PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773224

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773224

Functional Flours Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

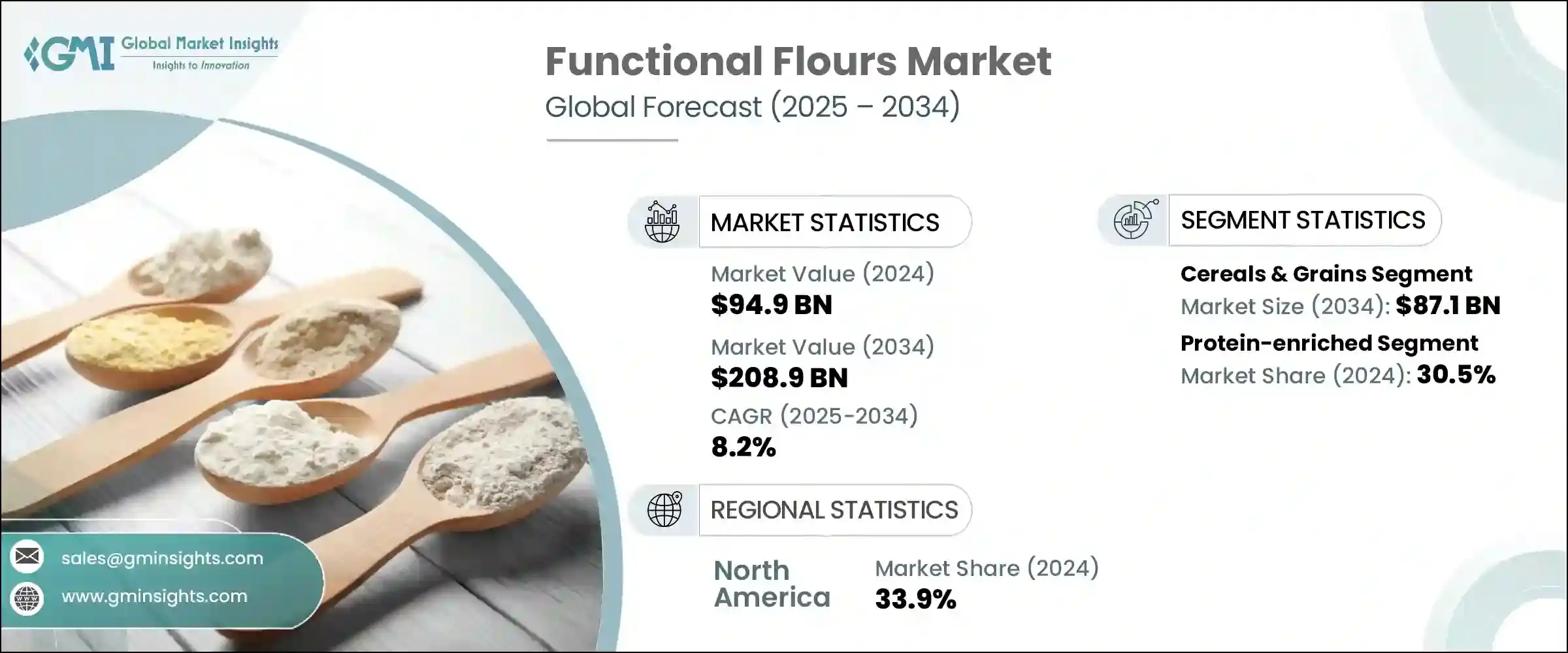

The Global Functional Flours Market was valued at USD 94.9 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 208.9 billion by 2034. This surge is being driven by growing awareness of the health advantages that fortified flours offer-particularly their roles in managing lifestyle-related conditions like obesity and diabetes. Consumers increasingly seek nutritious alternatives, leading manufacturers to enrich flours with fibers, proteins, and micronutrients. Additionally, rising demand across applications such as bakery, snacks, and convenience foods-especially clean-label and gluten-free segments-has strengthened market momentum. Technological enhancements in milling and production have also raised the bar, enabling the creation of flours with improved texture, nutritional value, and functional performance.

