11.7 Sandvik AB

- 11.8 Shanghai SANME Mining Machinery Corp Ltd

- 11.9 Shunda Mining Group Co Ltd

- 11.10 TAKRAF GmbH

- 11.11 Terex Corporation

- 11.12 The Makuri Group

- 11.13 ThyssenKrupp AG

- 11.14 Weir Group

- 11.15 XCMG