PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773226

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773226

Companion Animal Healthcare Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

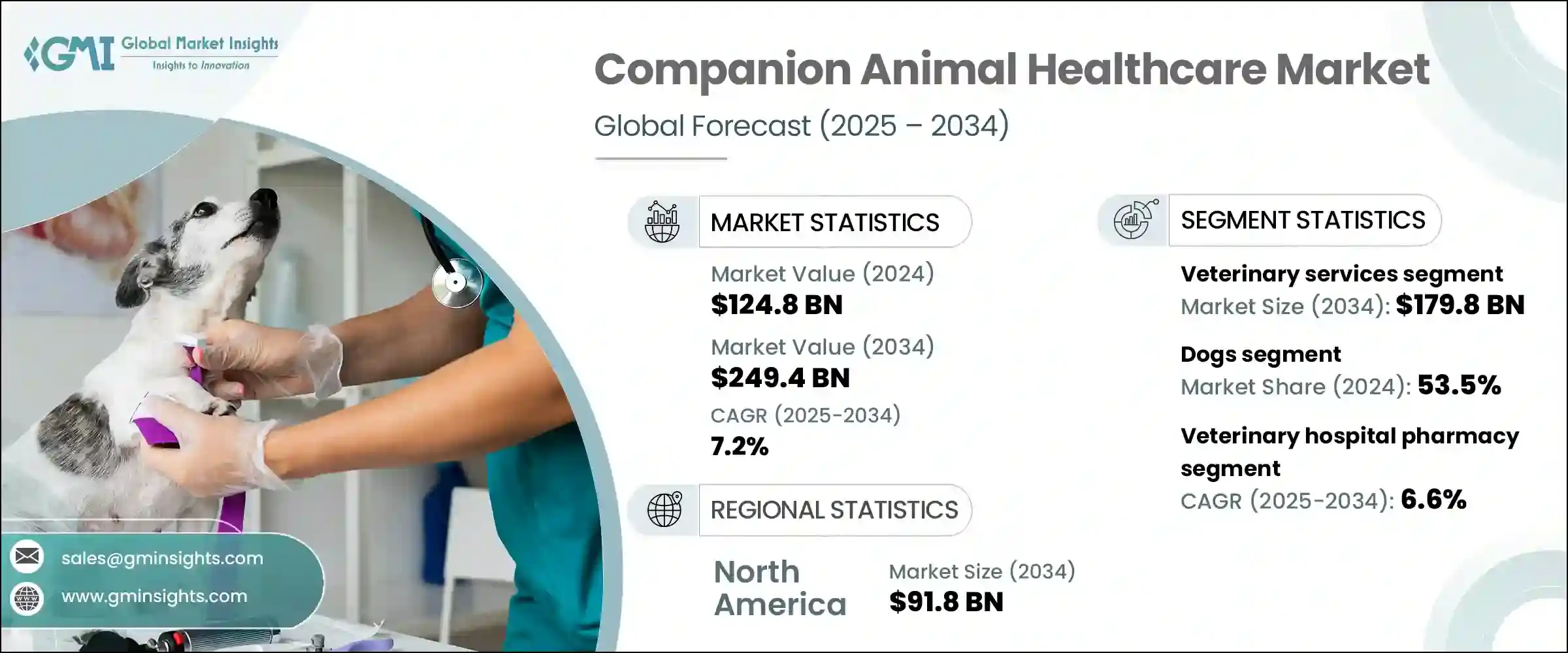

The Global Companion Animal Healthcare Market was valued at USD 124.8 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 249.4 billion by 2034. The increasing humanization of pets, along with the growing awareness around animal health and wellness, has led to a rising demand for comprehensive veterinary solutions. More pet owners today are actively investing in preventive healthcare, regular wellness checkups, and parasite control, contributing to higher spending across the companion animal health sector. Alongside these behavioral shifts, rising global pet adoption rates and higher disposable incomes are further fueling the demand for medical services, products, and advanced care solutions for pets.

Digital transformation in veterinary care has also emerged as a key growth driver. With the introduction of telemedicine platforms and remote monitoring tools, pet owners can access veterinary expertise more conveniently than ever before. The market is also benefiting from the growing adoption of pet insurance, which improves affordability and access to necessary treatments and preventive care services. As pet owners increasingly seek specialized and holistic healthcare for their animals, the industry continues to innovate with wellness products and digital tools that enhance care delivery. These advancements are not only expanding the reach of veterinary services but also improving health outcomes across various animal species.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $124.8 Billion |

| Forecast Value | $249.4 Billion |

| CAGR | 7.2% |

Companion animal healthcare encompasses a wide spectrum of medical services and solutions designed for domesticated animals such as dogs, cats, horses, and others. The market includes a variety of products and services, from pharmaceuticals and diagnostics to veterinary services. Among these segments, veterinary services held the largest share in 2024, valued at USD 89 billion, and are expected to double to USD 179.8 billion by 2034. This segment includes a broad range of offerings such as medical treatments, pet boarding, grooming, training, insurance services, and wellness programs. The rising prevalence of chronic conditions among companion animals and increasing expenditures on routine and preventive care continue to drive demand for these services.

