PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773312

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773312

Pressed and Blown Glass Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

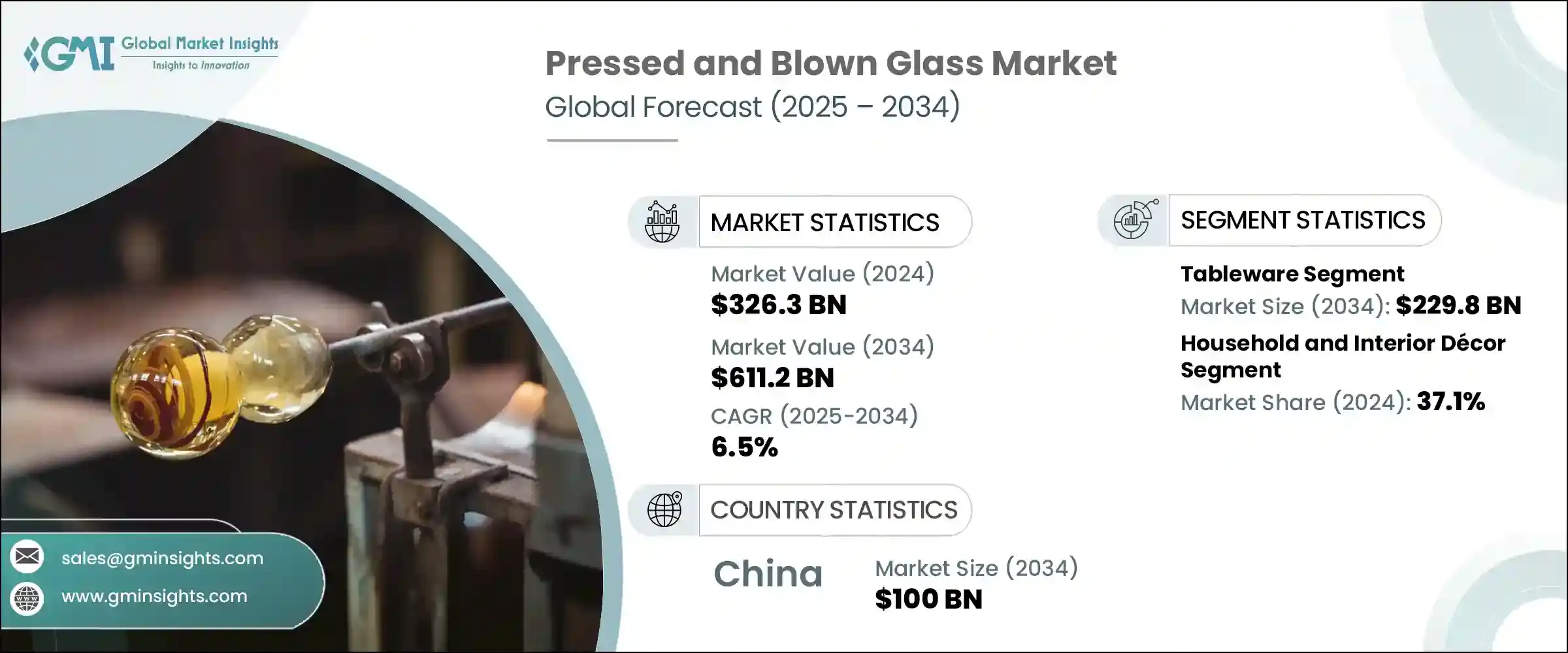

The Global Pressed and Blown Glass Market was valued at USD 326.3 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 611.2 billion by 2034. The market is being propelled by the evolution of molding technologies, expanding architectural applications, and heightened demand for decorative and packaging uses. Significant momentum is being generated in Asia-Pacific markets, where industrial expansion and growing consumer affluence are supporting glass product adoption across multiple verticals.