These advancements allow producers to meet diverse consumer expectations, further fueling market expansion by enabling the development of highly specialized flour products tailored to specific dietary preferences, health needs, and cultural trends. As consumers increasingly demand transparency, functionality, and clean-label ingredients, manufacturers are leveraging these innovations to create flours with enhanced nutritional value, better digestibility, and improved shelf life. The ability to customize flour formulations-whether gluten-free, low-carb, protein-rich, or allergen-friendly-empowers brands to cater to niche markets while broadening their overall consumer base. In turn, this strategic alignment with evolving food trends supports both premium product positioning and mass-market scalability, reinforcing the momentum of the global functional flour industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $94.9 Billion |

| Forecast Value | $208.9 Billion |

| CAGR | 8.2% |

The cereals & grains segment is forecasted to reach USD 87.1 billion by 2034, expanding at a CAGR of 5.4%. Its strong market presence is supported by widespread incorporation in everyday products like bread, breakfast cereals, snack bars, and ready-to-eat foods. A surge in consumer preference for better-for-you options-especially gluten-free, whole-grain, and high-fiber formulations-is fueling this segment's growth. As health and wellness trends continue to shape eating habits globally, this segment remains a staple in both developed and emerging markets. Despite this momentum, fluctuating raw material prices, transportation costs, and occasional supply chain interruptions pose ongoing risks. To counteract these challenges, producers are focusing on increasing the nutritional density of cereal-based flours by fortifying them with added fiber, vitamins, and minerals to appeal to health-conscious buyers.

In 2024, protein-enriched flours segment held 30.5% share. This segment is projected to grow at a CAGR of 5.2% through 2034, driven by surging demand for protein-rich diets, which are widely associated with improved physical performance, muscle health, satiety, and weight management. Heightened consumer awareness of the negative impacts of protein deficiency, especially among older adults and specific demographic groups, is intensifying interest in functional flours with added protein. In response, manufacturers are developing innovative offerings using plant-based proteins like lentils, peas, and soy to support growing vegetarian and vegan populations, while also catering to consumers with dairy or soy allergies.

North America Functional Flours Market held a 33.9% share in 2024. The region's leading share is largely attributed to rising awareness around dietary customization, with consumers actively seeking flours suited for gluten intolerance, celiac disease, and other lifestyle-based eating patterns. This demand is driving the production and consumption of flours derived from nutrient-dense sources like chickpeas, quinoa, and brown rice. The strong presence of established industry players, who are consistently expanding their product portfolios through innovation and product diversification, is further supporting market growth.

Major players in the market include Roquette Freres, Ingredion Incorporated, Archer Daniels Midland Company (ADM), SunOpta Inc., and Associated British Foods plc. Top companies in the functional flour space are focusing on diversification, health-driven innovation, and supply chain robustness. They are expanding their product ranges to include plant-based protein flours and alternative grains. Heavy investment in R&D is enabling the development of custom-tailored flour blends that support blood sugar control, gut health, or high-protein diets. Strategic alliances with bakery and food manufacturers are improving product penetration and end-use compatibility. These players are strengthening global supply chains through sourcing partnerships and storage infrastructure to hedge against raw material price fluctuations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Key manufacturers

- 3.1.2 Distributors

- 3.1.3 Profit margins across the industry

- 3.1.4 Supply chain and distribution analysis

- 3.1.4.1 Raw material sourcing

- 3.1.4.2 Production and manufacturing

- 3.1.4.3 Cold chain infrastructure

- 3.1.4.4 Distribution channels

- 3.1.4.5 Supply chain challenges and optimization

- 3.1.4.6 Sustainable practices

- 3.2 Trade statistics (HS code)

- 3.2.1 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.2.2 Major exporting countries, 2021-2024 (Kilo Tons)

( Note: the above trade statistics will be provided for key countries only)

- 3.3 Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising health consciousness

- 3.3.1.2 Growing demand for gluten-free products

- 3.3.1.3 Increasing protein consumption

- 3.3.1.4 Clean label trends

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 High cost compared to conventional flour

- 3.3.2.2 Limited shelf life

- 3.3.2.3 Processing challenges

- 3.3.2.4 Taste and texture limitations

- 3.3.3 Market opportunity

- 3.3.3.1 Emerging markets in Asia-Pacific

- 3.3.3.2 Innovation in plant-based products

- 3.3.3.3 Functional food applications

- 3.3.3.4 E-commerce expansion

- 3.3.1 Growth drivers

- 3.4 Raw material landscape

- 3.4.1 Manufacturing trends

- 3.4.2 Technology evolution

- 3.4.2.1 Processing technologies

- 3.4.2.2 Fortification methods

- 3.4.2.3 Quality testing & analysis

- 3.4.2.4 Packaging innovations

- 3.5 Pricing analysis and cost structure

- 3.5.1 Pricing trends (USD/Ton)

- 3.5.1.1 North America

- 3.5.1.2 Europe

- 3.5.1.3 Asia Pacific

- 3.5.1.4 Latin America

- 3.5.1.5 Middle East Africa

- 3.5.2 Pricing factors (raw materials, energy, labor)

- 3.5.3 Regional price variations

- 3.5.4 Cost structure breakdown

- 3.5.5 Profitability analysis

- 3.5.1 Pricing trends (USD/Ton)

- 3.6 Regulatory framework and standards

- 3.6.1 FDA regulations (U.S.)

