PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766365

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1766365

Vertical Farming Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

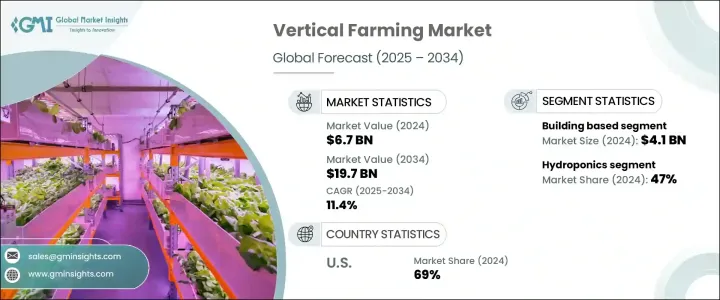

The Global Vertical Farming Market was valued at USD 6.7 billion in 2024 and is estimated to grow at a CAGR of 11.4% to reach USD 19.7 billion by 2034. This growth is largely driven by urban population expansion, the increasing emphasis on food security, and the rising demand for sustainable agricultural practices. Vertical farming, a controlled environment agriculture method, uses techniques like hydroponics, aeroponics, and aquaponics to cultivate crops efficiently indoors. These systems offer year-round production and maximize resource conservation by using less water and land.

Advanced technologies such as smart sensors, IoT, artificial intelligence, and energy-efficient LED lighting have further enhanced crop output and operational efficiency. Hydroponics remains the preferred method due to its ease of use and proven productivity, followed by other sustainable alternatives. With the help of climate-controlled environments, automated irrigation, fertigation, and real-time monitoring, vertical farms ensure consistent quality and quantity. The growing consumer interest in chemical-free, locally grown, and fresh produce is also pushing farmers to diversify crops, including vegetables, herbs, and fruits.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.7 Billion |

| Forecast Value | $19.7 Billion |

| CAGR | 11.4% |

High setup costs remain one of the primary barriers to vertical farming adoption. The upfront expenses related to installing advanced environmental control systems-ranging from LED grow lights to hydroponic or aeroponic systems-can be significantly higher than conventional agriculture. Facilities also incur added costs for acquiring or constructing buildings or containers to support vertical farming infrastructure.

In 2024, the building-based vertical farming segment generated USD 4.1 billion, driven by its ability to scale efficiently and offer flexible design options. These structures-whether renovated warehouses or purpose-built facilities-can support multiple growing layers per square foot, enhancing output density. They also accommodate integrated automation systems for lighting, climate, and irrigation, supporting stable production throughout the year. Proximity to urban areas not only reduces transportation time and costs but also ensures quicker delivery of fresher products to consumers. These benefits are attracting commercial growers to invest heavily in building-based vertical farms.

Hydroponics segment accounted for 47% share in 2024, solidifying its position as the dominant method. This system enables plants to thrive in nutrient-enriched water solutions, cutting down water usage by up to 90% compared to traditional farming. It eliminates the need for chemical inputs and supports rapid crop cycles and high yields. Hydroponics is simpler to implement and manage than complex systems like aeroponics or aquaponics, making it suitable for a wide variety of crops-particularly herbs and leafy greens-and ideal for commercial-scale operations.

U.S. Vertical Farming Market held a 69% share in 2024. Demand for locally grown, sustainable produce continues to increase, aligning with consumer expectations for fresh food with minimal environmental impact. Major metropolitan areas emerge as vertical farming hubs due to their ability to host these operations close to end consumers. The country's advanced technology infrastructure is accelerating the deployment of solutions such as hydroponic systems, AI-enabled climate control, LED lighting, and data-driven automation platforms. These innovations have significantly enhanced operational scalability and reliability, allowing farms to produce consistently even amid unpredictable external climates.

Prominent names in the Vertical Farming Industry include Ecopia, Signify, MechaTronix, Panasonic, UNI-TROLL, C-LED srl, Philips, AMS OSRAM AG, Tungsram, Nuvege, General Electronics, Artechno, LED iBond, Parus, and Organizzazione Orlandelli. Key strategies adopted by companies in the vertical farming market focus on strengthening market presence through innovation, partnerships, and geographic expansion. Players are heavily investing in research to develop energy-efficient lighting, smarter automation systems, and sustainable nutrient delivery models. Many are forming strategic alliances with retailers and food distributors to ensure better market penetration. Some firms are exploring urban real estate opportunities to establish farms closer to consumers. In addition, companies are deploying modular farming units and scalable models that cater to small and mid-sized businesses, broadening accessibility. Focus on resource optimization and environmentally responsible packaging is also helping these brands align with consumer expectations and regulatory standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Process

- 2.2.3 Crop Type

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization and limited arable land

- 3.2.1.2 Demand for fresh, pesticide-free produce

- 3.2.1.3 Government initiatives and incentives

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Technical complexity

- 3.2.3 Opportunities

- 3.2.4 Technological advancements

- 3.2.5 Supply chain optimization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By component

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Structure, 2021 – 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Shipping-container based

- 5.3 Building based

Chapter 6 Market Estimates and Forecast, By Process, 2021 – 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Hydroponics

- 6.3 Aeroponics

- 6.4 Aquaponics

Chapter 7 Market Estimates and Forecast, By Component, 2021 – 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Lighting systems

- 7.3 Irrigation and fertigation

- 7.4 Climate control

- 7.5 Sensors

Chapter 8 Market Estimates and Forecast, By Crop Type, 2021 – 2034 ($ Bn)

- 8.1 Key trends

- 8.2 Fruits

- 8.3 Vegetables

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AMS OSRAM AG

- 10.2 Artechno

- 10.3 C-LED srl

- 10.4 Ecopia

- 10.5 General Electronics

- 10.6 LED iBond

- 10.7 MechaTronix

- 10.8 Nuvege

- 10.9 Organizzazione Orlandelli

- 10.10 Panasonic

- 10.11 Parus

- 10.12 Philips

- 10.13 Signify

- 10.14 Tungsram

- 10.15 UNI-TROLL