PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773260

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773260

Enterprise Mobility Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

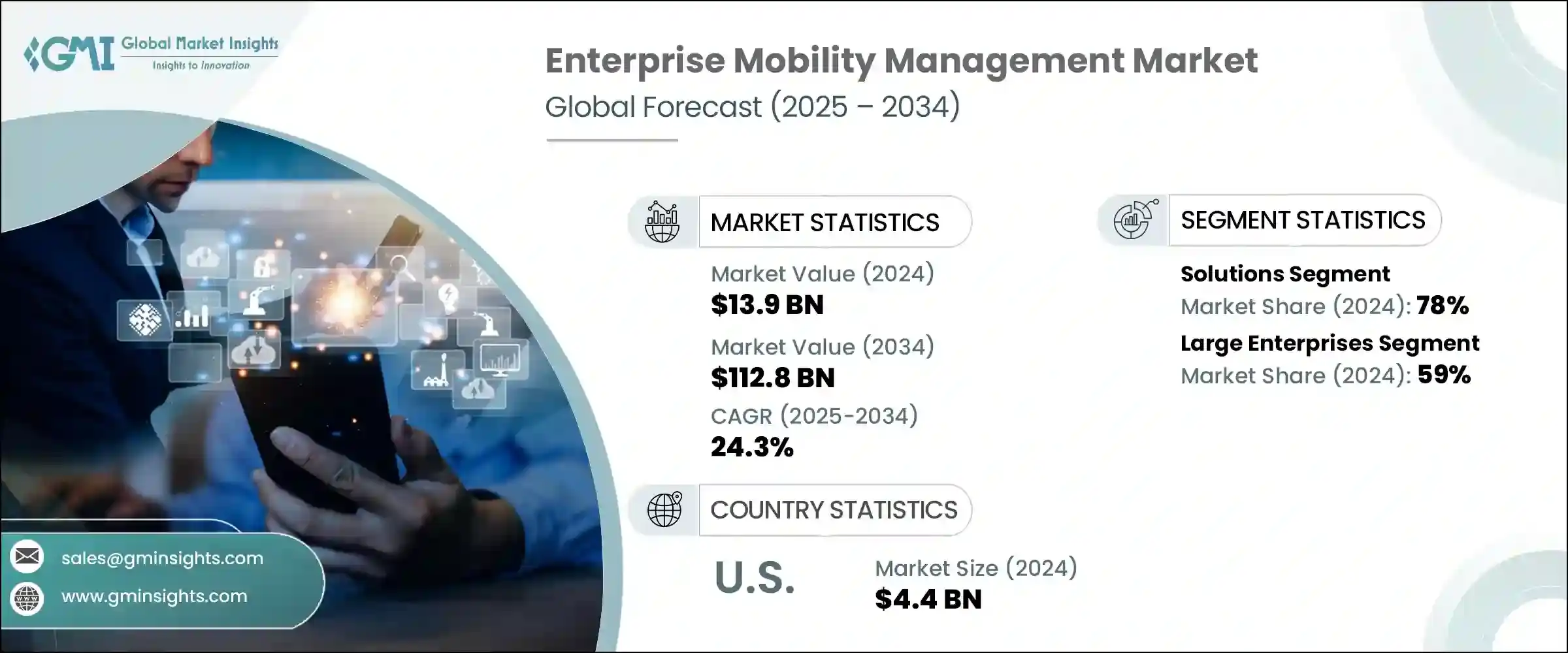

The Global Enterprise Mobility Management Market was valued at USD 13.9 billion in 2024 and is estimated to grow at a CAGR of 24.3% to reach USD 112.8 billion by 2034. The surge in smartphone, tablet, and laptop usage across workplaces is driving the need for robust EMM solutions. Companies are embracing mobile-first strategies as employees increasingly rely on both personal and corporate devices to work remotely, demanding seamless management and security for every endpoint. EMM platforms centralize device oversight, streamline connectivity, and enforce policies to safeguard sensitive data while ensuring smooth operations. The proliferation of bring-your-own-device (BYOD) programs has further accelerated demand for comprehensive, affordable EMM tools that can handle diverse devices securely and efficiently.

