PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773245

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773245

Animal Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

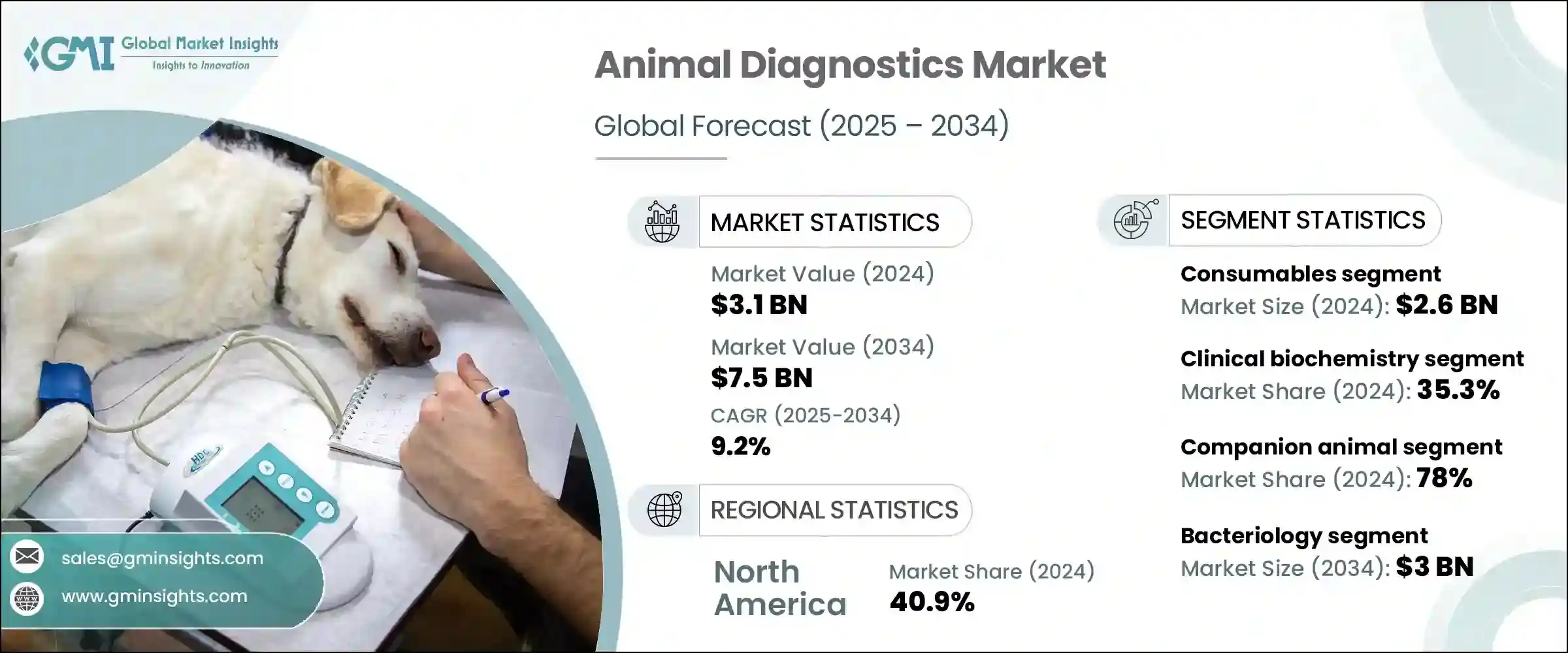

The Global Animal Diagnostics Market was valued at USD 3.1 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 7.5 billion by 2034. This growth is primarily driven by the rising prevalence of both infectious and chronic diseases in companion and farm animals. As animal health becomes a growing concern for both individual owners and the agricultural sector, the demand for reliable diagnostic solutions continues to increase.

Public and private investments in animal health infrastructure, coupled with supportive government policies targeting disease prevention and management, are fostering greater awareness and adoption of diagnostics across the veterinary landscape. Collaborations between veterinary clinics and diagnostic labs, as well as expanded outreach by major players in underserved regions, are significantly improving access to testing services in developing countries. Moreover, the growing popularity of pet insurance is easing the financial burden of frequent diagnostics for pet owners, thereby encouraging regular testing and early disease detection.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $7.5 Billion |

| CAGR | 9.2% |

Animal diagnostics involves a range of testing methods used to detect and monitor diseases or other health conditions in animals. These techniques include molecular diagnostics, serological testing, urinalysis, and clinical biochemistry, among others. Based on product type, the market is divided into instruments and consumables. Among these, the consumables segment held the largest share, valued at USD 2.6 billion in 2024. The dominance of this segment is due to the high usage frequency and recurring need for items such as diagnostic kits, reagents, slides, and collection tubes. These products are integral to daily operations in veterinary clinics and labs, contributing to their consistent demand and overall market leadership.

