PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773266

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773266

Medical X-ray Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

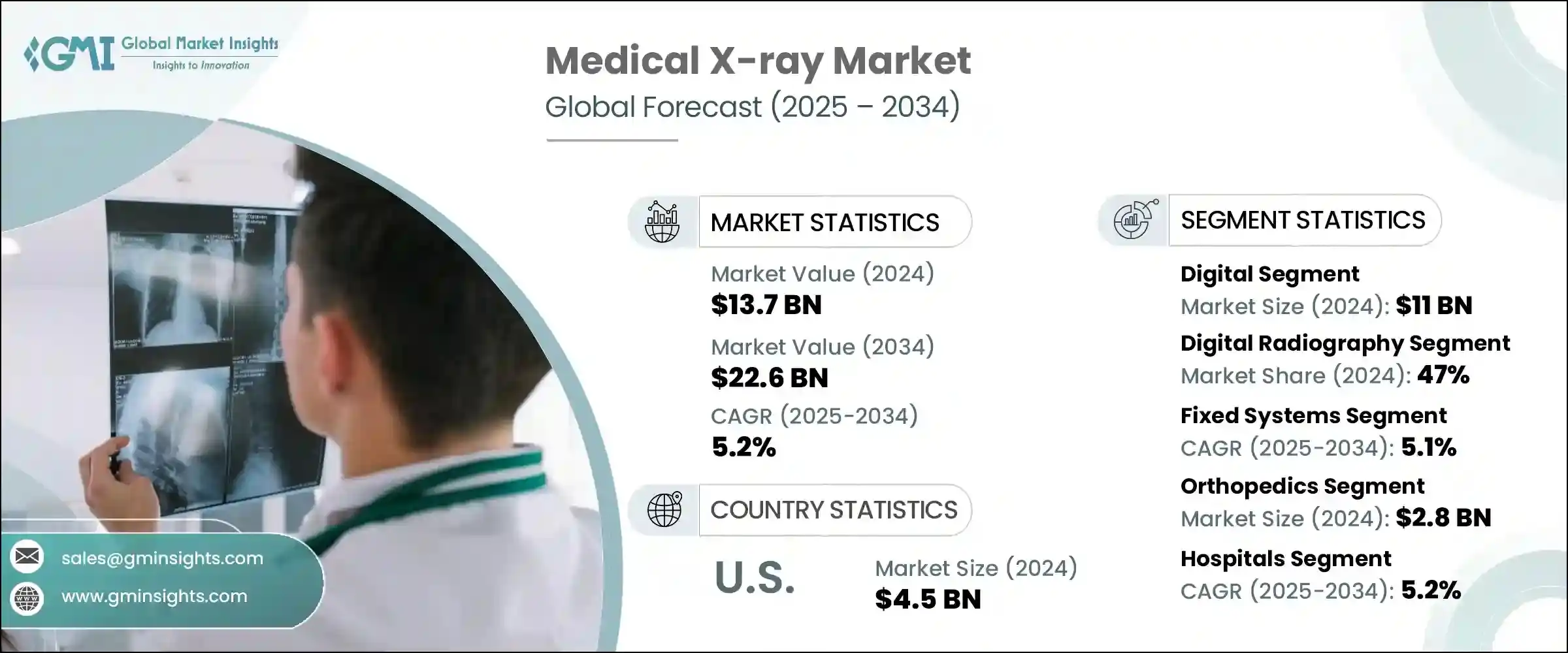

The Global Medical X-ray Market was valued at USD 13.7 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 22.6 billion by 2034. The demand for medical X-ray devices is primarily driven by the rising prevalence of chronic diseases, including cancer, cardiovascular issues, respiratory conditions, neurological disorders, and musculoskeletal problems. As more patients require early and precise diagnoses for these conditions, medical X-ray machines have become an essential diagnostic tool. X-ray imaging helps detect tumors, fractures, and abnormalities in bones, organs, and tissues. The growing and aging global population is also contributing to the rise in the need for diagnostic imaging, particularly for age-related conditions in elderly patients. These factors combine to fuel the market's expansion.

Additionally, medical X-rays play a vital role in diagnosing a wide range of chronic conditions and other medical issues. They provide high-resolution images of the body's internal structures, such as bones, organs, and soft tissues, which are essential for identifying fractures, tumors, infections, and abnormalities in various organs. These detailed images help physicians assess the severity of injuries or diseases, monitor ongoing treatments, and plan surgical interventions if necessary.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.7 Billion |

| Forecast Value | $22.6 Billion |

| CAGR | 5.2% |

Furthermore, X-ray technology is indispensable in early detection, allowing healthcare providers to identify problems before they develop into more serious health risks. Its non-invasive nature and ability to deliver precise results make it an indispensable tool for accurate diagnosis and effective treatment planning. With advancements in digital X-ray systems, image clarity, and diagnostic capabilities continue to improve, making it easier for doctors to make informed decisions about patient care.