- 3.6.2 EU regulations

- 3.6.3 Codex alimentarius standards

- 3.6.4 Regional regulatory bodies

- 3.6.5 Labeling requirements

- 3.6.6 Quality standards

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Company heat map analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.6.1 Expansion

- 4.6.2 Mergers & acquisition

- 4.6.3 Collaborations

- 4.6.4 New product launches

- 4.6.5 Research & development

- 4.7 Recent developments & impact analysis by key players

- 4.7.1 Company categorization

- 4.7.2 Participant’s overview

- 4.7.3 Financial performance

- 4.8 Product benchmarking

Chapter 5 Market Estimates & Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cereals & grains

- 5.2.1 Wheat

- 5.2.2 Rice

- 5.2.3 Corn

- 5.2.4 Oats

- 5.2.5 Barley

- 5.2.6 Quinoa

- 5.2.7 Other cereals & grains

- 5.3 Legumes

- 5.3.1 Chickpeas

- 5.3.2 Lentils

- 5.3.3 Peas

- 5.3.4 Beans

- 5.3.5 Other legumes

- 5.4 Nuts & seeds

- 5.4.1 Almonds

- 5.4.2 Coconut

- 5.4.3 Sunflower seeds

- 5.4.4 Flax seeds

- 5.4.5 Other nuts & seeds

- 5.5 Fruits & vegetables

- 5.5.1 Banana

- 5.5.2 Sweet potato

- 5.5.3 Cassava

- 5.5.4 Other fruits & vegetables

- 5.6 Other sources

- 5.6.1 Insects

- 5.6.2 Algae

- 5.6.3 Mushrooms

Chapter 6 Market Estimates & Forecast, By Functionality, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Protein enriched

- 6.3 Fiber enriched

- 6.4 Gluten-free

- 6.5 Vitamin & mineral fortified

- 6.6 Low carbohydrate

- 6.7 Probiotic

- 6.8 Antioxidant rich

- 6.9 Other functionalities

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Bakery & confectionery

- 7.2.1 Bread

- 7.2.2 Cakes & pastries

- 7.2.3 Cookies & biscuits

- 7.2.4 Muffins & cupcakes

- 7.2.5 Other bakery products

- 7.3 Snacks

- 7.3.1 Extruded snacks

- 7.3.2 Crackers

- 7.3.3 Chips

- 7.3.4 Other snacks

- 7.4 Beverages

- 7.4.1 Protein drinks

- 7.4.2 Smoothies

- 7.4.3 Functional beverages

- 7.4.4 Other beverages

- 7.5 Pasta & noodles

- 7.6 Breakfast cereals

- 7.7 Soups & sauces

- 7.8 Meat alternatives

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Powder

- 8.3 Granules

- 8.4 Flakes

- 8.5 Pellets

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 B2b (business-to-business)

- 9.2.1 Food manufacturers

- 9.2.2 Bakeries

- 9.2.3 Foodservice

- 9.2.4 Other b2b channels

- 9.3 B2c (business-to-consumer)

- 9.3.1 Supermarkets & hypermarkets

- 9.3.2 Specialty stores

- 9.3.3 Online retail

- 9.3.4 Convenience stores

- 9.3.5 Other b2c channels

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Cargill, Incorporated

- 11.2 Archer Daniels Midland Company (ADM)

- 11.3 Associated British Foods plc

- 11.4 General Mills, Inc.

- 11.5 Ingredion Incorporated

- 11.6 Roquette Freres

- 11.7 Tate & Lyle PLC

- 11.8 SunOpta Inc.

- 11.9 The Scoular Company

- 11.10 Agrana Beteiligungs-AG

- 11.11 Limagrain

- 11.12 Bunge Limited

- 11.13 The Andersons, Inc.

- 11.14 Grain Millers, Inc.

- 11.15 Hodgson Mill, Inc.

- 11.16 Lifeway Foods, Inc.

- 11.17 Manildra Group

- 11.18 Unicorn Grain Specialties

- 11.19 Bluebird Grain Farms