PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773251

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773251

Home Office Furniture Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

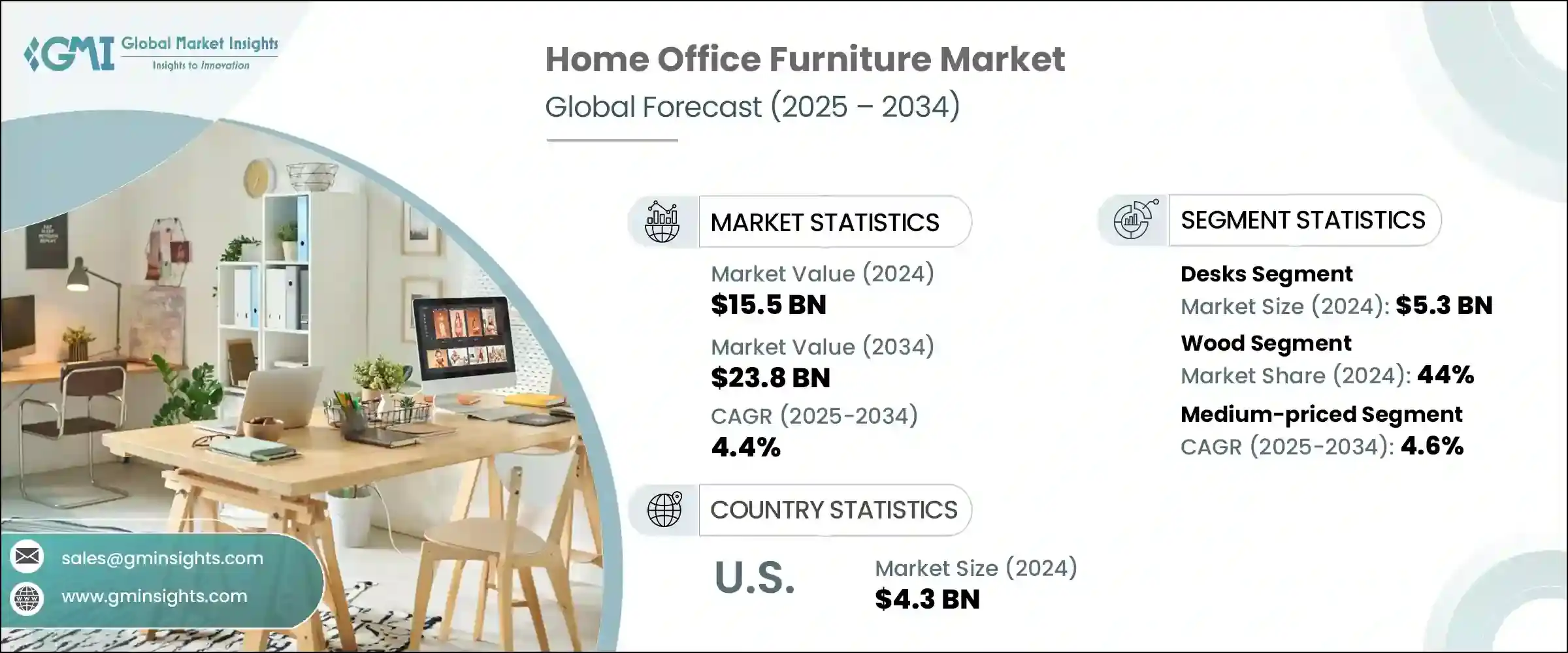

The Global Home Office Furniture Market was valued at USD 15.5 billion in 2024 and is estimated to grow at a CAGR of 4.4% to reach USD 23.8 billion by 2034. Key growth catalysts include the widespread shift toward remote working and the ongoing trend of urban living, which increases demand for compact and versatile home office setups. As more professionals in countries like the United States and Germany transition to hybrid or fully remote roles, the demand for functional, ergonomic, and stylish workspace furniture continues to rise. Shrinking urban housing footprints further accelerate the demand for modular and space-saving office furniture. As designs evolve to meet changing living standards, consumer interest grows in options that blend aesthetics with usability. While this trend supports market expansion, rising raw material prices and deforestation-induced timber shortages are putting pressure on margins.

