PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773248

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773248

Maternity Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

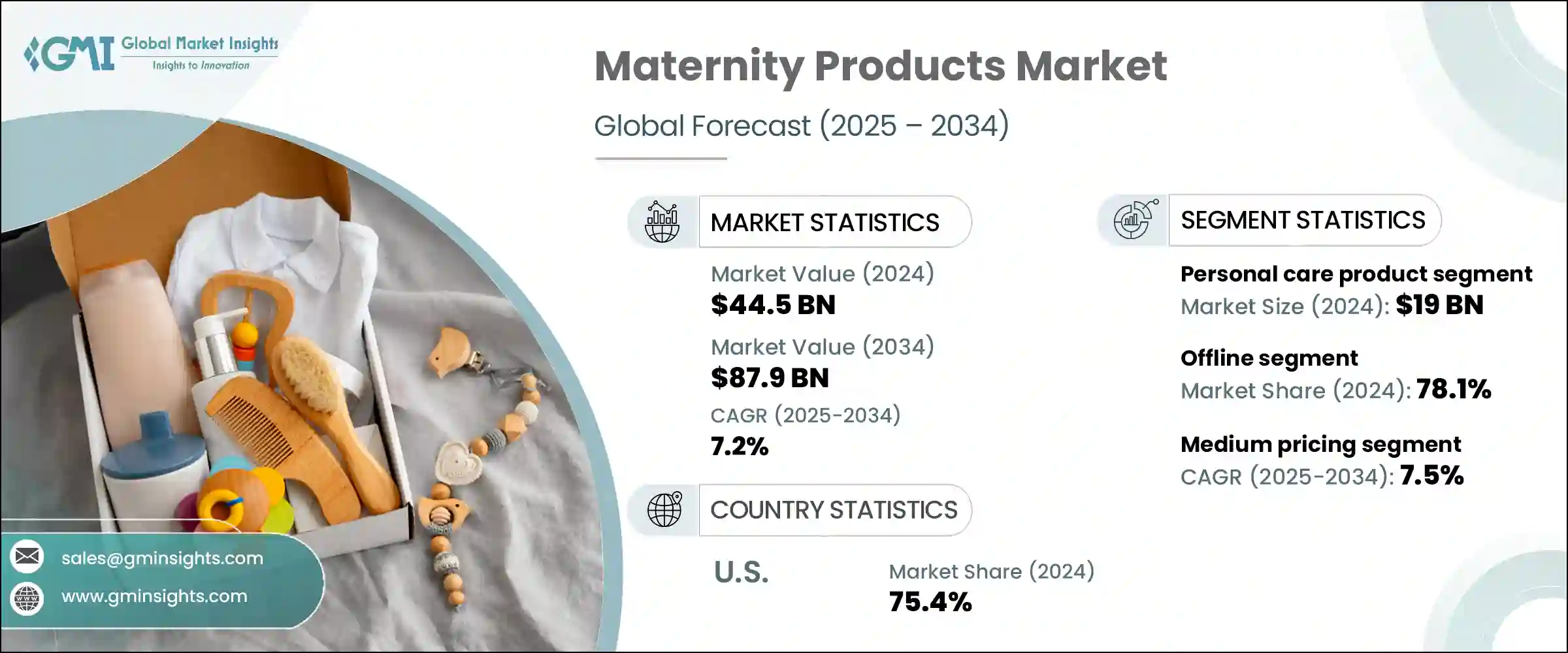

The Global Maternity Products Market was valued at USD 44.5 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 87.9 billion by 2034. The market is experiencing strong momentum, driven by rising awareness among parents regarding maternal wellness. There's a notable shift in how maternal health is approached, influenced by better healthcare access, evolving consumer expectations, and supportive government policies. One of the primary growth factors is increased consumer focus on both mental and physical health during and after pregnancy. Technology integration in maternal care is accelerating growth, with digital tools providing personalized health tracking, diet planning, and activity recommendations.