By technology, the clinical biochemistry segment led the global animal diagnostics market in 2024 with a 35.3% share. This segment continues to gain traction due to its ability to assess vital physiological markers through blood, urine, and other bodily fluids, allowing for the early detection of conditions such as liver and kidney disorders, metabolic diseases, and hormonal imbalances in animals. As awareness about preventive care in pets grows, the demand for routine health screenings, which often include biochemistry panels, has surged. The increasing cases of chronic conditions in pets have also played a key role in boosting the use of clinical chemistry tools in veterinary settings.

In terms of application, the market is segmented into bacteriology, pathology, parasitology, and other diagnostic applications. The bacteriology segment accounted for a significant portion of the market and is projected to reach USD 3 billion by 2034. This segment remains crucial for identifying bacterial pathogens that are responsible for a wide range of animal diseases. Bacteriological testing enables veterinarians to diagnose infections accurately and implement timely treatment protocols. Innovations in testing methodologies and the growing emphasis on controlling zoonotic diseases and improving food safety standards are contributing to the segment's continued dominance.

When segmented by animal type, the companion animals category led the market with a substantial 78% share in 2024. This includes diagnostics for dogs, cats, horses, and other household animals. The surge in pet ownership, especially in urban areas, has led to higher demand for veterinary services, including diagnostics. Furthermore, rising awareness about pet health and the increasing incidence of diseases like cancer and diabetes in animals are pushing pet owners to seek regular health checkups and diagnostic support.

By end use, diagnostic laboratories emerged as the leading segment in 2024 and are projected to grow at a CAGR of 9.3% from 2025 to 2034. These labs offer comprehensive testing services, supported by sophisticated equipment and skilled technicians capable of processing large sample volumes with precision. Their ability to perform advanced testing, such as real-time PCR and genetic sequencing, has made them the preferred choice for veterinarians seeking accurate results. Growing demand for centralized, high-throughput testing continues to position these facilities at the forefront of the market.

Regionally, North America maintained its position as the largest market in 2024, commanding 40.9% of the global share. The region benefits from widespread pet ownership, advanced veterinary healthcare infrastructure, and growing awareness of preventive animal care. The animal diagnostics market in the United States alone reached USD 1.14 billion in 2024, showing consistent year-over-year growth. Increased adoption of pet insurance and high spending on animal health are among the factors supporting this regional leadership.

The competitive landscape of the global animal diagnostics market is dominated by key players that control around 65% to 70% of the industry. These companies leverage their expansive product portfolios and international presence to maintain a strong foothold. Strategic initiatives, including acquisitions, new product launches, and facility expansions, are common tactics used to drive growth and enhance technological capabilities in this rapidly evolving market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Technology

- 2.2.4 Application

- 2.2.5 Animal type

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing trend of adopting pet animals

- 3.2.1.2 Rising prevalence of foodborne and zoonotic diseases

- 3.2.1.3 Favorable government initiatives

- 3.2.1.4 Advancements in companion diagnostics

- 3.2.1.5 Increasing adoption of pet insurance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Prohibitive cost associated with animal tests

- 3.2.2.2 Low out of pocket expenditure on veterinary care

- 3.2.3 Market opportunities

- 3.2.3.1 Technological advancements and point-of-care molecular tools

- 3.2.3.2 Expanding livestock industry and demand for food safety

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pricing analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Consumables

- 5.3 Instruments

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Clinical biochemistry

- 6.2.1 Glucose monitoring

- 6.2.2 Blood gas and electrolyte analysis

- 6.2.3 Other clinical biochemistry tests

- 6.3 Immunodiagnostics

- 6.3.1 Lateral flow assays

- 6.3.2 ELISA

- 6.3.3 Immunoassay analyzers

- 6.3.4 Other immunodiagnostic tests

- 6.4 Molecular diagnostics

- 6.4.1 PCR

- 6.4.2 Microarrays

- 6.4.3 Other molecular diagnostic tests

- 6.5 Hematology

- 6.6 Urinalysis

- 6.7 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bacteriology

- 7.3 Pathology

- 7.4 Parasitology

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Companion animals

- 8.2.1 Dogs

- 8.2.2 Cats

- 8.2.3 Horses

- 8.2.4 Other companion animals

- 8.3 Farm animals

- 8.3.1 Cattle

- 8.3.2 Swine

- 8.3.3 Poultry

- 8.3.4 Other farm animals

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary hospitals and clinics

- 9.3 Diagnostic labs

- 9.4 Home care settings

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Poland

- 10.3.7 Netherlands

- 10.3.8 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Columbia

- 10.5.5 Peru

- 10.5.6 Chile

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

- 10.6.5 Egypt

- 10.6.6 Israel

Chapter 11 Company Profiles

- 11.1 bioMerieux

- 11.2 BioNote

- 11.3 Bio-Rad Laboratories

- 11.4 Boehringer Ingelheim International

- 11.5 Heska Corporation

- 11.6 Idexx laboratories

- 11.7 KogeneBiotech

- 11.8 Median Diagnostics

- 11.9 Neogen Corporation

- 11.10 Randox

- 11.11 Thermo Fischer Scientific

- 11.12 Virbac

- 11.13 VetAll Laboratories

- 11.14 Qiagen

- 11.15 Zoetis