PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773314

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773314

Automotive Engine Cover Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

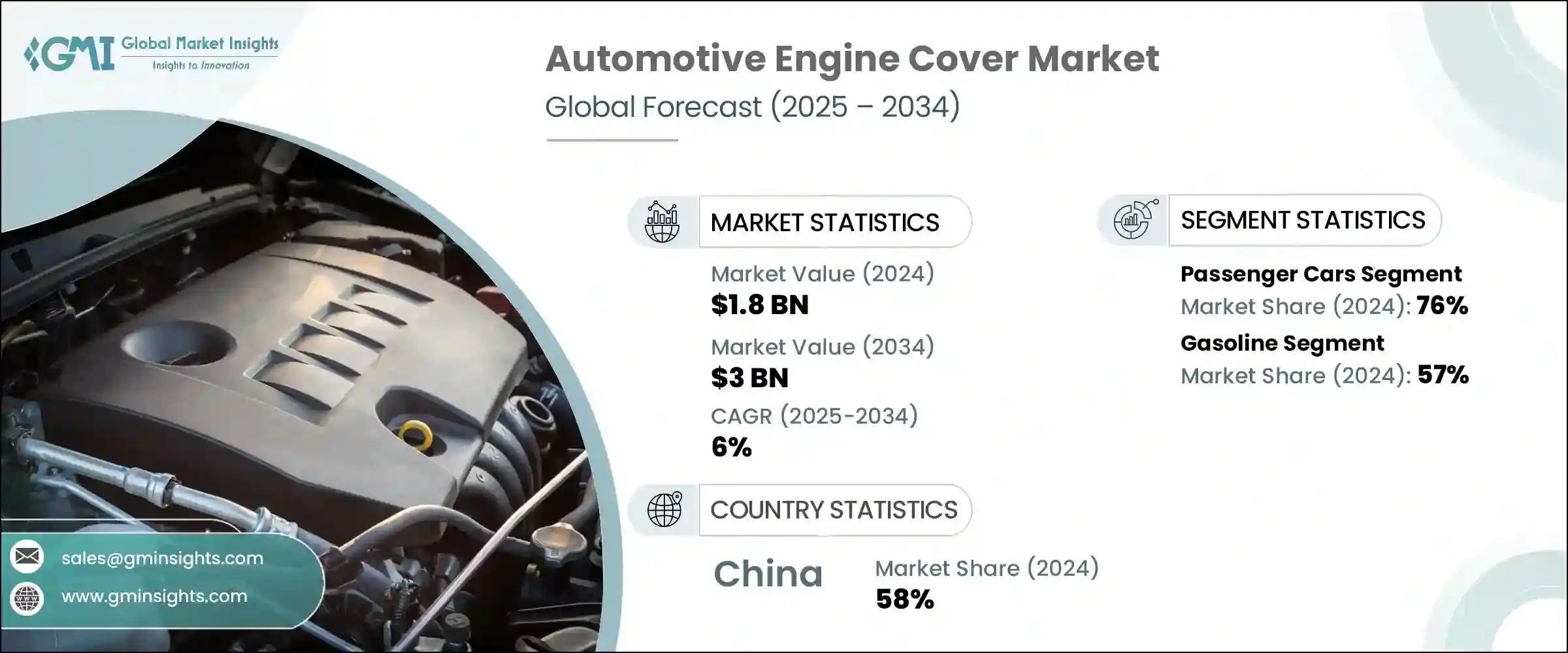

The Global Automotive Engine Cover Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 3 billion by 2034. This growth is driven by rising global vehicle production and the increasing need for lighter, more efficient automotive components. As industry shifts toward greater performance and fuel economy, engine covers have transformed from basic enclosures into key components that deliver thermal control, sound insulation, and visual cohesion with overall vehicle design. As both internal combustion and hybrid vehicle platforms continue to expand globally, engine covers are being engineered as critical elements in powertrain design across a wide range of models and applications.