The digital X-ray segment generated USD 11 billion in 2024 driven by technological innovations in digital systems. Digital X-ray devices offer superior imaging capabilities with high resolution and better contrast, critical for accurate diagnoses. Their ability to quickly capture and process images significantly reduces patient waiting times. Furthermore, advancements like AI-powered imaging solutions are increasing the efficiency and consistency of diagnostic results. These features contribute to the widespread adoption of digital X-ray technology across healthcare facilities. In terms of radiography, digital systems have become increasingly popular, mainly due to their integration with modern IT infrastructure, which improves data management and accessibility.

The hospital segment is expected to grow at a CAGR of 5.2% through 2034. The growth in the number of hospitals, both in developing and developed regions, is being driven by factors such as population growth, the increasing prevalence of chronic diseases, and advancements in medical imaging technologies. These factors are collectively fueling the demand for state-of-the-art medical X-ray systems, both in newly built hospitals and within existing healthcare facilities. Additionally, the expanding healthcare infrastructure in regions like the Middle East, Africa, and Asia Pacific is accelerating the adoption of advanced medical X-ray technologies in hospital settings.

Europe Medical X-ray market was valued at USD 3.8 billion in 2024. This growth can be attributed to the rising incidence of chronic diseases and the ongoing efforts by governments in the region to improve healthcare infrastructure. Additionally, advancements in X-ray technology, particularly in digital and portable systems, will further drive market growth in Europe. The presence of major market players in the region also strengthens Europe's competitive edge. Companies operating in the region are actively investing in innovative solutions and continuously upgrading their offerings, contributing to the overall expansion of the market.

The key players in the Global Medical X-ray market include a diverse range of companies such as Agfa-Gevaert Group, Allengers Medical Systems, Canon, Carestream Health, Dentsply Sirona, Fujifilm Holdings Corporation, GE Healthcare Technologies, Hologic, Koninklijke Philips N.V., Konica Minolta, Midmark, Neusoft Medical Systems, Perlong Medical Equipment, Samsung Electronics, Shimadzu, Siemens Healthineers, and Trivitron Healthcare. To solidify their position in the competitive medical X-ray market, companies are focusing on several strategic initiatives. They are heavily investing in research and development to bring advanced imaging solutions to the market, such as digital X-ray systems with AI capabilities that enhance diagnostic accuracy.

Additionally, companies are prioritizing the integration of their products with IT infrastructure, allowing for better data accessibility, storage, and management. Many players are also developing portable and wireless X-ray systems to offer greater flexibility and convenience to healthcare providers. Cost reduction through digital radiography solutions, which eliminate the need for traditional film processing, is another strategy being employed to appeal to cost-conscious institutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Market scope and definitions

- 1.3 Research design

- 1.3.1 Research approach

- 1.3.2 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Technology

- 2.2.4 Portability

- 2.2.5 Application

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements in diagnostic imaging in developed countries

- 3.2.1.2 Rising prevalence of chronic diseases worldwide

- 3.2.1.3 Growing number of diagnostic imaging procedures

- 3.2.1.4 Presence of reimbursement for medical x-ray procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of high radiation exposure

- 3.2.2.2 High cost associated with installation of medical imaging modalities

- 3.2.3 Market opportunities

- 3.2.3.1 Growing use of low-dose X-ray technologies to minimize radiation exposure while maintaining high image quality.

- 3.2.3.2 Increasing demand for AI-integrated X-ray systems to enhance image interpretation and reduce diagnostic errors.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Digital

- 5.3 Analog

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Film-based radiography

- 6.3 Computed radiography

- 6.4 Digital radiography

Chapter 7 Market Estimates and Forecast, By Portability, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Fixed systems

- 7.3 Portable systems

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Dental

- 8.2.1 Intraoral imaging

- 8.2.2 Extraoral imaging

- 8.3 Veterinary

- 8.3.1 Oncology

- 8.3.2 Orthopedics

- 8.3.3 Cardiology

- 8.3.4 Neurology

- 8.3.5 Other veterinary applications

- 8.4 Mammography

- 8.5 Chest

- 8.6 Cardiovascular

- 8.7 Orthopedics

- 8.8 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic centers

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Vietnam

- 10.4.5 South Korea

- 10.4.6 Thailand

- 10.4.7 Oceania

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Egypt

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Agfa-Gevaert Group

- 11.2 Allengers Medical Systems

- 11.3 Canon

- 11.4 Carestream Health

- 11.5 Dentsply Sirona

- 11.6 Fujifilm Holdings Corporation

- 11.7 GE HealthCare Technologies

- 11.8 Hologic

- 11.9 Koninklijke Philips N.V.

- 11.10 Konica Minolta

- 11.11 Midmark

- 11.12 Neusoft Medical Systems

- 11.13 Perlong Medical Equipment

- 11.14 Samsung Electronics

- 11.15 Shimadzu

- 11.16 Siemens Healthineers

- 11.17 Trivitron Healthcare