PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773270

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773270

Holter ECG Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

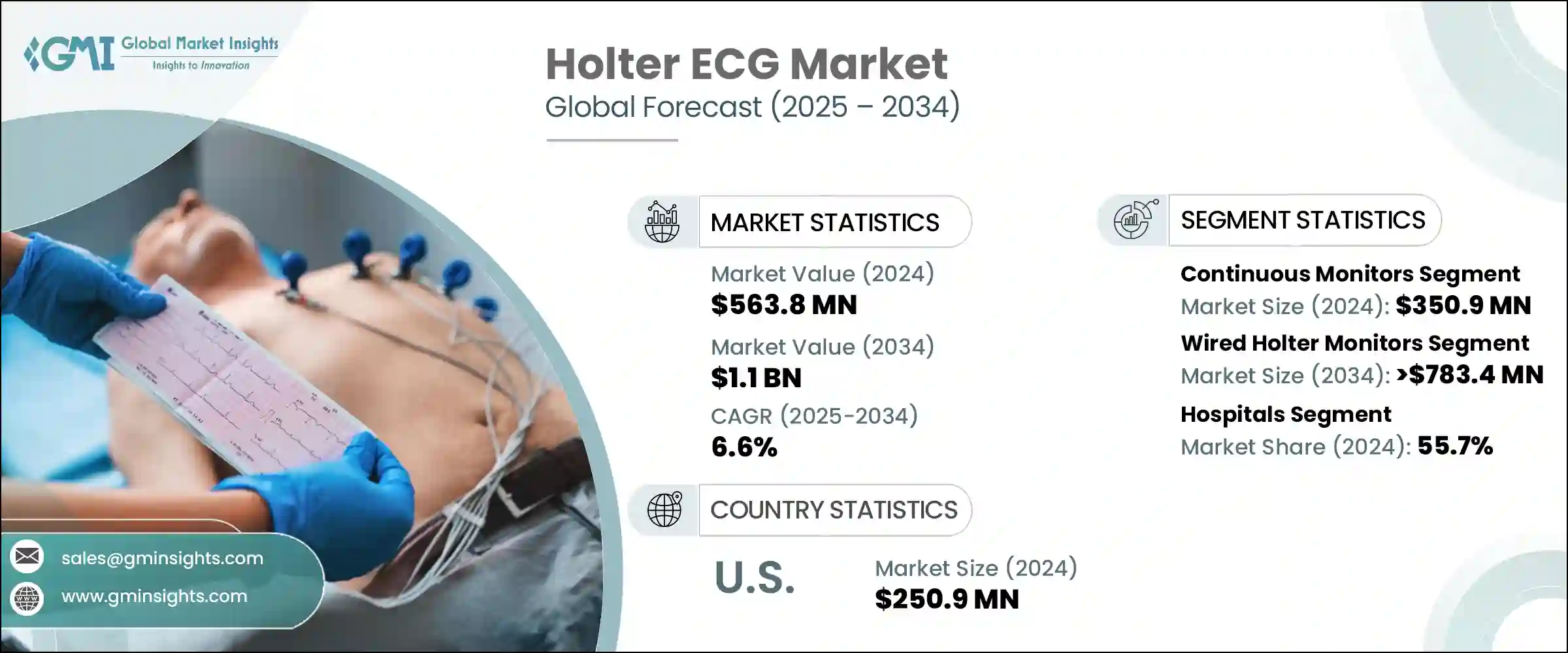

The Global Holter ECG Market was valued at USD 563.8 million in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 1.1 billion by 2034. This growth is largely fueled by the rising incidence of heart-related conditions, the increasing acceptance of less invasive monitoring technologies, and the growing demand for remote cardiac diagnostics. The surging number of individuals diagnosed with cardiovascular diseases worldwide continues to drive the need for sophisticated diagnostic solutions. With heart ailments contributing significantly to global mortality rates, early and accurate diagnosis has become a critical medical priority.

Demand for Holter ECGs is rising steadily as these devices help identify cardiac irregularities in both hospital and at-home settings. Technological progress has led to smaller, user-friendly devices with improved battery life and wireless features, enhancing usability for both healthcare providers and patients. These technological upgrades have made it easier to detect intermittent arrhythmia, increasing adoption. Remote patient monitoring trends and the availability of more wearable diagnostic devices have opened new doors for proactive health management. Combined with broader awareness and healthcare spending, these factors continue to accelerate the demand for Holter ECG devices across global markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $563.8 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 6.6% |

Holter ECGs are compact wearable systems that track heart rhythms for a defined duration. Electrodes are attached to specific parts of the chest and abdomen, linked to a portable monitor that continuously captures the heart's electrical activity. As newer technologies reshape healthcare delivery, these devices are seeing faster adoption not just in clinics but also in home-based cardiac monitoring setups. Advances in sensor design and microelectronics have led to discreet, long-wear monitors that remain hidden under clothing. These features significantly increase patient comfort and compliance, which are essential for effective cardiac rhythm assessment. These innovations also support physicians in detecting hard-to-catch arrhythmias and managing treatment more effectively. The appeal of extended-use devices lies in their ability to maintain high data quality while improving ease of use, making them an essential tool in modern cardiac care.

