PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773247

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773247

Dental Preventive Supplies Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

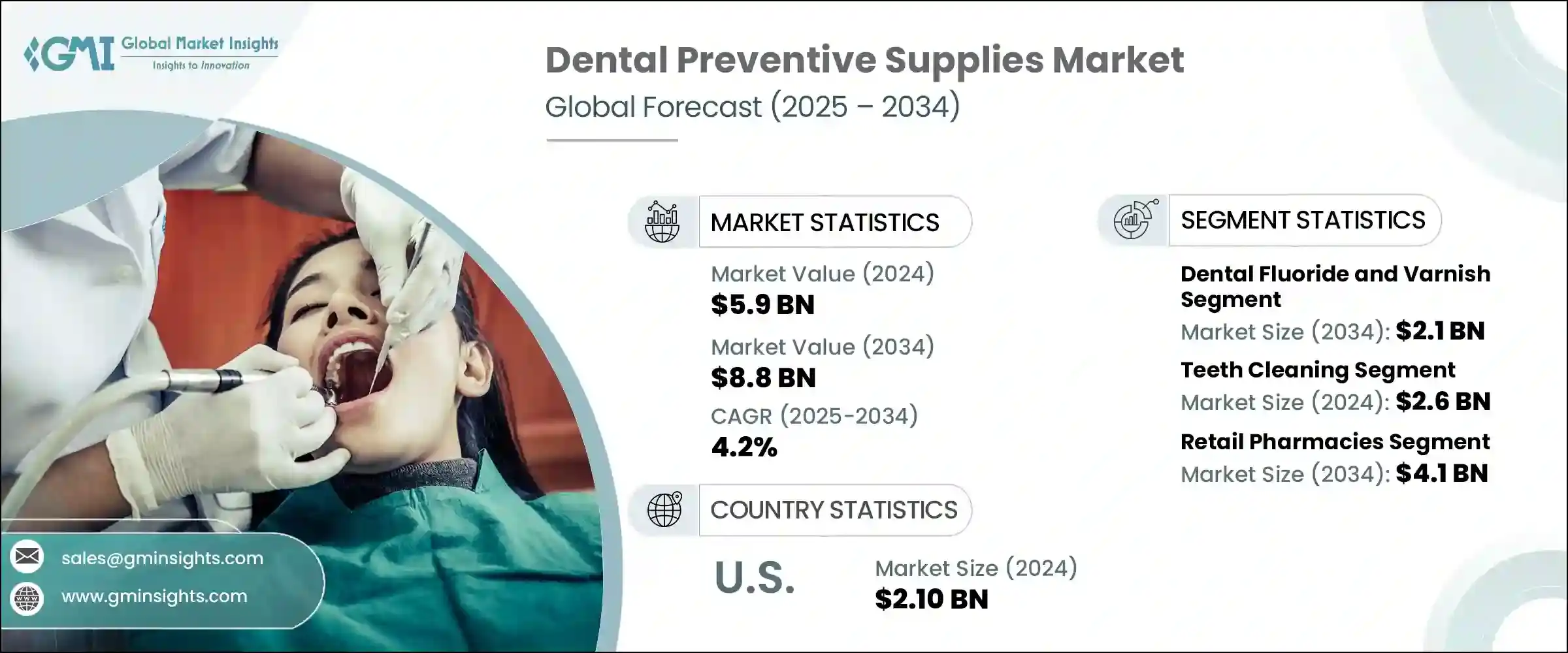

The Global Dental Preventive Supplies Market was valued at USD 5.9 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 8.8 billion by 2034. This growth is fueled by the rising incidence of dental conditions, increasing public awareness about oral health, and continuous technological innovations in dental preventive products. As more people recognize the importance of prevention, products like toothpaste, floss, and mouthwash are seeing broader adoption. Efforts by governments and health organizations promoting oral hygiene, especially through school programs and public awareness campaigns, are further encouraging the use of preventive supplies. Advancements in dental preventive tools are revolutionizing how both professionals and consumers approach oral care, making daily routines more effective and tailored to individual needs.

