PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773252

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773252

Spay and Neuter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

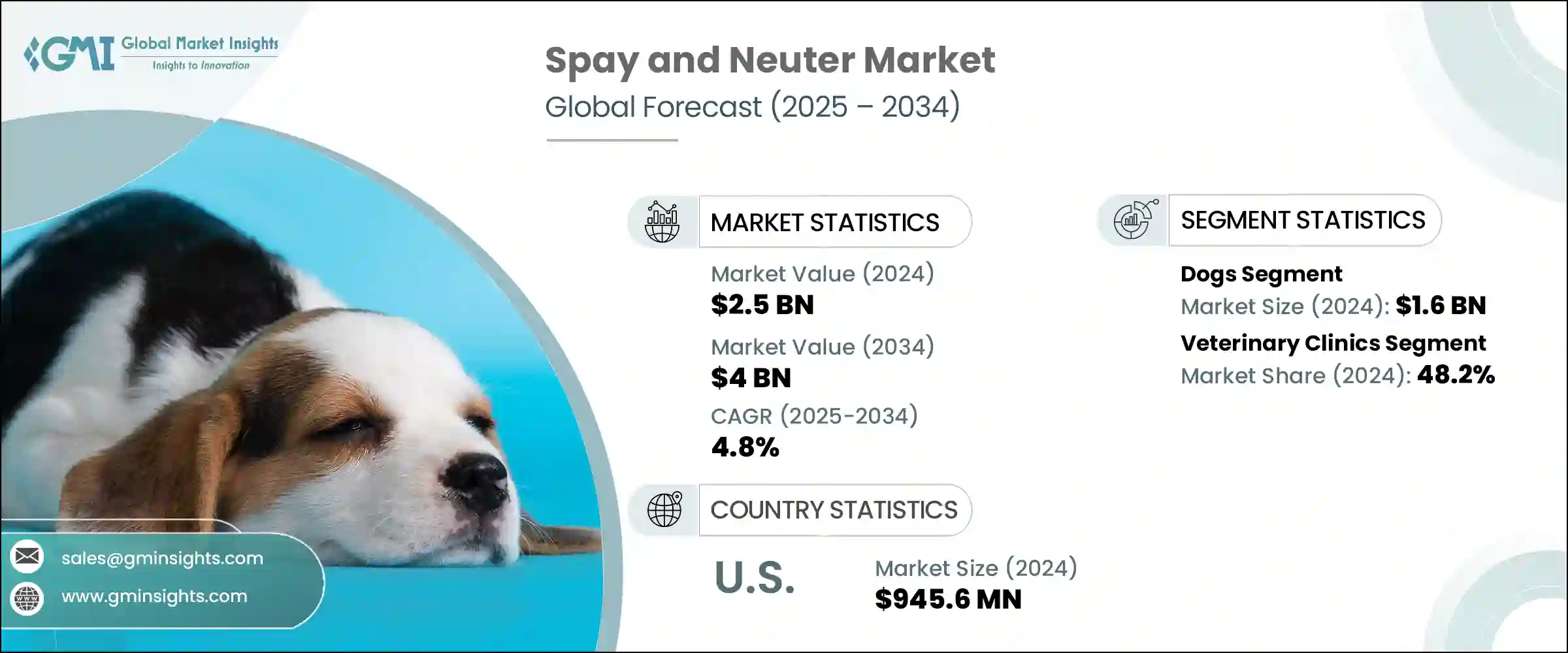

The Global Spay and Neuter Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 4 billion by 2034. Rising awareness about pet overpopulation and the health benefits associated with sterilization procedures are major drivers behind this growth. Public campaigns led by veterinary associations, governments, and animal welfare organizations continue to encourage responsible pet ownership. Educational and community outreach initiatives are also transforming perceptions around pet sterilization, leading to a significant rise in procedure rates across both urban and rural areas. This evolving mindset, supported by institutional efforts, has played a crucial role in fueling market momentum.