Remote consultations through telehealth services are also improving maternity care accessibility. Governments and health organizations are promoting digital maternal solutions to address existing care gaps. As disposable incomes rise globally, parents are more inclined to invest in advanced, comfortable, and safe maternity products. The surge in online retail platforms has also transformed accessibility and convenience. With greater privacy, wider product choices, and the ability to compare offerings, e-commerce continues to attract modern, tech-savvy parents who are looking for quality solutions to support the motherhood journey.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $44.5 Billion |

| Forecast Value | $87.9 Billion |

| CAGR | 7.2% |

In 2024, personal care products generated USD 19 billion and are forecasted to grow at a CAGR of 7.4% by 2034. These items dominate the global market, largely due to growing awareness of skincare and wellness among pregnant and postpartum women. Concerns such as skin irritation, pigmentation, and stretch marks are prompting demand for a broad spectrum of solutions, including creams, gels, and organic skincare lines. Increasing participation of women in the workforce, along with a preference for natural, safe, and high-performing products, continues to fuel growth in this segment. Mothers are prioritizing both convenience and effectiveness, supporting a shift toward trusted and eco-conscious brands.

The offline retail channels segment accounted for 78.1% share in 2024 and is projected to maintain a CAGR of 7.1% during 2025-2034. Physical retail stores hold a dominant position because they offer hands-on product assessment. Pregnant consumers prefer the opportunity to touch, test, and evaluate items before making a purchase-particularly when it comes to comfort, fit, quality, and size. Sales personnel add value by guiding customers based on their individual needs, which improves the shopping experience and builds brand trust. Offline formats also support a more curated product comparison, especially when purchasing wearables, health devices, or skin care solutions.

United States Maternity Products Market held 75.4% share in 2024 and is on track to grow at a CAGR of 7.1% during 2025-2034. Consumers in the US are highly attuned to maternal health and prioritize both safety and innovation. An increase in working mothers and rising income levels are contributing to greater spending on premium-quality maternity products. Additionally, product development focused on sustainable and tech-driven innovations is gaining strong consumer interest. The market's maturity and fast adoption of health-enhancing technologies continue to position the US as a leader in this space.

Leading companies in the Global Maternity Products Market include Gap, Motherhood, H&M Mama, Seraphine, JoJo Maman Bebe, A Pea in the Pod, PinkBlush, HATCH, Old Navy, Cake, Frida, ASOS, Destination, Isabella Oliver, and The Moms Co. Companies in the maternity products industry are focusing on innovation, quality, and omnichannel retail strategies to expand their presence. Many brands are enhancing their digital storefronts and optimizing e-commerce channels to meet rising demand for convenient, discreet shopping experiences. Product portfolios are being diversified with organic, dermatologically tested, and sustainability-certified offerings to cater to the health-conscious consumer base. Collaborations with healthcare professionals and influencers help boost brand credibility and consumer engagement. In-store experiences are being improved through personalized consultation services and curated displays.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.2.4 Pricing

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behaviour analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behaviour

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 – 2034, (USD Billion)(Thousand Units)

- 5.1 Key trends

- 5.2 Maternal apparel

- 5.3 Personal care products

- 5.4 Nutritional supplements

- 5.5 Maternity accessories

Chapter 6 Market Estimates & Forecast, By Application, 2021 – 2034, (USD Billion)(Thousand Units)

- 6.1 Key trends

- 6.2 Pregnancy

- 6.3 Postnatal

Chapter 7 Market Estimates & Forecast, By Pricing, 2021 – 2034, (USD Billion)(Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion)(Thousand Units)

- 8.1 Key trends

- 8.2 Online sales

- 8.2.1 E-commerce

- 8.2.2 Company website

- 8.3 Offline sales

- 8.3.1 Wholesales/distributors

- 8.3.2 Hypermarkets/supermarkets

- 8.3.3 Specialty stores

- 8.3.4 Others(multi-brand stores, etc.)

Chapter 9 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion)(Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 A Pea in the Pod

- 10.2 ASOS

- 10.3 Cake

- 10.4 Destination

- 10.5 Frida

- 10.6 Gap

- 10.7 H&M Mama

- 10.8 Hatch

- 10.9 Isabella Oliver

- 10.10 JoJo Maman Bebe

- 10.11 Motherhood

- 10.12 Old Navy

- 10.13 Pink Blush

- 10.14 Seraphine

- 10.15 The Moms Co.