PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773316

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773316

Layer Palletizers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

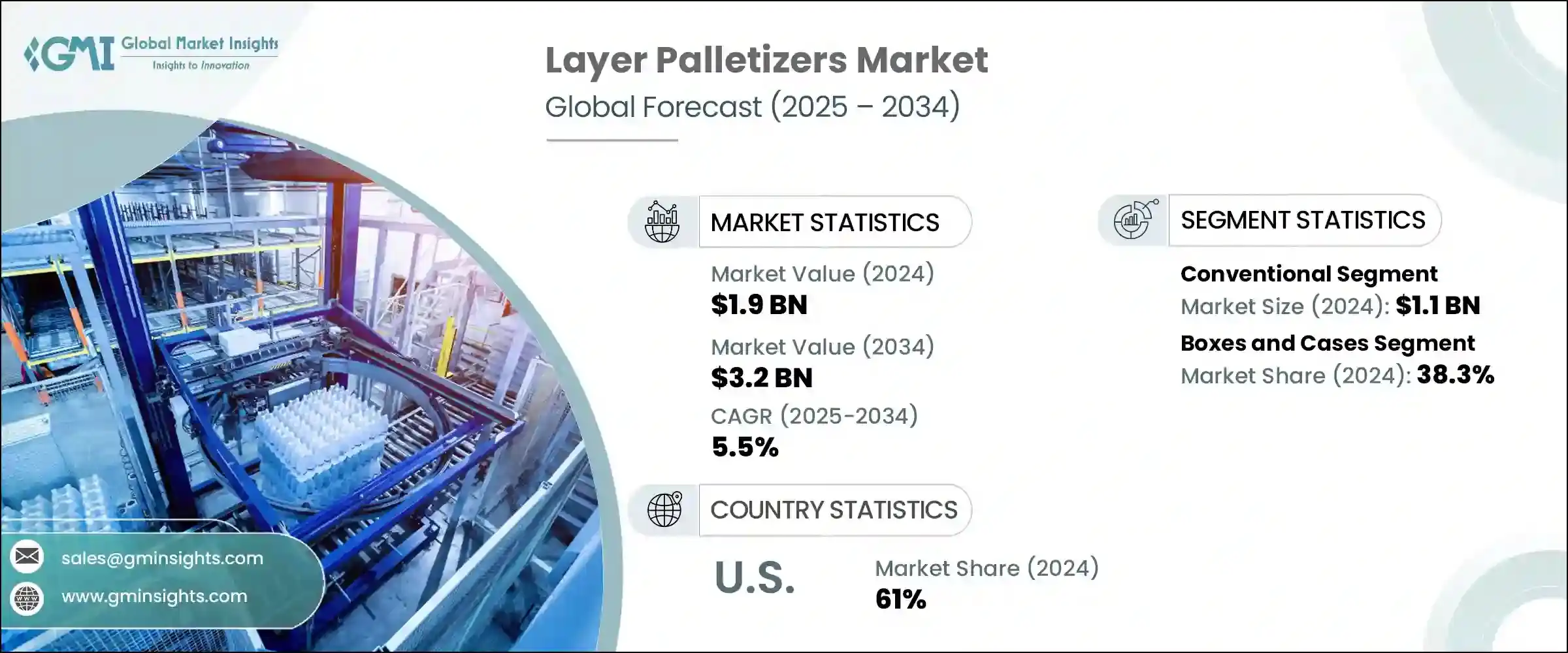

The Global Layer Palletizers Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 3.2 billion by 2034. Layer palletizers play a crucial role in organizing products on pallets for efficient transport, with widespread applications across logistics, supply chain, and storage operations. Over recent years, automated palletizing systems have increasingly replaced manual methods in warehouses and manufacturing facilities, driven by their ability to enhance efficiency, reduce product damage, and lessen physical strain on workers.