Evolving consumer tastes also present challenges, with demand shifting toward adaptable, comfortable, and sustainable home office solutions that support flexible work habits. As remote and hybrid work become permanent fixtures in daily life, users are seeking multifunctional furniture that blends seamlessly into living spaces without compromising on performance. There's growing interest in ergonomic designs that promote health and well-being, including features like lumbar support, adjustable heights, and integrated tech enhancements. Aesthetic preferences have also changed, favoring minimalistic, modular styles that reflect personal taste while offering functionality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.5 Billion |

| Forecast Value | $23.8 Billion |

| CAGR | 4.4% |

The desks segment generated USD 5.3 billion in 2024 and is expected to grow at a CAGR of 4.5% through 2034. Their prominence stems from the global adoption of work-from-home arrangements and the growing preference for co-working-style environments. Modern desks offer features like adjustable heights and modular add-ons, enhancing both comfort and efficiency. In addition, emerging innovations such as AI-enabled desks are gaining traction. These intelligent systems can adjust desk settings based on user activity, connect with multiple devices, and include integrated technology like wireless charging pads and smart sensors that optimize performance and track ergonomics in real time.

In 2024, the wood furniture segment held a 44% share and is anticipated to grow at a CAGR of 4.8% through 2034. Wood remains a preferred material due to its durability, aesthetic appeal, and adaptability across various interior styles. Eco-conscious customers are increasingly choosing reclaimed wood and recycled metals, with approximately 40% of them seeking sustainable materials in their purchasing decisions. Design trends are evolving to incorporate soft, rounded features that foster calm and inviting workspaces. Flexible furniture pieces that can be rearranged or serve multiple functions-such as transforming from a work desk into a dining table-are gaining popularity for their ability to conserve space without compromising style or functionality.

United States Home Office Furniture Market held a 77% share and generated USD 4.3 billion in 2024. This leadership position is largely attributed to the rise of hybrid and remote work models, growing consumer interest in personalized home office setups, and robust purchasing power. US buyers are willing to invest in high-quality, tech-integrated furniture solutions that cater to comfort, performance, and longevity. Unlike many other regions where price sensitivity can curb innovation, the US market demand has propelled manufacturers to develop advanced offerings tailored specifically to the remote work culture.

Leading players in the Home Office Furniture Market include Knoll, Kokuyo, Product Depot International, Godrej Interio, HON, Williams-Sonoma, Sunon Furniture, La-Z-Boy, Steelcase, Vitra International, Haworth, Humanscale, Virco, Herman Miller, and HNI Corporation. To build market resilience and expand their footprint, home office furniture companies are focusing on multiple strategies. These include introducing modular and ergonomic designs that accommodate diverse work styles and spatial constraints. Many firms are integrating smart technology into their product lines, enabling features such as wireless charging, sit-stand automation, and digital health tracking. Sustainability remains a major focus, with companies incorporating recycled materials and promoting environmentally responsible sourcing. In addition, strong omnichannel retail strategies, including immersive online experiences and virtual room planners, are helping brands engage customers more effectively.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Price

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Middle East and Africa

- 4.2.1.5 Latin America

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Desks

- 5.3 Chairs

- 5.4 Storage units & cabinets

- 5.5 Tables

- 5.6 Accessories

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Wood

- 6.3 Metal

- 6.4 Glass

- 6.5 Plastic

- 6.6 Others (fabrics etc.)

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce

- 8.2.2 Company websites

- 8.3 Offline

- 8.3.1 Supermarkets/hypermarket

- 8.3.2 Specialty retail stores

- 8.3.3 Others (independent retailer etc.)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Godrej Interio

- 10.2 Haworth

- 10.3 Herman Miller

- 10.4 HNI Corporation

- 10.5 HON

- 10.6 Humanscale

- 10.7 Knoll

- 10.8 Kokuyo

- 10.9 La-Z-Boy

- 10.10 Product Depot International

- 10.11 Steelcase

- 10.12 Sunon Furniture

- 10.13 Virco

- 10.14 Vitra International

- 10.15 Williams-Sonoma