PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773254

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773254

Fog Computing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

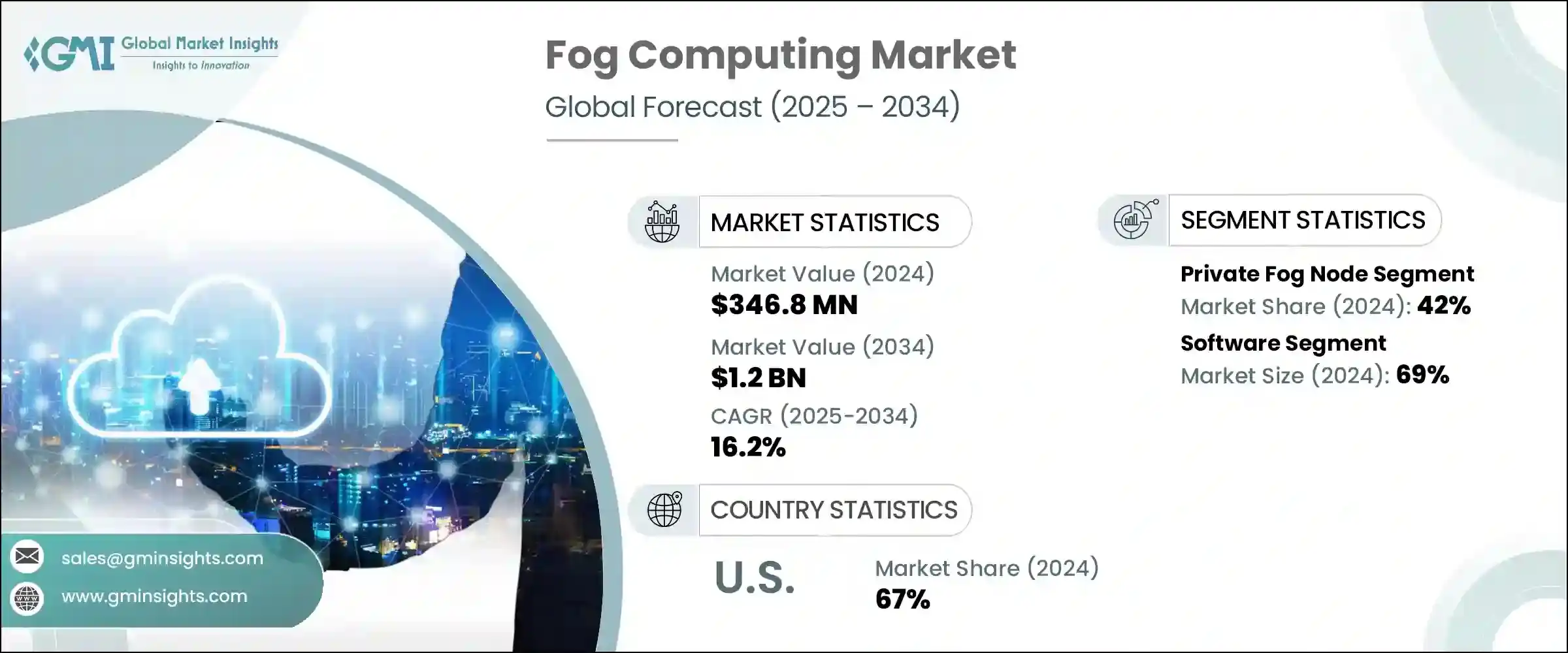

The Global Fog Computing Market was valued at USD 346.8 million in 2024 and is estimated to grow at a CAGR of 16.2% to reach USD 1.2 billion by 2034. This rapid expansion is being fueled by rising demand for low-latency communication, decentralized processing, and real-time analytics across industries such as telecom, manufacturing, smart infrastructure, and healthcare. As organizations continue to shift toward digital transformation, the need for efficient data handling closer to the source is growing. Fog computing plays a critical role by enabling faster data processing, reducing pressure on bandwidth, and enhancing decision-making through local computing resources. The increasing number of connected devices and the push for intelligent, scalable solutions are making fog computing a core component of modern edge-cloud architectures.

