PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773263

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773263

Refurbished Laptop Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

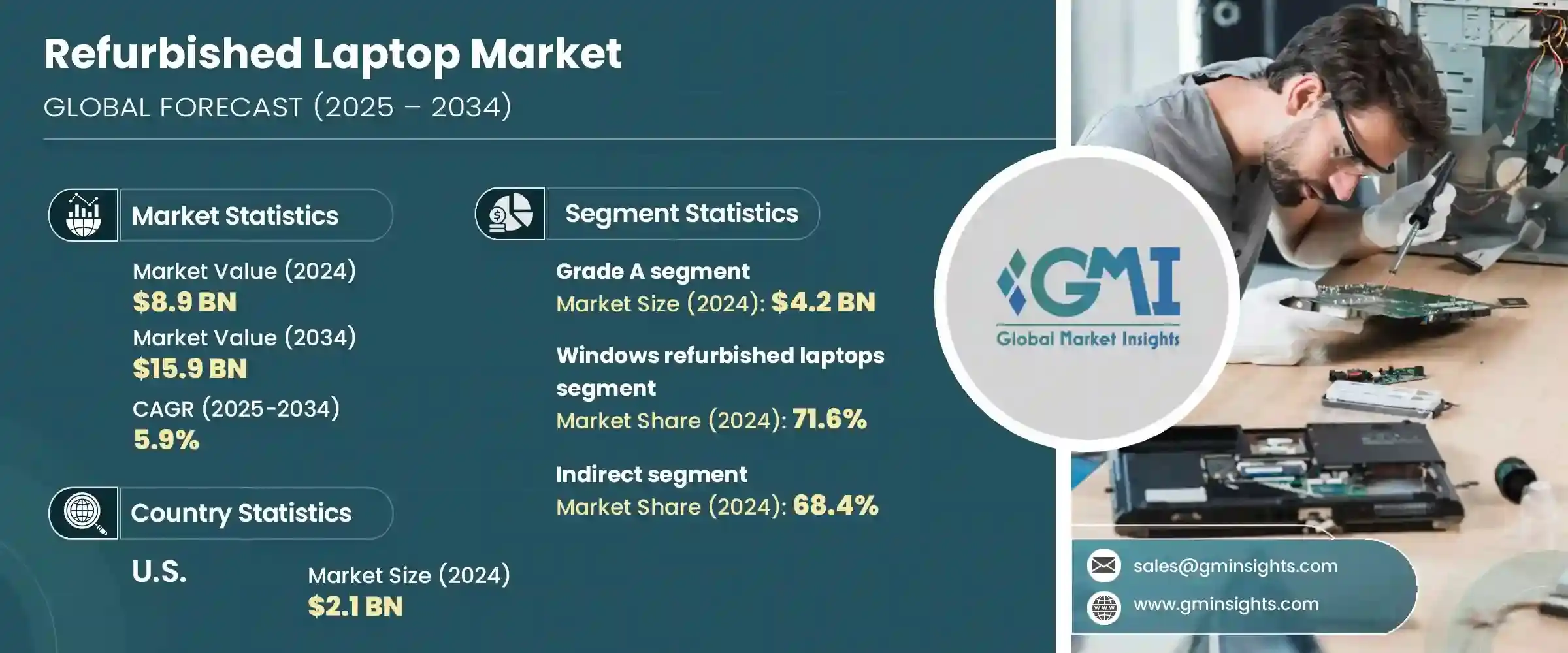

The Global Refurbished Laptop Market was valued at USD 8.9 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 15.9 billion by 2034. This market surge is primarily driven by small and medium-sized businesses (SMBs) and the education sector, both of which operate under tight budget constraints. Refurbished laptops, priced 30-50% lower than brand-new models, offer these organizations a cost-effective way to equip their workforce and students with reliable technology. The digital transformation accelerated by the COVID-19 pandemic increased demand for affordable computing devices, pushing institutions to seek budget-friendly alternatives. Additionally, refurbished laptops align well with sustainability goals, as they reduce electronic waste and lower carbon emissions. Higher standards in quality testing, extended warranties, and certified refurbishing processes have boosted consumer confidence.

