PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773220

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773220

Micro-irrigation System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

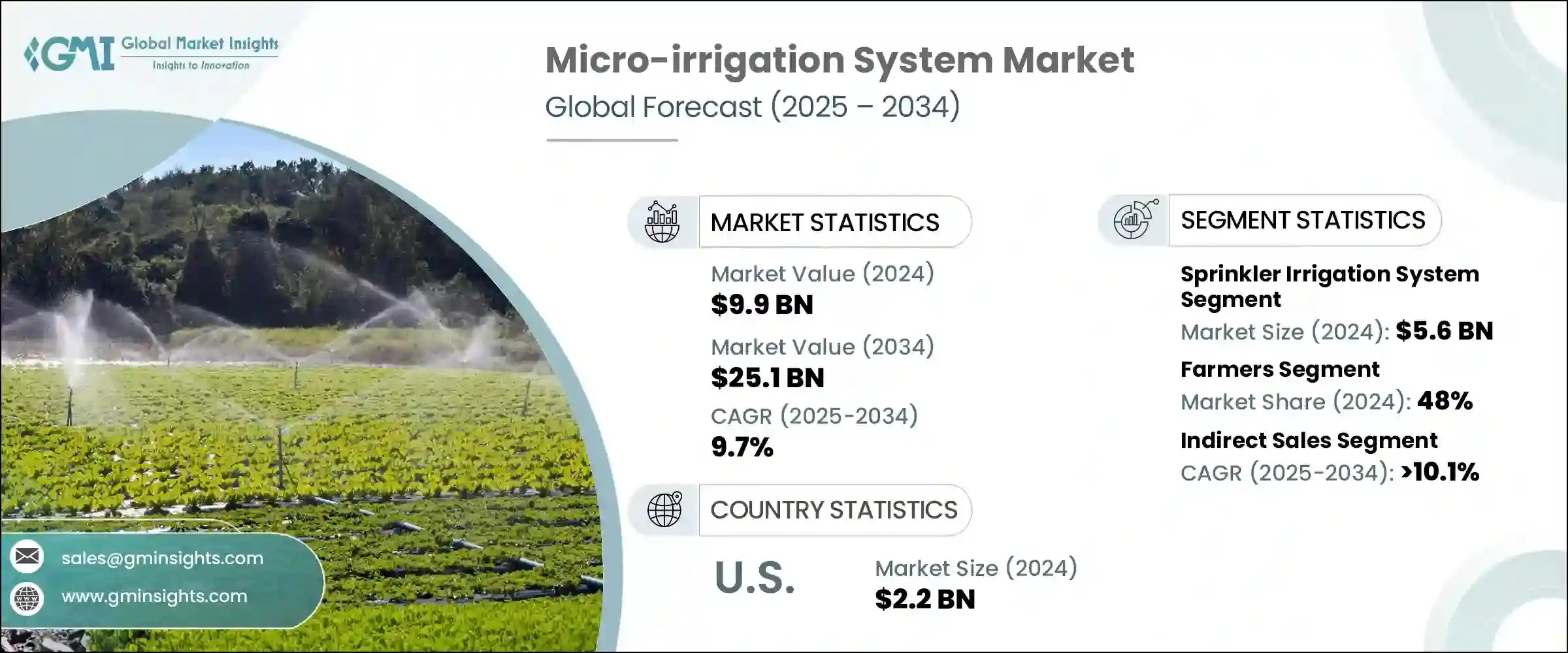

The Global Micro-irrigation System Market was valued at USD 9.9 billion in 2024 and is estimated to grow at a CAGR of 9.7% to reach USD 25.1 billion by 2034. Demand for these systems continues to rise due to the growing global population and increasing concern over food security. As water becomes a more limited resource in agriculture, micro-irrigation offers an efficient solution to meet crop requirements across varying climate conditions. In both dry and humid regions, micro-irrigation plays a vital role, either enabling crop cultivation in arid areas or supplementing natural rainfall when seasonal precipitation is inadequate. This method not only helps maintain consistent crop yields but also significantly improves agricultural productivity and profitability, which is particularly essential as arable land per capita continues to shrink globally.