In 2024, the continuous monitoring segment brought in USD 350.9 million, dominating the Holter ECG landscape. Continuous Holter ECG devices deliver uninterrupted data for 24 to 48 hours or even longer, giving doctors an enhanced window to observe heart function. Their extended recording duration increases the likelihood of identifying sporadic rhythm disorders that would often go unnoticed in shorter evaluations. As a result, healthcare professionals often prefer them for thorough ambulatory cardiac assessment. These devices are often considered the primary option for initial evaluations of irregular heartbeat conditions. Due to their consistent use across both specialized cardiac practices and general medicine, continuous monitors have become an industry standard, contributing substantially to overall market development.

The wired Holter monitors segment is anticipated to witness a CAGR of 6% through 2034, reaching a market valuation of USD 783.4 million. These systems have long been trusted in cardiology for their robust performance and consistent data accuracy. Their low maintenance requirements and compatibility with digital hospital infrastructure make them a staple in many healthcare settings. These devices seamlessly integrate with patient data systems like ECG software, PACS, and archiving networks, which streamlines diagnostic workflows. Physicians rely on their proven reliability, which minimizes the chance of data gaps and ensures a clearer diagnosis of heart rhythm issues. While newer wireless options are emerging, wired solutions still retain strong market demand due to their dependable output and ease of integration into current hospital IT environments.

United States Holter ECG Market was worth USD 250.9 million in 2024 and is set to grow at a CAGR of 5.5% from 2025 to 2034. Adoption is especially robust among elderly populations and individuals living with chronic heart disease. Cloud-based platforms and AI-enhanced data interpretation tools have revolutionized the way cardiac conditions are monitored remotely. These digital enhancements allow for better management of patient data and improved clinical outcomes. Additionally, favorable reimbursement structures and the continuous launch of innovative products by local companies are contributing to the growth of Holter ECGs in the country. Preventive care initiatives, particularly those focusing on cardiovascular wellness, are further strengthening the market's position.

Major companies competing in the Holter ECG Market include GE HealthCare, SPACELABS HEALTHCARE, ScottCare, VIVALINK, PHILIPS, SCHILLER, iRHYTHM, FUKUDA, Bittium, and Baxter. To reinforce their position in the Holter ECG industry, key players are implementing strategies such as extensive product innovation, targeted acquisitions, and technology integration. Many are investing in AI-powered ECG interpretation tools to enhance diagnostic accuracy and support remote analysis. Companies are also expanding their geographic reach through strategic partnerships and collaborations with healthcare providers. Product portfolios are being diversified to include long-duration and wireless wearable monitors, tailored to meet rising consumer expectations for comfort and usability. Additionally, manufacturers are working to streamline compatibility with hospital IT ecosystems, ensuring seamless data sharing and interpretation. These approaches are helping brands to stay competitive and capture a larger share of this rapidly evolving market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Modality

- 2.2.4 End use

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cardiac diseases

- 3.2.1.2 Technological advancements

- 3.2.1.3 Growing adoption of minimally invasive devices

- 3.2.1.4 Surging preference for remote patient cardiac monitoring

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory policies

- 3.2.2.2 High cost of the Holter ECG

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of remote patient monitoring (RPM) and telecardiology

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 Reimbursement scenario

- 3.10 PESTEL analysis

- 3.11 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 By region

- 4.3.1.1 North America

- 4.3.1.2 Europe

- 4.3.1.3 Asia Pacific

- 4.3.1 By region

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Continuous monitors

- 5.3 Intermittent monitors

Chapter 6 Market Estimates and Forecast, By Modality, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Wired Holter monitors

- 6.2.1 3 lead Holter monitors

- 6.2.2 12 lead Holter monitors

- 6.2.3 Other wired Holter monitors

- 6.3 Wireless Holter monitors

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Baxter

- 9.2 Bittium

- 9.3 FUKUDA

- 9.4 GE HealthCare

- 9.5 iRHYTHM

- 9.6 PHILIPS

- 9.7 SCHILLER

- 9.8 ScottCare

- 9.9 SPACELABS HEALTHCARE

- 9.10 VIVALINK