The rise in hybrid learning, remote working, and Bring Your Own Device (BYOD) policies has significantly boosted the demand for refurbished laptops, making them an essential resource for SMBs and educational institutions alike. As more students and employees require flexible access to technology both at home and in the office, organizations are increasingly turning to cost-effective solutions that can support these new working and learning environments. This shift not only drives volume sales but also encourages continuous upgrades and replacements within limited budgets. Moreover, the flexibility and affordability of refurbished laptops enable schools and businesses to quickly adapt to changing needs without compromising on performance or reliability, reinforcing their role as key drivers of market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.9 Billion |

| Forecast Value | $15.9 Billion |

| CAGR | 5.9% |

In 2024, the grade A segment led the market generating USD 4.2 billion, and is anticipated to grow at a CAGR of 6.1% until 2034. These Grade A refurbished laptops attract buyers due to their like-new appearance, minimal wear, and reliable performance that rivals new devices. Consumers favor them for delivering cost savings without compromising quality or warranty coverage. This segment receives a steady influx of products from corporate off-lease returns and short-term business use. Industry data from trusted government sources corroborate the steady demand and supply in this high-grade category.

Refurbished laptops running on the Windows operating system segment dominated with a 71.6% market share in 2024 and are expected to grow at a CAGR of 6.1% by 2034. Windows remains the most widely used OS globally, especially in corporate and personal environments, which contributes to the abundance of Windows-based devices available for refurbishment. The variety of brands, models, and specifications under the Windows umbrella offers customers a broad spectrum of choices at different price ranges, enhancing its market dominance.

United States Refurbished Laptop Market generated USD 2.1 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2034. This region benefits from robust e-commerce infrastructure and a growing emphasis on affordable and environmentally friendly technology solutions. The competitive market caters to students, freelancers, and small businesses all seeking dependable yet budget-conscious devices. The U.S. market's leadership stems from widespread internet accessibility, digitally savvy consumers, and a strong network of IT asset disposition (ITAD) companies that ensure reliable sources of refurbished laptops.

Leading companies shaping the Refurbished Laptop Market include: TechSoup, Walmart Renewed, Lenovo Outlet, Dell Refurbished, Amazon Renewed, HP Renew, Arrow Direct, Refurbees, Newegg Renewed, Refurb That, TigerDirect Refurbished, Apple Certified Refurbished, Refurb.io, Laptop Outlet, and Back Market. To solidify their market presence, key players in the refurbished laptop industry focus on enhancing product quality through rigorous testing and certification, offering extended warranty packages that build consumer trust. They emphasize creating diverse product portfolios that cater to varying customer budgets and preferences while strengthening partnerships with corporate clients to secure off-lease devices. Companies are also leveraging advanced refurbishing technologies to improve performance and extend product lifecycles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Grade

- 2.2.3 Operating System

- 2.2.4 Screen Size

- 2.2.5 End use

- 2.2.6 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand in SMB and education sectors

- 3.2.1.2 Corporate IT asset disposal programs

- 3.2.1.3 E-commerce growth

- 3.2.1.4 OEM and certified Refurbisher involvement

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Consumer perception and trust issues

- 3.2.2.2 Rapid tech obsolescence

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation Landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By grade

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Grade, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Grade A

- 5.3 Grade B

- 5.4 Grade C

- 5.5 Grade D

Chapter 6 Market Estimates & Forecast, By Operating System, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Windows refurbished laptops

- 6.3 Mac refurbished laptops

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By Screen Size, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 11-13 inches

- 7.3 14-16 inches

- 7.4 17 inches and above

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Individual consumers

- 8.3 Businesses

- 8.4 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Amazon Renewed

- 11.2 Apple Certified Refurbished

- 11.3 Arrow Direct

- 11.4 Back Market

- 11.5 Dell Refurbished

- 11.6 HP Renew

- 11.7 Laptop Outlet

- 11.8 Lenovo Outlet

- 11.9 Newegg Renewed

- 11.10 Refurb That

- 11.11 Refurb.io

- 11.12 Refurbees

- 11.13 TechSoup

- 11.14 TigerDirect Refurbished

- 11.15 Walmart Renewed