PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773273

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773273

Veterinary Point of Care Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

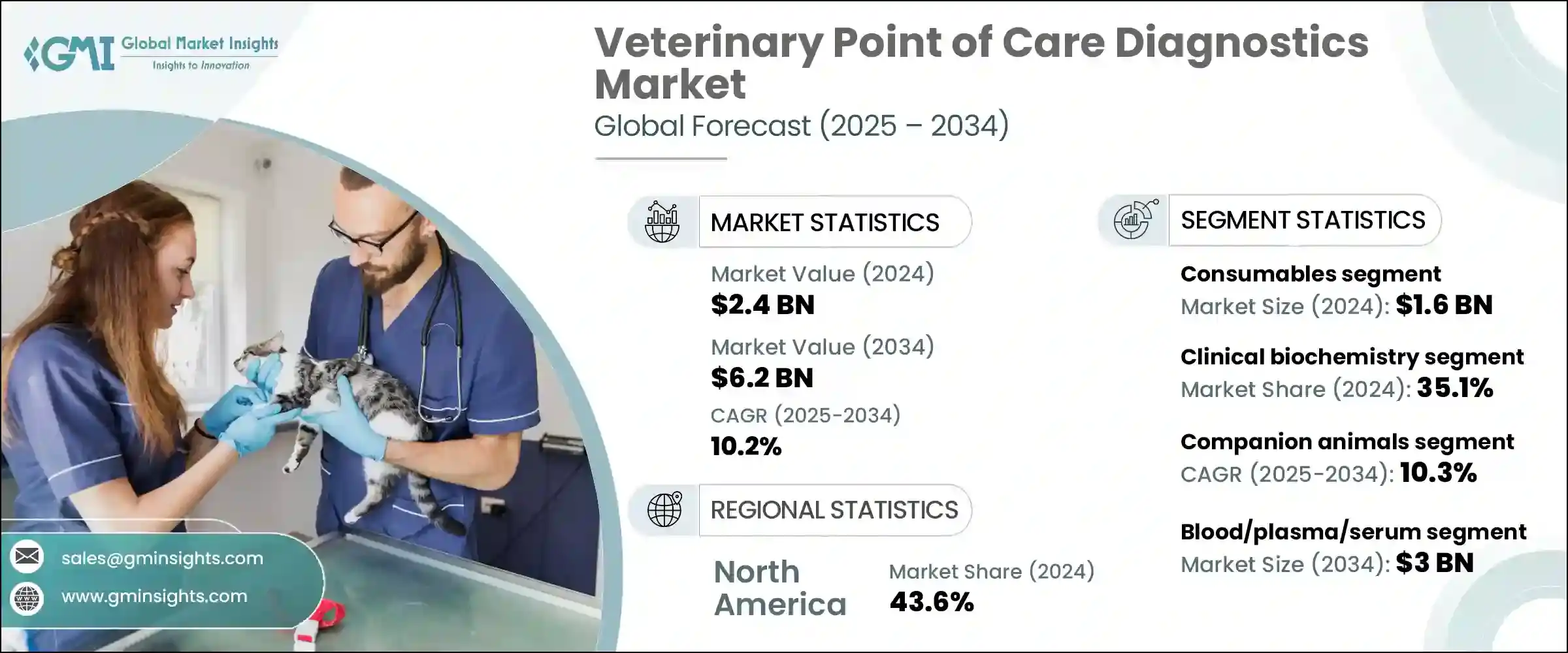

The Global Veterinary Point of Care Diagnostics Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 10.2% to reach USD 6.2 billion by 2034. The surge reflects increasing rates of infectious diseases in animals and the growing concern over zoonotic illnesses crossing between species. As pet ownership and livestock populations expand, the need for rapid, on-site testing has intensified. Clinics and labs are responding by deploying advanced diagnostic tools that boast quick results and portability, thanks in part to AI and IoT-enabled platforms that enhance accuracy and streamline animal health management.

Together with better access to veterinary care and rising pet insurance adoption, these trends are fueling confidence in point-of-care testing and accelerating market growth. As more pet owners prioritize preventive care and early disease detection, they are increasingly relying on rapid diagnostics available at the point of care for faster treatment decisions. This growing demand is encouraging veterinary clinics and hospitals to invest in advanced, portable diagnostic tools that provide accurate, real-time results without the delays of external lab testing. Additionally, the convenience and reliability offered by these tools are reinforcing the perception of quality care, making pet owners more willing to engage in regular veterinary checkups and health monitoring, thereby propelling sustained growth across the entire veterinary diagnostics sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $6.2 Billion |

| CAGR | 10.2% |

The consumables segment from the veterinary point-of-care diagnostics market generated USD 1.6 billion in 2024. They include cartridges, reagents, test kits, and assays-essential for each point-of-care procedure and necessitating frequent replenishment. This continuous requirement supports reliable recurring revenue as testing volumes climb. As clinics and hospitals expand, demand for portable and easy-use consumables grows, enabling immediate results and reduced waiting times, which pet owners and professionals appreciate.