Glass is increasingly favored for its functional versatility and visual appeal in modern design, with shifting consumer preferences emphasizing both performance and aesthetics. In sectors like packaging and interiors, durable and recyclable glass materials are replacing less sustainable alternatives. Additionally, technological upgrades in automated blowing and pressing processes allow manufacturers to produce at scale while meeting custom requirements. Advanced tools like AI-integrated monitoring and robotic forming are gaining traction, improving production outcomes and quality control.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $326.3 Billion |

| Forecast Value | $611.2 Billion |

| CAGR | 6.5% |

European and North American operations have embraced automation, enhanced speed and efficiency, and helping companies meet rising consumer expectations. The market is further supported by ongoing investments in eco-conscious production methods, as the industry aligns itself with global sustainability goals. Blown glass is gaining traction due to rising demand for personalized and high-end decorative products. Meanwhile, pressed glass remains a dominant material in container manufacturing, playing a crucial role in industries such as pharmaceuticals, beauty, and beverages.

The tableware segment held the largest market share in 2024, generating USD 121.2 billion, and is projected to hit USD 229.8 billion by 2034, growing at a CAGR of 6.7%. Glass tableware-including drinkware, plates, and serving items-continues to be in high demand for its hygiene, thermal resistance, and long-term usability. The movement toward environmentally friendly dining habits is steering consumers away from plastics and ceramics. Design trends favoring artisan craftsmanship and minimal, transparent serveware have helped accelerate glass tableware sales in key markets such as North America and Europe.

The household and interior decor category captured a 37.1% share in 2024. This growth is being fueled by urban development, increased interest in modern living aesthetics, and custom orders for multifunctional decorative pieces. Items like glass vases, lighting fixtures, art pieces, and accent panels are seeing a rise in popularity, especially those that are handcrafted or sustainably produced. Consumer preference for long-lasting, eco-friendly interior elements is promoting greater use of both pressed and hand-blown designs across several regions including parts of Asia-Pacific, Europe, and North America.

China Pressed and Blown Glass Market generated USD 52.7 billion in 2024 and is expected to grow at a CAGR of 6.7%, reaching USD 100 billion by 2034. This expansion is tied to rising consumption, improvements in mechanized manufacturing, and a transition to more intelligent production systems. Chinese producers are placing greater emphasis on sustainability, integrating more recycled cullet into production to cut costs and minimize environmental impact. Younger generations are shaping trends in custom and digital glassware, fostering demand for unique aesthetics and functional elegance.

Leading players in the market include Krosno Glass S.A., Libbey Inc., Arc Holdings, Bormioli Rocco, and Pasabahce under the Sisecam Group. Major companies in the pressed and blown glass market are prioritizing technological integration to enhance productivity and reduce errors. Robotic forming systems and AI-powered quality inspection tools are being widely deployed to improve consistency and cut production time. To meet the growing demand for sustainable solutions, many firms are shifting toward using recycled raw materials and adopting energy-efficient processes. Investments in digital design platforms allow these brands to quickly prototype and customize products, catering to both industrial clients and design-conscious consumers. Strategic partnerships with designers and retail distributors further enable companies to stay ahead in style and function.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics(Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 LATAM

- 4.2.6 MEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.7 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Tableware