The market is also seeing strong traction due to the shift toward advanced materials like composites and thermoplastics. These materials provide the right balance of durability, heat resistance, and weight reduction, enabling manufacturers to meet tightening emission regulations and fuel efficiency standards. Original equipment manufacturers and Tier-1 suppliers are adopting scalable, modular cover designs to support production across compact cars, sport utility vehicles, and light-duty trucks. These platforms help achieve uniform NVH (noise, vibration, and harshness) performance while accelerating time to market and reducing manufacturing complexity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3 Billion |

| CAGR | 6% |

The passenger cars segment held a 76% share in 2024 and is projected to grow at a CAGR of 6.8% through 2034. Engine covers have become essential components in the design of modern passenger vehicles, where tighter engine bays and higher engine outputs demand greater heat and noise management. Their integration into sedans, hatchbacks, and luxury vehicles is helping manufacturers enhance both performance and in-cabin experience. Lightweight thermoplastics and reinforced composites are used to create sleek, aerodynamic, and brand-aligned covers, combining insulation with premium aesthetics.

Gasoline-powered vehicles segment led the market with a 57% share in 2024 and is expected to register a CAGR of 7.1% through 2034. Despite the rise of electric mobility, gasoline engines continue to dominate production volumes in many regions. Engine covers in these vehicles are designed to manage high combustion heat and reduce engine noise while enhancing visual appeal. Manufacturers are turning to composite and polymer blends to offer optimized thermal shielding and lightweight benefits at lower production costs.

Asia Pacific Automotive Engine Cover Market held a 58% share and generated USD 553.1 million in 2024. The country's dominance is supported by its large-scale automotive manufacturing infrastructure, rising consumer demand, and active presence of global OEMs and domestic component manufacturers. Leading companies in China are focusing on producing thermoplastic and composite engine covers in high volume to support diverse vehicle platforms. Government policies encouraging local innovation and greener technologies are driving demand for lightweight, emission-reducing components. Local firms continue expanding through global partnerships to deliver custom-engineered engine cover systems aligned with next-gen mobility trends.

Key companies operating in this industry include Rochling Group, Denso Corporation, MAHLE GmbH, Woco Industrietechnik, Montaplast, Toyota Boshoku Corporation, Aisin Corporation, Valeo S.A., ElringKlinger, and Continental. Market players are leveraging advanced manufacturing technologies to deliver lightweight, durable engine covers that align with global fuel efficiency mandates. Companies are investing in material science innovation, particularly in thermoplastics and composite formulations, to enhance heat resistance while reducing weight. Strategic alliances with automakers help manufacturers align product development with evolving platform needs. Modular and scalable design approaches are increasingly adopted to support a variety of vehicle models, minimizing tooling costs and speeding up production cycles. Digital simulation and prototyping tools allow rapid customization, helping firms meet specific OEM standards and aesthetic requirements.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Propulsion

- 2.2.4 Material

- 2.2.5 Functionality

- 2.2.6 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global vehicle production

- 3.2.1.2 Increasing demand for lightweight components

- 3.2.1.3 Growth in Internal Combustion Engine (ICE) vehicles

- 3.2.1.4 OEM focus on component integration

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Design complexity with integrated powertrains

- 3.2.2.2 Raw material cost volatility

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in premium and luxury vehicle sales

- 3.2.3.2 Growing adoption of sustainable & recyclable materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Passenger cars

- 5.2.1 Sedans

- 5.2.2 Hatchbacks

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light duty

- 5.3.2 Medium duty

- 5.3.3 Heavy duty

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Electric

- 6.5 PHEV

- 6.6 HEV

- 6.7 FCEV

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Composites

- 7.3 Metals

- 7.4 Thermoplastics

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Functionality, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Aesthetic engine covers

- 8.3 Functional engine covers

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Aisin Corporation

- 11.2 Continental

- 11.3 Denso Corporation

- 11.4 ElringKlinger

- 11.5 Futaba Industrial

- 11.6 Hanil E-Hwa Automotive Systems

- 11.7 Magna International

- 11.8 MAHLE

- 11.9 Mann+Hummel

- 11.10 Montaplast

- 11.11 Motherson Sumi Systems

- 11.12 Plastic Omnium

- 11.13 Polytec Group

- 11.14 Rochling Group

- 11.15 Simoldes Plasticos

- 11.16 SRG Global

- 11.17 Toyota Boshoku Corporation

- 11.18 Valeo S.A.

- 11.19 Woco Industrietechnik

- 11.20 YAPP Automotive Systems