Another key contributor to the market's expansion is the steady increase in global companion animal ownership. As more families welcome pets into their homes, the demand for veterinary services, especially sterilization, is growing. With hundreds of millions of dogs and cats living in households across regions, demand for spay and neuter services has surged. In many cases, rescue centers and adoption agencies require sterilization as a condition for adoption, further accelerating the uptake. The growing popularity of animal adoption over commercial breeding-often driven by awareness campaigns against stray populations-has reinforced sterilization as a necessary health and population control measure, amplifying the need for affordable and accessible procedures.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $4 Billion |

| CAGR | 4.8% |

In 2024, dogs held the largest segment share of the market, generating USD 1.6 billion. This dominance is largely due to the widespread adoption of dogs as pets, coupled with rising consumer spending on their care. Countries in Europe report high populations of pet dogs, which contributes to increased demand for sterilization. Dog owners are more likely to opt for spaying or neutering as part of general health and behavioral management. Additionally, expanding disposable incomes in emerging markets and the rising uptake of pet insurance coverage continue to make sterilization services more financially feasible. These combined trends are expected to fuel segment growth in the coming years.

The veterinary clinics segment commanded the highest share in 2024, accounting for 48.2%. Their leadership position is backed by strong patient volumes and competitive pricing, making them a popular choice among pet owners. Clinics offer expert care with advanced surgical equipment, ensuring safety and quality. From comprehensive pre-surgery evaluations to follow-up care, clinics provide a reliable environment for these procedures. Many of them are also introducing promotional packages, installment payment plans, and community partnerships that help expand access to essential services. Their expertise, affordability, and proactive outreach strategies have made veterinary clinics the primary channel for spay and neuter operations globally.

U.S. Spay and Neuter Market generated USD 945.6 million in 2024. The country's extensive veterinary infrastructure and a well-developed network of professionals support consistent demand for sterilization services. The sheer number of household pets alone boosts the requirement for regular animal healthcare, particularly spay and neuter operations. Technological advancements in minimally invasive surgeries like laparoscopy and endoscopy are gaining ground due to their reduced recovery times and lower complication rates. Moreover, with rising consumer expenditure on pet wellness and preventive healthcare, the demand for sterilization services is expected to remain high, reinforcing the U.S. as a dominant force in the global market.

Leading participants in the Spay and Neuter Market include Auburn Valley Humane Society, Alley Cat Allies, CVS Group Plc, Banfield Pet Hospital, The PAWS Clinic, Companions Spay & Neuter, Fix Long Beach, Indian Street Animal Clinic, VetPartners Group Limited, Houston Humane Society, Petco Animal Supplies, Naoi Animal Hospital, Animal Spay-Neuter Clinic, Holt Road Pet Hospital, Ethos Veterinary Health, S/Nipped Clinic. To reinforce their position in the competitive spay and neuter market, companies are adopting a range of targeted strategies. Many focus on expanding clinic networks into underserved or rural areas to capture a broader clientele. Offering bundled services, including vaccinations and wellness check-ups with sterilization, improves convenience and boosts uptake. Organizations are also investing in educational campaigns and working closely with shelters to streamline adoption-linked sterilization processes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Animal type

- 2.2.3 Service provider

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing awareness about the benefits of spaying and neutering

- 3.2.1.2 Expansion of mobile spay and neuter clinics

- 3.2.1.3 Advancement in the spay and neuter surgical procedures

- 3.2.1.4 Supportive initiatives by public/ private organizations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk associated with spay and neuter surgeries

- 3.2.2.2 Regulations/ cultural beliefs against spay and neuter surgeries in some countries

- 3.2.3 Market opportunities

- 3.2.3.1 Government and NGO initiatives for population control

- 3.2.3.2 Mandatory sterilization laws and pet licensing regulations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Pet ownership statistics by country, 2024

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Merger and acquisition

- 4.5.2 Partnership and collaboration

- 4.5.3 New service launches

- 4.5.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dogs

- 5.2.1 Spaying

- 5.2.2 Neutering

- 5.3 Cats

- 5.3.1 Spaying

- 5.3.2 Neutering

- 5.4 Other animal types

- 5.4.1 Spaying

- 5.4.2 Neutering

Chapter 6 Market Estimates and Forecast, By Service Provider, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Veterinary clinics

- 6.3 Veterinary hospitals

- 6.4 Other service providers

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Alley Cat Allies

- 8.2 Auburn Valley Humane Society

- 8.3 Animal Spay-Neuter Clinic

- 8.4 Banfield Pet Hospital

- 8.5 CVS Group Plc

- 8.6 Companions Spay & Neuter

- 8.7 Ethos Veterinary Health

- 8.8 Fix Long Beach

- 8.9 Holt Road Pet Hospital

- 8.10 Houston Humane Society

- 8.11 Indian Street Animal Clinic

- 8.12 Naoi Animal Hospital

- 8.13 Petco Animal Supplies

- 8.14 S/Nipped Clinic

- 8.15 The PAWS Clinic

- 8.16 VetPartners Group Limited