- 5.2.1 Drinking glasses

- 5.2.1.1 Tumblers

- 5.2.1.2 Stemware

- 5.2.1.3 Mugs and cups

- 5.2.1.4 Shot glasses

- 5.2.1.5 Others

- 5.2.2 Dinnerware

- 5.2.2.1 Plates

- 5.2.2.2 Bowls

- 5.2.2.3 Serving dishes

- 5.2.2.4 Others

- 5.2.3 Serveware

- 5.2.3.1 Pitchers and decanters

- 5.2.3.2 Trays and platters

- 5.2.3.3 Others

- 5.2.1 Drinking glasses

- 5.3 Containers

- 5.3.1 Bottles

- 5.3.1.1 Beverage bottles

- 5.3.1.2 Pharmaceutical bottles

- 5.3.1.3 Cosmetic and perfume bottles

- 5.3.1.4 Others

- 5.3.2 Jars

- 5.3.2.1 Food jars

- 5.3.2.2 Cosmetic jars

- 5.3.2.3 Others

- 5.3.3 Vials and ampoules

- 5.3.4 Others

- 5.3.1 Bottles

- 5.4 Decorative glass

- 5.4.1 Figurines and sculptures

- 5.4.2 Vases and bowls

- 5.4.3 Ornaments

- 5.4.4 Others

- 5.5 Lighting products

- 5.5.1 Lamp shades

- 5.5.2 Chandeliers and pendants

- 5.5.3 Others

- 5.6 Technical and industrial glass

- 5.6.1 Laboratory glassware

- 5.6.2 Technical components

- 5.6.3 Others

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Glass Type, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Soda-lime glass

- 6.3 Borosilicate glass

- 6.4 Crystal glass

- 6.4.1 Lead crystal

- 6.4.2 Lead-free crystal

- 6.5 Heat-resistant glass

- 6.6 Colored glass

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Manufacturing Process, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Press process

- 7.2.1 Single gob

- 7.2.2 Double gob

- 7.2.3 Triple gob

- 7.3 Blow process

- 7.3.1 Blow and blow

- 7.3.2 Press and blow

- 7.3.3 Narrow neck press and blow (NNPB)

- 7.4 Combined processes

- 7.5 Hand-crafted processes

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 Food and beverage

- 8.2.1 Alcoholic beverages

- 8.2.2 Non-alcoholic beverages

- 8.2.3 Food packaging

- 8.2.4 Others

- 8.3 Pharmaceutical

- 8.3.1 Packaging

- 8.3.2 Laboratory equipment

- 8.3.3 Others

- 8.4 Cosmetics and personal care

- 8.4.1 Perfumes and fragrances

- 8.4.2 Skincare products

- 8.4.3 Others

- 8.5 Household and interior decor

- 8.5.1 Tableware

- 8.5.2 Decorative items

- 8.5.3 Lighting

- 8.5.4 Others

- 8.6 Hospitality and foodservice

- 8.6.1 Hotels and restaurants

- 8.6.2 Bars and pubs

- 8.6.3 Catering services

- 8.6.4 Others

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 B2b/direct sales

- 9.2.1 Manufacturers to retailers

- 9.2.2 Manufacturers to wholesalers

- 9.2.3 Manufacturers to end use

- 9.3 Retail

- 9.3.1 Hypermarkets/supermarkets

- 9.3.2 Specialty stores

- 9.3.3 Department stores

- 9.3.4 Others

- 9.4 Online retail

- 9.4.1 Company websites

- 9.4.2 E-commerce platforms

- 9.4.3 Others

- 9.5 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Anchor Hocking LLC

- 11.2 Arc International

- 11.3 Ardagh Group S.A.

- 11.4 Beatson Clark Ltd.

- 11.5 Bormioli Rocco S.p.A.

- 11.6 Borosil Limited

- 11.7 Garbo Glassware Co., Ltd.

- 11.8 Gerresheimer AG

- 11.9 Glass Dynamics LLC

- 11.10 Kopp Glass, Inc.

- 11.11 Libbey Inc.

- 11.12 O-I Glass, Inc. (Owens-Illinois)

- 11.13 Piramal Glass Limited

- 11.14 Rayotek Scientific Inc.

- 11.15 Saverglass SAS

- 11.16 SCHOTT AG

- 11.17 Sisecam Group

- 11.18 Steelite International

- 11.19 Stoelzle Glass Group

- 11.20 Verallia

- 11.21 Vetropack Holding Ltd.

- 11.22 Vidrala S.A.

- 11.23 Vitro, S.A.B. de C.V.

- 11.24 Wiegand-Glas GmbH

- 11.25 Zwiesel Kristallglas AG