The ability to deliver water directly to the root zone of plants ensures minimal water waste while maximizing crop output. As pressure mounts on farmers to increase efficiency, conserve water, and enhance soil health, the adoption of micro-irrigation technologies has become an increasingly attractive choice. These systems reduce manual labor, lower energy usage, and support more sustainable farming practices. With agricultural stakeholders worldwide embracing modern irrigation techniques, the market continues to expand, driven by both economic and environmental incentives. Additionally, government initiatives promoting water-efficient farming are further accelerating industry growth, especially in regions prone to drought or limited freshwater availability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.9 Billion |

| Forecast Value | $25.1 Billion |

| CAGR | 9.7% |

In 2024, the sprinkler irrigation system led the market by system type, generating USD 5.6 billion in revenue, and is projected to grow at a CAGR of 10.1% over the forecast period. This system is preferred for its versatility and broad application across various crop types. On the other hand, technological innovations in drip irrigation are allowing for more granular control, giving farmers the flexibility to adjust irrigation schedules, duration, and flow rates based on specific crop needs and climatic conditions. These advancements have enhanced the reliability and precision of irrigation, allowing growers to optimize yields and conserve resources simultaneously.

Modern drip systems now integrate sensor technologies that track key environmental and soil metrics. These sensors help monitor soil moisture, weather changes, and plant conditions, enabling farmers to fine-tune water applications. Whether wired or wireless, these sensor systems often link to central controllers or cloud-based platforms, streamlining data collection and decision-making in real time. Such integration reduces guesswork in irrigation, helping farmers improve efficiency and crop health with minimal human intervention.

Based on end use, the farmer segment dominated the market in 2024, accounting for 48% of the total revenue, and is projected to expand at a CAGR of 10.2% through 2034. Cost control remains a critical factor among field crop producers, which continues to drive the shift toward micro-irrigation. These systems align well with the operational goals of small and large-scale farms alike, offering long-term cost savings through reduced water consumption and improved crop uniformity.

In terms of distribution channel, indirect sales led the market in 2024 and are forecasted to maintain a CAGR exceeding 10.1% during the analysis period. Farmers heavily rely on local distributors, retailers, and online platforms to access irrigation equipment, especially in developing regions. These indirect channels provide wider accessibility and tailored support, making them a vital part of the sales ecosystem. Additionally, the rising adoption of digital commerce has allowed manufacturers to penetrate new markets and extend their reach to underserved areas, further boosting sales through indirect routes.

While indirect sales dominate, direct sales are gradually gaining traction. This approach allows producers to engage directly with end-users and offer customized solutions, technical assistance, and competitive pricing. More manufacturers are leaning toward direct engagement strategies to build stronger customer relationships and provide enhanced after-sales service.

The United States remained the leading country in the micro-irrigation system market in 2024, contributing USD 2.2 billion in revenue and commanding 84% of the total North American share. The country's irrigation infrastructure has evolved significantly, supported by technological advancements and regional policy initiatives. Shifting cropping patterns and the need for higher water-use efficiency continue to drive adoption. While the overall intensity of irrigation may fluctuate due to various regional factors, the focus remains firmly on improving productivity through more efficient systems.

The competitive landscape features several prominent players who are actively working to strengthen their positions through acquisitions, capacity expansions, and partnerships. Companies such as Adritec Europe, Netafim, Lindsay, Rivulis, and Toro together hold a combined market share of approximately 8% to 12%. These industry leaders continue to invest in innovation and strategic collaborations to diversify their product portfolios and increase customer reach.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 By regional

- 2.2.2 By system type

- 2.2.3 By application

- 2.2.4 By end use

- 2.2.5 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By system type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By System Type, 2021 - 2034 ($Billion, Million Units)

- 5.1 Key trends

- 5.2 Drip irrigation system

- 5.2.1 Surface drip irrigation

- 5.2.2 Sub-surface drip irrigation

- 5.2.3 Family drip

- 5.2.4 In-line drip

- 5.2.5 Others (online drip etc.)

- 5.3 Sprinkler irrigation system

- 5.3.1 Centre pivot

- 5.3.2 Towable pivot

- 5.3.3 Rain gun

- 5.3.4 Impact sprinkler

- 5.3.5 Pop up sprinkler

- 5.3.6 Others (linear move sprinkler etc.)

- 5.4 Others (bubbler, spray irrigation etc.)

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Billion, Million Units)

- 6.1 Key trends

- 6.2 Field crops

- 6.3 Landscapes

- 6.4 Container gardening

- 6.5 Small-scale farming

- 6.6 Others (indoor plants etc.)

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Billion, Million Units)

- 7.1 Key trends

- 7.2 Farmers

- 7.3 Corporate farms

- 7.4 Government agencies

- 7.5 Others (industrial users etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Million Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Adritec Europe

- 10.2 Automat Industries

- 10.3 Captain Polyplast

- 10.4 Ecoflo India

- 10.5 Hunter

- 10.6 Jain Irrigation Systems

- 10.7 Lindsay

- 10.8 N-Drip

- 10.9 Netafim

- 10.10 Novagric

- 10.11 Rain Bird Corporation

- 10.12 Rivulis

- 10.13 T-L Irrigation

- 10.14 Toro

- 10.15 Valmont