PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773262

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773262

Drilling Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

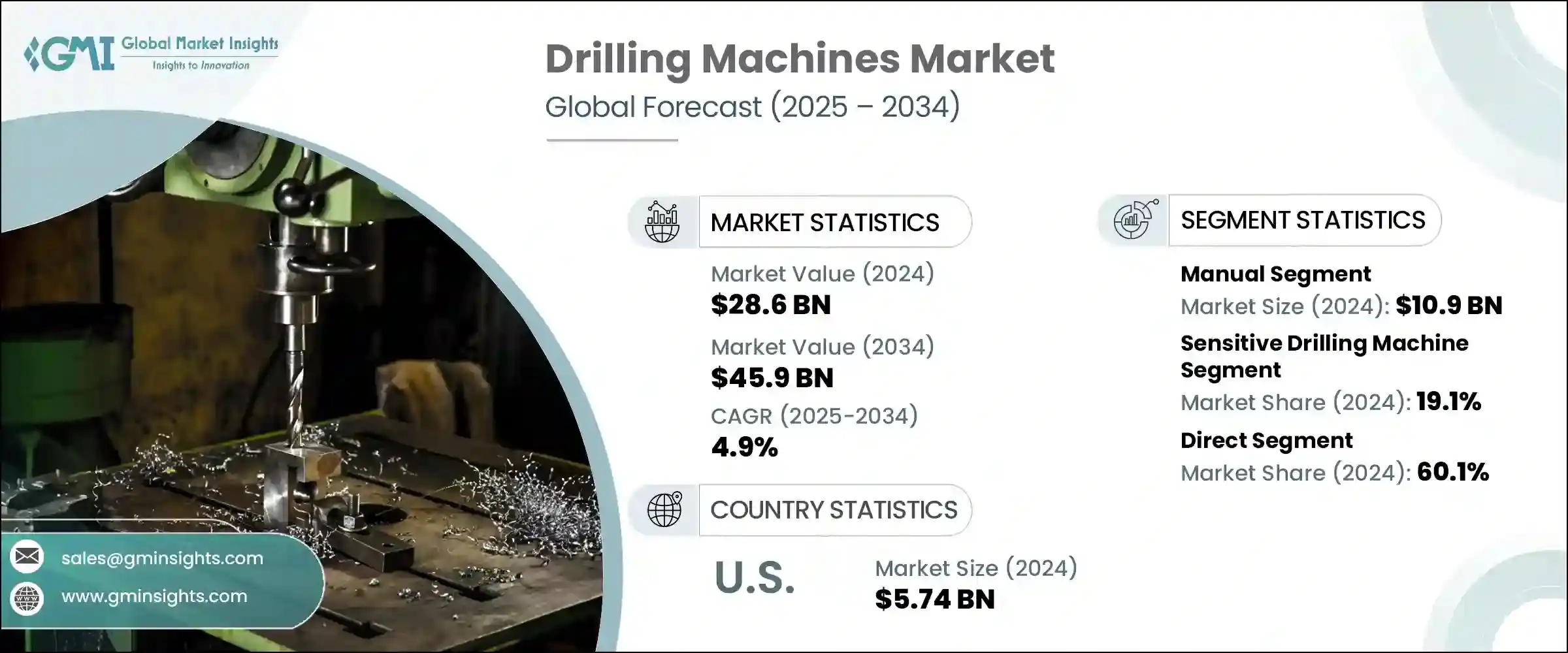

The Global Drilling Machines Market was valued at USD 28.6 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 45.9 billion by 2034. The ongoing evolution of smart manufacturing and rapid growth in industrial automation are fueling market expansion. CNC drilling machines, known for their precision and consistent output, are becoming essential components in smart factory environments. As Industry 4.0 and IoT-driven systems gain momentum across manufacturing industries, drilling machines are being enhanced with intelligent features such as real-time performance monitoring, remote system diagnostics, and predictive maintenance, all of which contribute to improved efficiency and reduced downtime.

Demand is also growing in construction-heavy regions, particularly due to robust infrastructure development and urban expansion in industrializing economies. These trends are influencing local manufacturers to produce more compact and cost-efficient machines that meet the unique needs of emerging markets. The industry's growth is further supported by the widening application base across sectors, improved access to advanced technology, and rising investment in digital manufacturing ecosystems. Combined, these dynamics are reshaping how drilling machines are used across global industrial supply chains and contributing to the sector's steady upward trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $28.6 Billion |

| Forecast Value | $45.9 Billion |

| CAGR | 4.9% |

With construction activities gaining momentum, there is a growing need for heavy-duty drilling solutions that can keep up with large-scale operations. Many developing markets are experiencing a surge in infrastructure upgrades, which is creating consistent demand for rugged, efficient machines. In response, manufacturers are focusing on building equipment that is not only durable but also adaptable to varying working conditions.

In 2024, manual drilling machines generated USD 10.9 billion and are expected to grow at a CAGR of 3.8% through 2034. Despite the surge in automation, manual drilling equipment remains essential in many industries due to its lower cost, flexibility, and ease of use. These machines are frequently utilized in regions with limited access to energy or where skilled labor costs remain low. They are often the first choice for smaller businesses, mobile workshops, and remote worksites where basic drilling operations are sufficient and advanced systems are not yet feasible. Their multifunctional nature and adaptability for basic operations make them a practical solution for everyday industrial and construction tasks in less-developed or infrastructure-poor environments.