Dental preventive supplies encompass a wide array of products designed to reduce the risk of oral diseases such as tooth decay and gum inflammation. These supplies serve both dental practitioners and individuals who want to maintain optimal oral health. Technological progress plays a key role in market expansion, with innovative products enhancing usability, accuracy, and convenience. For instance, smart toothbrushes equipped with sensors, artificial intelligence, and Bluetooth connectivity allow users to monitor brushing habits and improve techniques through real-time feedback, transforming oral care into a more personalized experience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.9 Billion |

| Forecast Value | $8.8 Billion |

| CAGR | 4.2% |

The dental fluoride and varnish segment is projected to grow to USD 2.1 billion by 2034, driven largely by the increasing global incidence of dental issues, especially dental caries and tooth decay among children and older adults. Factors such as high sugar intake, tobacco consumption, and poor oral hygiene habits significantly contribute to the rising prevalence of these dental diseases. This, in turn, fuels the demand for preventive measures like fluoride treatments and varnishes, which help protect teeth and reduce decay.

In 2024, the teeth cleaning services segment generated USD 2.6 billion. This growth is largely due to greater public awareness about the importance of preventing dental conditions such as cavities and gingivitis. The segment is further supported by the expanding aging population worldwide, which tends to experience more oral health problems. As a result, the demand for routine professional teeth cleaning services has increased, helping maintain oral health and prevent further complications.

U.S. Dental Preventive Supplies Market was valued at USD 2.10 billion in 2024. This strong market position is supported by many highly trained dental professionals specializing in preventive care. Additionally, continuous advancements in dental technologies and education across the country help sustain market growth. These factors make the U.S. a vital player in the global dental preventive supplies industry, with ongoing innovation and expertise fueling demand and product development.

Major players operating in the Dental Preventive Supplies Market include Colgate-Palmolive Company, 3M Company, Johnson & Johnson, The Procter & Gamble Company, Dentsply Sirona Inc., Haleon, Ivoclar Vivadent, Henry Schein, Inc., Sunstar Suisse S.A., Kerr Corporation, Hu-Friedy Mfg. Co., LLC., Ultradent Products Inc., Church & Dwight Co., and Young Innovations, Inc. Leading companies in the dental preventive supplies sector focus on continuous innovation, expanding product portfolios, and strategic partnerships to strengthen their market position.

Investment in R&D allows firms to introduce advanced solutions like smart dental devices and natural ingredient-based products that meet evolving consumer preferences. Market leaders also emphasize geographic expansion by entering emerging markets where oral health awareness is growing rapidly. Collaborations with dental professionals, educational institutions, and government health programs help boost product adoption and brand credibility. Additionally, companies leverage digital marketing and e-commerce platforms to reach a wider audience directly.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing oral health awareness

- 3.2.1.2 Increasing prevalence of dental disorders

- 3.2.1.3 Technological advancements in dental preventive supplies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with dental procedures

- 3.2.2.2 Economic barriers to dental care access

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.3.1 Japan

- 3.4.3.2 China

- 3.4.3.3 India

- 3.5 Technological landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Value chain analysis

- 3.9 Consumer behaviour analysis

- 3.9.1 Shifting trends in oral hygiene practices

- 3.9.2 Influence of digital media on preventive dental care

- 3.9.3 Consumer preferences for natural and organic products

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dental fluorides and varnish

- 5.3 Tooth whitening and desensitizers

- 5.4 Prophylactic pastes and powders

- 5.5 Sealants

- 5.6 Dental floss

- 5.7 Mouth gels

- 5.8 Other product types

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Teeth cleaning

- 6.3 Teeth whitening

- 6.4 Teeth coating

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Retail pharmacies

- 7.3 Drug stores

- 7.4 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M Company

- 9.2 Church & Dwight Co.

- 9.3 Colgate-Palmolive Company

- 9.4 Dentsply Sirona

- 9.5 GC International

- 9.6 Haleon

- 9.7 Henry Schein

- 9.8 Hu-Friedy Mfg.

- 9.9 Ivoclar Vivadent

- 9.10 Johnson & Johnson

- 9.11 Kerr Corporation

- 9.12 Sunstar Suisse

- 9.13 The Procter & Gamble Company

- 9.14 Ultradent Products

- 9.15 Young Innovations