PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773238

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773238

Veterinary Dermatology Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

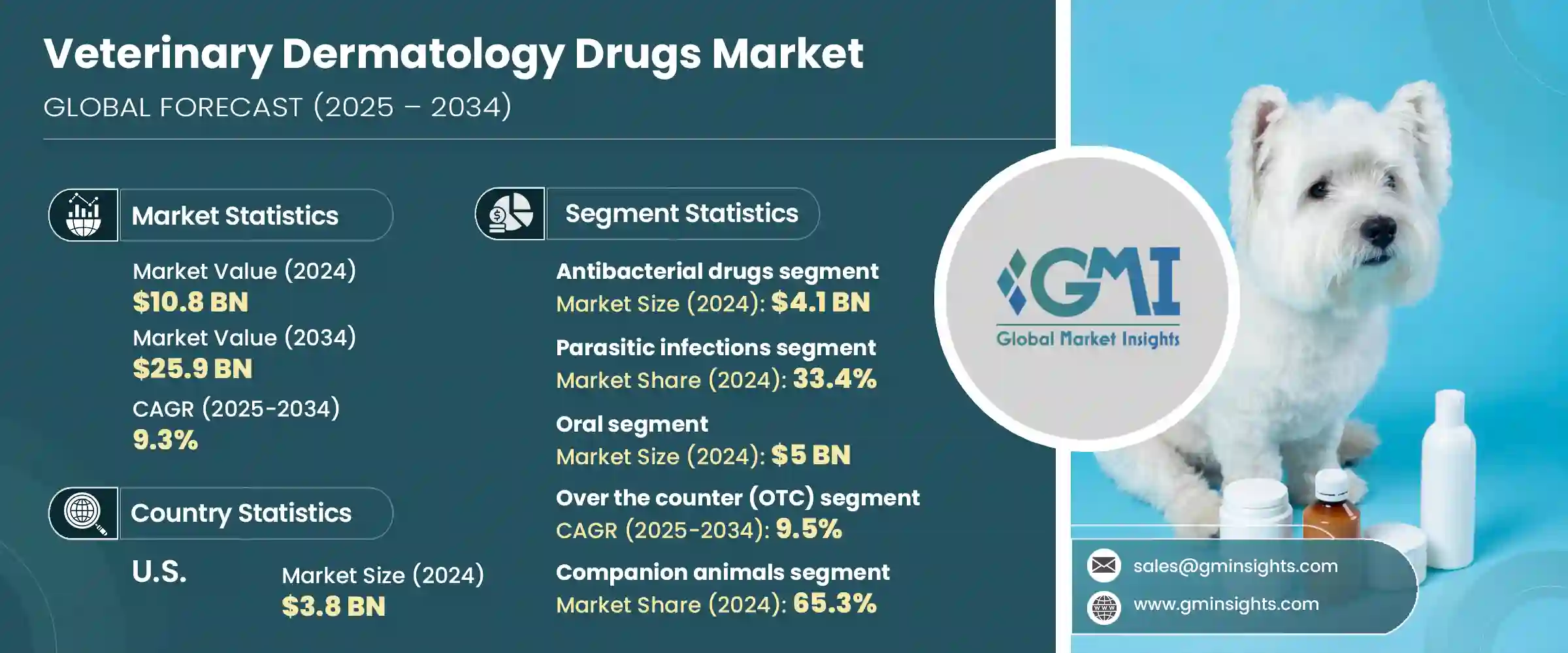

The Global Veterinary Dermatology Drugs Market was valued at USD 10.8 billion in 2024 and is estimated to grow at a CAGR of 9.3% to reach USD 25.9 billion by 2034. This growth is being driven by a sharp increase in the incidence of skin disorders among animals, coupled with rising awareness around pet health and wellness. As pet ownership continues to rise worldwide, demand for veterinary drugs designed to treat dermatological issues has surged. This demand is further amplified by an uptick in animal healthcare spending and an increasing medicalization rate, particularly in urban areas where companion animals are more prevalent. Investment in animal healthcare infrastructure is gaining momentum across emerging economies, especially in regions such as Asia-Pacific and Latin America, creating favorable conditions for market expansion.

Another factor contributing to the market's progress is the development of advanced dermatological drugs aimed at minimizing side effects while enhancing therapeutic outcomes. Pharmaceutical companies are focusing on new formulations, particularly topical and oral options, that improve ease of administration and efficacy. As awareness continues to grow about the impact of skin diseases on animal health, the market is witnessing greater acceptance of dermatology-specific medications. Additionally, the rise in skin infections among livestock and companion animals is pushing the need for early diagnosis and treatment, encouraging the widespread use of dermatology drugs across veterinary practices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.8 Billion |

| Forecast Value | $25.9 Billion |

| CAGR | 9.3% |

Veterinary dermatology drugs encompass a broad spectrum of treatments used to manage and cure skin disorders in animals, ranging from infections and inflammations to autoimmune skin conditions. These medications are typically categorized into several drug classes, including antibacterial, antifungal, antiparasitic, and anti-inflammatory drugs. These drugs are administered through multiple routes, such as oral, topical, and injectable, depending on the condition and the animal's response to treatment.