The sensitive drilling machines segment accounted for a 19.1% share in 2024 and is forecasted to grow at a CAGR of 4.2% through 2034. These machines are favored for their precision, reliability, and suitability for light-duty applications requiring high levels of accuracy. They are extensively used in operations where space is limited and delicate handling is crucial. Because of their compact structure and straightforward maintenance, they are widely adopted in fields requiring meticulous hole placement and fine detailing. Emerging economies are increasingly investing in precision manufacturing, driving the need for these machines in educational workshops, small-scale fabrication units, and other sectors prioritizing affordable, high-performance tools.

United States Drilling Machines Market was valued at USD 5.74 billion in 2024 and is projected to grow at a CAGR of 4.7% between 2025 and 2034. With the country's continued investment in modern manufacturing practices and adoption of Industry 4.0 technologies, the demand for automated and intelligent drilling machines is growing significantly. The resurgence of domestic production capacity, coupled with expanding renewable energy initiatives and efforts to upgrade outdated infrastructure, is spurring consistent demand for a range of drilling systems. The U.S. also benefits from a robust supply chain, strong R&D investment, and early adoption of new technologies, which supports the integration of sophisticated and innovative equipment across manufacturing, energy, and industrial segments.

Major companies competing in the Drilling Machines Market include Cheto Corporation SA, Soilmec S.p.A., Minitool, Hitachi Construction Machinery Ltd, Mitsubishi Heavy Industries Ltd., Ingersoll Rand, Sandvik AB, Epiroc AB, KURAKI Co Ltd, SMTCL, Beretta S.r.l. P, ERLO Group, Bauer Maschinen GmbH, Robert Bosch GmbH, Caterpillar, Liebherr Group, Dezhou Hongxin Machine Tool Co Ltd, Shenyang Machine Tool Co Ltd, Atlas Copco, and Boart Longyear. To strengthen their market position, leading companies in the drilling machines industry are pursuing strategies such as expanding their product lines with next-generation machines featuring AI integration, IoT connectivity, and automation-friendly designs. Partnerships and joint ventures are being formed to access new regions and enhance distribution capabilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Automation Level

- 2.2.4 Operation

- 2.2.5 Application

- 2.2.6 End use

- 2.2.7 Structure

- 2.2.8 Power Source

- 2.2.9 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Industrial automation and smart manufacturing

- 3.2.1.2 Rising infrastructure and construction projects

- 3.2.1.3 Urbanization and industrialization in emerging economies

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Slow adoption in certain end use industries

- 3.2.2.2 Safety and operational hazards

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Sensitive drilling machine

- 5.3 Upright drilling machine

- 5.4 Radial drilling machine

- 5.5 Gang drilling machine

- 5.6 Deep hole drilling machine

- 5.7 CNC drilling machine

- 5.8 Multiple spindle drilling machine

- 5.9 Others (magnetic drilling machine)

Chapter 6 Market Estimates & Forecast, By Automation Level, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-Automated

- 6.4 Fully Automated

Chapter 7 Market Estimates & Forecast, By Operation, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Hole drilling

- 7.3 Tapping

- 7.4 Counterboring

- 7.5 Reaming

- 7.6 Spot facing

- 7.7 Others (Boring, Peck, Core)

Chapter 8 Market Estimates & Forecast, By Structure, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Fixed

- 8.3 Portable

Chapter 9 Market Estimates & Forecast, By Power Source, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Battery powered

- 9.3 Corded

Chapter 10 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Metal drilling

- 10.3 Wood drilling

- 10.4 Fiber & plastic drilling

- 10.5 Composite material drilling

- 10.6 Glass and ceramic drilling

- 10.7 Others (Medical implants & Surgical tools, PCB drilling (Micro drilling), etc.)

Chapter 11 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Aerospace

- 11.3 Heavy equipment

- 11.4 Automotive

- 11.5 Energy industry

- 11.6 Military & defense

- 11.7 Others

Chapter 12 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 Direct

- 12.3 Indirect

Chapter 13 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 South Korea

- 13.4.5 Australia

- 13.4.6 Indonesia

- 13.4.7 Malaysia

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.6 MEA

- 13.6.1 Saudi Arabia

- 13.6.2 UAE

- 13.6.3 South Africa

Chapter 14 Company Profiles

- 14.1 Atlas Copco

- 14.2 Bauer Maschinen GmbH

- 14.3 Beretta S.r.l. P

- 14.4 Boart Longyear

- 14.5 Caterpillar

- 14.6 Cheto Corporation SA

- 14.7 Dezhou Hongxin Machine Tool Co Ltd

- 14.8 Epiroc AB

- 14.9 ERLO Group

- 14.10 Hitachi Construction Machinery Ltd

- 14.11 Ingersoll Rand

- 14.12 KURAKI Co Ltd

- 14.13 Liebherr Group

- 14.14 Minitool

- 14.15 Mitsubishi Heavy Industries ltd.

- 14.16 Robert Bosch GmbH

- 14.17 Sandvik AB

- 14.18 Shenyang Machine Tool Co Ltd

- 14.19 SMTCL

- 14.20 Soilmec S.p.A.