With the rise in cyber threats such as phishing, ransomware, and data breaches, organizations must strengthen mobile security to protect critical information. Compliance with regulations like GDPR, HIPAA, and CCPA has made data privacy more critical than ever, forcing businesses to adopt solutions that offer strong authentication, encryption, remote wiping capabilities, and early intrusion detection. EMM systems control access to corporate data and maintain detailed audit trails, reducing breach risks and easing compliance burdens. Growing security concerns and the potential for costly legal penalties have driven global adoption of unified, wide-ranging EMM platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.9 Billion |

| Forecast Value | $112.8 Billion |

| CAGR | 24.3% |

In 2024, the solutions segment held a 78% share and is projected to grow at a CAGR of 23% during 2025-2034. Modern mobility management platforms leverage artificial intelligence to automate device setup, enforce policies in real-time, detect emerging threats, and direct support where it's needed most. These platforms operate quietly in the background, deploying patches automatically, enforcing compliance without manual intervention, and flagging suspicious activities as they arise. This automation frees IT teams to focus on strategic initiatives rather than routine troubleshooting, increasing overall organizational efficiency.

The large enterprises segment held 59% share in 2024 and is expected to maintain a CAGR of 23% through 2034. Many top corporations have made unified endpoint management (UEM) the foundation of their mobility strategies, allowing IT staff to monitor laptops, smartphones, and IoT devices from a single dashboard. Demand surged as remote employees connected from various locations and frequently switched devices for different projects. By consolidating numerous EMM functions into one platform, UEM has improved productivity while reducing helpdesk workloads. Its promise of simplified security and reduced manual IT work has particularly appealed to firms focused on tightening governance and improving operational agility.

United States Enterprise Mobility Management Market held an 83% share in 2024, generating USD 4.4 billion. American companies rapidly adopted cloud-based EMM solutions alongside widespread BYOD policies to manage the complex mix of devices employees use. These tools effectively segregate personal and work data, control user permissions, and detect anomalies - core strengths of EMM platforms. This dynamic has fueled the rapid adoption of remote work technologies across the U.S., leaving other regions working to catch up.

Key players driving the Global Enterprise Mobility Management Industry include IBM, SAP SE, VMware, Microsoft, Cisco Systems, Jamf, and SOTI Inc. To strengthen their foothold in the EMM market, companies have focused on integrating artificial intelligence and machine learning to enhance threat detection and automate routine tasks. Strategic partnerships and acquisitions have expanded product portfolios and geographical reach, enabling firms to serve diverse enterprise needs more effectively.

Many providers prioritize cloud-native solutions, catering to the growing demand for scalable and flexible mobile management across distributed workforces. Customer-centric innovation, such as intuitive user interfaces and seamless cross-platform compatibility, helps improve adoption rates. By emphasizing compliance readiness and advanced security features, vendors position themselves as trusted partners in data protection.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment mode

- 2.2.4 Enterprise size

- 2.2.5 Operating system

- 2.2.6 Industry vertical

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Proliferation of mobile devices across enterprises

- 3.2.1.2 Shift towards remote and hybrid models

- 3.2.1.3 Rising cybersecurity concerns and data protection regulations

- 3.2.1.4 Integration with cloud-based infrastructure & SaaS application

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Integration complexity with legacy systems

- 3.2.2.2 User resistance and adoption barriers

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for unified endpoint management

- 3.2.3.2 Growth in regulated industries needs compliance-ready solutions

- 3.2.3.3 Expansion across emerging markets with BYOD and cloud adoption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

- 3.12 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Solutions

- 5.2.1 Mobile device management

- 5.2.2 Mobile application management

- 5.2.3 Mobile content management

- 5.2.4 Identity and access management

- 5.3 Services

- 5.3.1 Professional services

- 5.3.1.1 Consulting

- 5.3.1.2 Integration & deployment

- 5.3.1.3 Support & maintenance

- 5.3.1 Professional services

5.3.2. Managed services

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud-based

Chapter 7 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Small & medium-sized enterprises

- 7.3 Large enterprises

Chapter 8 Market Estimates & Forecast, By Operating System, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 iOS

- 8.3 Android

- 8.4 Windows

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Industry Vertical, 2021 -2034 (USD Million)

- 9.1 Key trends

- 9.2 IT & Telecom

- 9.3 BFSI

- 9.4 Healthcare

- 9.5 Retail & E-commerce

- 9.6 Manufacturing

- 9.7 Government & public sector

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 42Gears Mobility Systems

- 11.2 Baramundi Software

- 11.3 BlackBerry Limited

- 11.4 Cisco Systems

- 11.5 Citadel

- 11.6 Citrix Systems

- 11.7 IBM

- 11.8 Jamf

- 11.9 ManageEngine

- 11.10 Matrix42

- 11.11 Microsoft

- 11.12 Mitsogo

- 11.13 MobileIron

- 11.14 SAP SE

- 11.15 Scalefusion

- 11.16 Snow Software

- 11.17 Sophos

- 11.18 SOTI

- 11.19 VMware