Based on the type of animal, the market is divided into dogs, cats, horses, and others. The dogs segment led the global market in 2024, accounting for a 53.5% share. This strong performance is attributed to the high popularity of dogs as household companions, which translates into greater spending on nutrition, routine checkups, vaccinations, grooming, and specialized treatments. Pet owners are also becoming more aware of breed-specific health needs and are increasingly opting for tailored wellness plans, thereby further strengthening the demand within this segment.

In terms of distribution, the companion animal healthcare market is segmented into veterinary hospital pharmacies, retail pharmacies, and e-commerce platforms. Veterinary hospital pharmacies commanded the largest market share in 2024 and are projected to grow at a CAGR of 6.6% during the forecast period. These pharmacies are typically integrated within veterinary clinics and hospitals, providing immediate access to prescribed and over-the-counter medications after consultations. Their proximity to diagnostic and treatment services allows for faster medication dispensing and personalized guidance. Moreover, these pharmacies are staffed with professionals specialized in veterinary pharmacology, improving safety and precision in pet treatments. As the demand for prescription-based drugs and complex therapies grows, the relevance and influence of this segment continue to expand.

Regionally, North America led the global companion animal healthcare market with a revenue of USD 54.4 billion in 2024 and is projected to reach USD 91.8 billion by 2034, registering a CAGR of 5.4%. The region benefits from well-established veterinary infrastructure, high awareness around pet wellness, and a robust insurance ecosystem. A strong network of clinics, growing use of AI-driven diagnostics, and a mature pet care market further contribute to its leadership position. North America also houses several companies involved in the development and distribution of pet medications, diagnostics, and wellness solutions, which helps maintain a competitive edge in the global landscape.

The companion animal healthcare market is highly competitive, with a mix of global players and specialized providers aiming to strengthen their presence. Industry participants are continuously enhancing their offerings by investing in research, digital technologies, and service expansion. Strategic initiatives such as partnerships, innovation in digital health, and a focus on personalized pet care continue to define the competitive dynamics of this rapidly evolving sector.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Animal

- 2.2.4 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet ownership rate

- 3.2.1.2 Increasing prevalence of chronic conditions

- 3.2.1.3 Growing technological advancements

- 3.2.1.4 Expanding online platforms for veterinary services

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of treatment

- 3.2.2.2 Limited access in developing regions

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding pet insurance coverage

- 3.2.3.2 Growing demand for personalized veterinary medicines

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pet population statistics 2024

- 3.5 Reimbursement scenario

- 3.6 Venture capitalist scenario in animal health industry

- 3.7 Regulatory landscape

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pharmaceuticals

- 5.2.1 Drugs

- 5.2.1.1 Antiparasitic

- 5.2.1.2 Anti-inflammatory

- 5.2.1.3 Anti-infectives

- 5.2.1.4 Corticosteroids

- 5.2.1.5 Tranquilizers

- 5.2.1.6 Cardiovascular drugs

- 5.2.1.7 Gastrointestinal drugs

- 5.2.2 Vaccines

- 5.2.2.1 Modified live vaccines (MLV)

- 5.2.2.2 Killed inactivated vaccines

- 5.2.2.3 Recombinant vaccines

- 5.2.3 Medicated feed additives

- 5.2.3.1 Antibiotics

- 5.2.3.2 Vitamins

- 5.2.3.3 Amino acids

- 5.2.3.4 Enzymes

- 5.2.3.5 Antioxidants

- 5.2.3.6 Prebiotics and probiotics

- 5.2.3.7 Minerals

- 5.2.3.8 Carbohydrates

- 5.2.3.9 Propandiol

- 5.2.1 Drugs

- 5.3 Medical devices

- 5.3.1 Veterinary diagnostic equipment

- 5.3.2 Veterinary anesthesia equipment

- 5.3.3 Veterinary patient monitoring equipment

- 5.3.4 Veterinary surgical equipment

- 5.3.5 Veterinary consumables

- 5.3.6 Other medical devices

- 5.4 Veterinary services

- 5.4.1 Grooming services

- 5.4.2 Boarding and daycare

- 5.4.3 Training services

- 5.4.4 Pet insurance

- 5.4.5 Medical services

- 5.4.6 Other veterinary services

Chapter 6 Market Estimates and Forecast, By Animal, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Horses

- 6.5 Other animals

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Veterinary hospital pharmacy

- 7.3 Retail pharmacy

- 7.4 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 B Braun

- 9.2 Boehringer Ingelheim

- 9.3 Ceva

- 9.4 Dechra

- 9.5 Elanco

- 9.6 Endovac

- 9.7 Figo Pet Insurance

- 9.8 Hartville

- 9.9 Hester

- 9.10 HIPRA

- 9.11 Hollard

- 9.12 IDEXX Laboratories

- 9.13 Mars

- 9.14 Medtronic

- 9.15 Merck

- 9.16 Neogen

- 9.17 PetIQ

- 9.18 Phibro

- 9.19 Vetoquinol

- 9.20 Virbac

- 9.21 Zoetis