The growing global demand for automation and operational efficiency is fueling the expansion of this market. These machines carefully stack items such as boxes or bags into neat, stable layers, a process vital for streamlined distribution, storage, and transport across multiple industries. Key market drivers include rising labor expenses, an increased focus on workplace safety by minimizing manual handling, and the need for production lines to operate with greater speed and fewer errors. Manufacturers typically evaluate palletizers based on throughput capacity, adaptability to different product types, facility layout, and compatibility with existing conveyor and packaging systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 5.5% |

Technological advancements, especially in robotics, artificial intelligence (AI), and the Industrial Internet of Things (IIoT), are propelling the market forward. Modern layer palletizers boast enhanced flexibility, handling diverse product sizes and shapes while integrating seamlessly into existing production lines. This adaptability ensures manufacturers can meet evolving demands with greater precision and less downtime.

The conventional layer palletizers segment generated USD 1.1 billion in 2024. These systems build pallet loads by stacking goods such as crates and boxes layer by layer, with an upstream conveyor system aligning packages before placement. Conventional palletizers are particularly well-suited to small and medium-sized production facilities and meet the requirements of multi-channel markets. By automating the palletizing process with these advanced systems, businesses can address labor shortages, reduce downtime, and satisfy rising demand across sectors.

In 2024, the boxes and cases segment held a 38.3% share. Layer palletizers are especially effective for handling standardized rectangular or square cartons due to their uniform shape and rigidity. Boxes and cases serve numerous packaging needs across industries such as food and beverages, consumer goods, pharmaceuticals, and e-commerce. Their consistent shape and stackability enable fast, precise, and stable pallet formation, which is essential for efficient supply chains.

U.S. Layer Palletizers Market held a 61% share in 2024. High labor costs combined with workforce shortages for repetitive tasks such as palletizing are major factors driving demand in the U.S. A strong push towards industrial automation across manufacturing, logistics, and the booming e-commerce sector has encouraged widespread adoption of automated palletizing technologies. Companies in the U.S. invest heavily in these systems to boost efficiency, increase output, and maintain consistent product handling standards. Moreover, North America's market growth benefits from the presence of numerous established palletizer manufacturers and technology providers who continuously innovate and enhance product offerings.

Key players shaping the Global Layer Palletizers Market include Korber AG, BW Flexible Systems, Scott Automation, Premier Tech, PHS Innovate, Segbert Palletizing and Automation, COSMAPACK, TRAPO GmbH, Honeywell International Inc, SMB, Brolla, TMI, Mollers Packaging Technology GmbH, Concetti SpA, and Rane. To solidify their market positions, companies in the layer palletizers industry focus heavily on innovation and customization, developing solutions tailored to diverse industry needs and production scales. They invest in integrating cutting-edge robotics, AI, and IIoT capabilities to enhance system flexibility and efficiency. Collaborations with original equipment manufacturers (OEMs) and packaging solution providers allow them to offer comprehensive turnkey systems that seamlessly fit into existing lines. Firms also prioritize expanding their global footprint through strategic partnerships, localized manufacturing, and robust service networks to support customer requirements worldwide.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Capacity

- 2.2.4 Application

- 2.2.5 End Use Industry

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth of e-commerce and logistics

- 3.2.1.2 Rising demand from the food and beverages industry

- 3.2.1.3 Adoption of automation in various industries

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Limited flexibility for product variation

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 Conventional

- 5.2.1 Low/Floor level

- 5.2.2 High level

- 5.3 Robotic

Chapter 6 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Boxes and cases

- 7.3 Bags and sacks

- 7.4 Trays and crates

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Food and beverages

- 8.3 Pharmaceuticals

- 8.4 Consumer goods

- 8.5 E-commerce and logistics

- 8.6 Chemicals and materials

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Brolla

- 10.2 BW Flexible Systems

- 10.3 Concetti SpA

- 10.4 COSMAPACK

- 10.5 Honeywell International Inc

- 10.6 Korber AG

- 10.7 KUKA AG

- 10.8 Mollers Packaging Technology GmbH

- 10.9 PHS Innovate

- 10.10 Premier Tech

- 10.11 Scott Automation

- 10.12 Segbert Palletizing and Automation

- 10.13 SMB

- 10.14 TMI

- 10.15 TRAPO GmbH