The clinical biochemistry segment held a 35.1% share in 2024, driven by its central role in evaluating metabolism, organ function, infection, and inflammation. Tests in this segment include panels for liver, kidney, electrolytes, glucose, and sepsis biomarkers. Widespread adoption in veterinary clinics and labs underscores their importance in timely diagnosis and treatment, especially critical in emergency and chronic conditions.

Europe Veterinary Point of Care Diagnostics Market reached USD 605.8 million in 2024 and is poised for strong future growth. Rising awareness around rapid animal diagnostics, backed by government initiatives targeting zoonotic and livestock diseases, is accelerating adoption. Enhanced by innovations in microfluidics, immunoassays, and portable molecular testing, along with collaborations between diagnostic firms and veterinary organizations, the European market is advancing rapidly.

Key companies in the Veterinary Point of Care Diagnostics Market include IDEXX Laboratories, GE Healthcare, Zoetis, Thermo Fisher Scientific, Mindray, BioMerieux, Antech, FUJIFILM SonoSite, Eurolyser Diagnostics, Randox Laboratories, Carestream Health, Esaote, NeuroLogica, Biotangents, Virbac, Woodley Equipment. Diagnostic providers are strengthening their market foothold through product innovation, expanding partnerships, and strategic pricing. Companies prioritize R&D to enhance test sensitivity, portability, and integration with AI and cloud platforms. They forge alliances with veterinary clinics, animal health networks, and government agencies to expand distribution and embed solutions in standard care protocols. Bundling consumables with equipment and offering subscription or reagent-replenishment programs secures recurring revenues while maintaining clinician loyalty. Regional expansions and collaborations with local distributors enable customized solutions for diverse markets. Additionally, competitive pricing, bundled service contracts, and warranty schemes help differentiate offerings. A dual emphasis on technological excellence and customer support allows players to maintain relevance and capture share in a rapidly growing, outcome-driven sector.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Test type

- 2.2.4 Animal type

- 2.2.5 Sample type

- 2.2.6 Application

- 2.2.7 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for point of care diagnostics

- 3.2.1.2 Increasing animal healthcare expenditures

- 3.2.1.3 Rising prevalence of animal diseases

- 3.2.1.4 Advancements in diagnostics technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of POC diagnostic devices and consumables

- 3.2.2.2 Shortage of skilled veterinary professionals

- 3.2.3 Market opportunities

- 3.2.3.1 Rising companion animal ownership and pet humanization

- 3.2.3.2 Growing use of point of care in veterinary education and training

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Future market trends

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Number of veterinarians, by country, 2024

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Consumables

- 5.3 Instruments and devices

Chapter 6 Market Estimates and Forecast, By Test Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Clinical biochemistry

- 6.3 Immunodiagnostics

- 6.4 Molecular diagnostics

- 6.5 Hematology

- 6.6 Urinalysis

- 6.7 Other test types

Chapter 7 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Companion animals

- 7.2.1 Dogs

- 7.2.2 Cats

- 7.2.3 Horses

- 7.2.4 Other companion animals

- 7.3 Livestock animals

- 7.3.1 Cattle

- 7.3.2 Swine

- 7.3.3 Poultry

- 7.3.4 Other livestock animals

Chapter 8 Market Estimates and Forecast, By Sample Type, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Blood/plasma/serum

- 8.3 Urine

- 8.4 Fecal

- 8.5 Other sample types

Chapter 9 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Infectious diseases

- 9.3 Non-infectious conditions

- 9.4 Hereditary and congenital conditions

- 9.5 Acquired health conditions

- 9.6 Other applications

Chapter 10 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Veterinary hospitals and clinics

- 10.3 Diagnostic labs

- 10.4 Home care settings

- 10.5 Other end use

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Antech

- 12.2 BioMerieux

- 12.3 Biotangents

- 12.4 Carestream Health

- 12.5 Esaote

- 12.6 Eurolyser Diagnostica

- 12.7 FUJIFILM SonoSite

- 12.8 GE Healthcare

- 12.9 IDEXX Laboratories

- 12.10 Mindray

- 12.11 NeuroLogica

- 12.12 Randox Laboratories

- 12.13 Thermo Fisher Scientific

- 12.14 Virbac

- 12.15 Woodley Equipment

- 12.16 Zoetis