In terms of drug class, antibacterial medications held the largest market share, reaching a value of USD 4.1 billion in 2024. The demand for antibacterial veterinary drugs is largely fueled by the increasing frequency of bacterial skin infections, particularly among companion animals. As these infections become more common, veterinarians are turning to more advanced antibacterial formulations and combination therapies to deliver effective results. The emergence of drug-resistant strains has also accelerated the need for stronger and more targeted antibacterial products. Furthermore, the rising awareness of these conditions and improvements in diagnostic capabilities have enabled early detection, contributing to the consistent dominance of this segment.

By indication, parasitic infections accounted for the largest market share, capturing 33.4% of the total in 2024. Skin conditions caused by parasites are among the most common dermatological issues in animals. Changes in environmental and climatic conditions are playing a role in the increased spread of parasitic diseases, particularly in tropical climates. In response, pharmaceutical companies are introducing long-acting antiparasitic drugs in both topical and oral forms. These new formulations focus on simplifying treatment routines while delivering lasting protection. Ongoing research and innovation in antiparasitic drug development, combined with favorable regulatory conditions, are supporting segment growth. Enhanced access through expanded distribution networks has also contributed to the segment's strong performance.

Among the various routes of administration, oral drugs accounted for USD 5 billion in 2024 and are forecast to grow at a CAGR of 9% through 2034. Oral administration is widely preferred due to its systemic approach, which allows the drug to circulate through the bloodstream and tackle the root cause of skin issues. It also ensures better compliance, as animals tend to accept oral medications more readily than external applications. This high compliance rate contributes to consistent treatment results, which in turn drives demand in this segment.

Regionally, North America led the global veterinary dermatology drugs market, holding a 38.6% share in 2024. The market in the United States alone was valued at USD 3.8 billion that year, up from USD 3.5 billion in 2023. Growth in this region can be attributed to the presence of robust R&D capabilities and the steady introduction of improved drug formulations. The high volume of companion animals and the cultural emphasis on pet care are central to the region's dominant market position. As pet owners continue to invest in premium healthcare solutions for their animals, the demand for dermatology drugs has followed suit.

Competition within the market remains strong, with numerous players striving to gain market share through targeted R&D, innovation in drug formulations, geographic expansion, and compliance with evolving regulatory standards. Companies are increasingly focusing on creating specialized products that meet the unique dermatological needs of animals, positioning themselves strategically within this rapidly growing sector.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Drug class

- 2.2.3 Indication

- 2.2.4 Route of administration

- 2.2.5 Type

- 2.2.6 Animal type

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of dermatological diseases

- 3.2.1.2 Technological advancements

- 3.2.1.3 Increasing number of veterinary dermatology practitioners

- 3.2.1.4 Increased spending on animal healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse side effects and safety concerns

- 3.2.2.2 High cost of treatment

- 3.2.3 Market opportunities

- 3.2.3.1 Rising pet ownership and spending

- 3.2.3.2 Expansion of e-commerce and retail channels

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Antibacterial drugs

- 5.3 Antifungal drugs

- 5.4 Antiparasitic drugs

- 5.5 Other drug classes

Chapter 6 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Parasitic infections

- 6.3 Allergic infections

- 6.4 Autoimmune skin diseases

- 6.5 Skin cancer

- 6.6 Other indications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Topical

- 7.4 Injectable

Chapter 8 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Prescription

- 8.3 Over the counter (OTC)

Chapter 9 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Companion animals

- 9.2.1 Dogs

- 9.2.2 Cats

- 9.2.3 Horses

- 9.2.4 Other companion animals

- 9.3 Livestock animals

- 9.3.1 Bovine

- 9.3.2 Swine

- 9.3.3 Other livestock animals

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Veterinary hospital pharmacies

- 10.3 Retail pharmacies

- 10.4 Online pharmacies

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Bimeda

- 12.2 Bioiberica

- 12.3 Boehringer Ingelheim

- 12.4 Ceva Sante Animale

- 12.5 Dechra Pharmaceuticals

- 12.6 Elanco Animal Health

- 12.7 Indian Immunologicals

- 12.8 Merck & Co.

- 12.9 Vee Remedies

- 12.10 Virbac

- 12.11 Vetoquinol

- 12.12 Vivaldis

- 12.13 Zoetis