Fog computing enables local storage, analysis, and action, distinguishing itself from traditional cloud models by reducing the distance data must travel. As more organizations deploy edge systems, demand for flexible, real-time platforms that process data on-site without delays is accelerating. Industries relying on time-sensitive data, particularly where privacy and speed are key, are rapidly turning to fog computing as a dependable and secure infrastructure solution that bridges local operations and broader cloud systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $346.8 Million |

| Forecast Value | $1.2 Billion |

| CAGR | 16.2% |

Private fog node deployments segment 42% share and is projected to grow at a CAGR of 17.2% through 2034. These localized nodes give enterprises more direct control over infrastructure, offering tailored performance, security, and compliance solutions. Businesses managing critical operations or sensitive data, including those in healthcare, defense, and energy, continue to favor private nodes for their ability to handle confidential workloads independently and securely while ensuring data governance and reducing latency.

The software segment held a 69% share in 2024. As industry evolves from a niche technology to a key driver of edge intelligence, robust fog computing software becomes essential. Companies increasingly rely on orchestration tools, analytics platforms, and virtualization technologies that allow seamless management and deployment across complex edge ecosystems. These platforms support consistent performance across distributed infrastructures, streamlining operations for enterprises that rely on fast, accurate insights from their edge environments.

United States Fog Computing Market held a 67% share and generated USD 114.2 million in 2024. Strong digital infrastructure, a fast-moving innovation ecosystem, and growing enterprise demand for localized processing have positioned the country as a frontrunner in this space. Fog computing is now integral to operational strategies in sectors where real-time data is vital, offering a competitive advantage through improved efficiency and immediate response capabilities.

Major companies in the Fog Computing Market include Schneider, ARM Holdings, FogHorn, Cisco, Intel, Fujitsu, GE, Microsoft, IBM, and Dell. Companies in the fog computing sector are leveraging key strategies to enhance their market foothold. Strategic collaborations with edge device manufacturers and cloud service providers are helping vendors extend their reach and enable seamless integration across platforms.

Firms are heavily investing in R&D to develop advanced orchestration software, security protocols, and AI-powered automation for distributed environments. Customization of fog solutions for industry-specific use cases, especially in energy, healthcare, and manufacturing, is also on the rise. Many businesses are transitioning toward hybrid cloud-fog models to meet growing performance and compliance demands. Additionally, partnerships with governments and smart city developers are unlocking new deployment opportunities.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Vehicle

- 2.2.4 Technology

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of IoT devices

- 3.2.1.2 Growing demand for real-time data processing and analytics

- 3.2.1.3 Need for low-latency processing

- 3.2.1.4 Rise of 5G networks

- 3.2.1.5 Industry 4.0 adoption

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Lack of standardization

- 3.2.2.2 High initial costs

- 3.2.3 Market opportunities

- 3.2.3.1 IoT and edge device integration

- 3.2.3.2 Smart energy and utilities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Cost breakdown analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly initiatives

- 3.10.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Gateways

- 5.2.2 Routers & switches

- 5.2.3 IP video cameras

- 5.2.4 Sensors

- 5.2.5 Micro data sensors

- 5.3 Software

- 5.3.1 Fog computing platform

- 5.3.2 Customized application software

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 B Private fog node

- 6.3 Community fog node

- 6.4 Public fog node

- 6.5 Hybrid fog node

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Security

- 7.3 Intelligent energy

- 7.4 Smart manufacturing

- 7.5 Traffic & logistics

- 7.6 Connected health

- 7.7 Building & home automation

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 ADLINK

- 9.2 Amazon Web Services

- 9.3 ARM Holdings

- 9.4 Cisco Systems

- 9.5 Cradlepoint

- 9.6 Dell

- 9.7 FogHorn

- 9.8 Fujitsu

- 9.9 GE

- 9.10 Hitachi

- 9.11 Huawei

- 9.12 IBM

- 9.13 Intel

- 9.14 MachineShop

- 9.15 Microsoft

- 9.16 Nebbiolo

- 9.17 SAP

- 9.18 Schneider

- 9.19 Toshiba

- 9.20 Zebra