PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773317

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773317

EV Battery Health Diagnostics System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

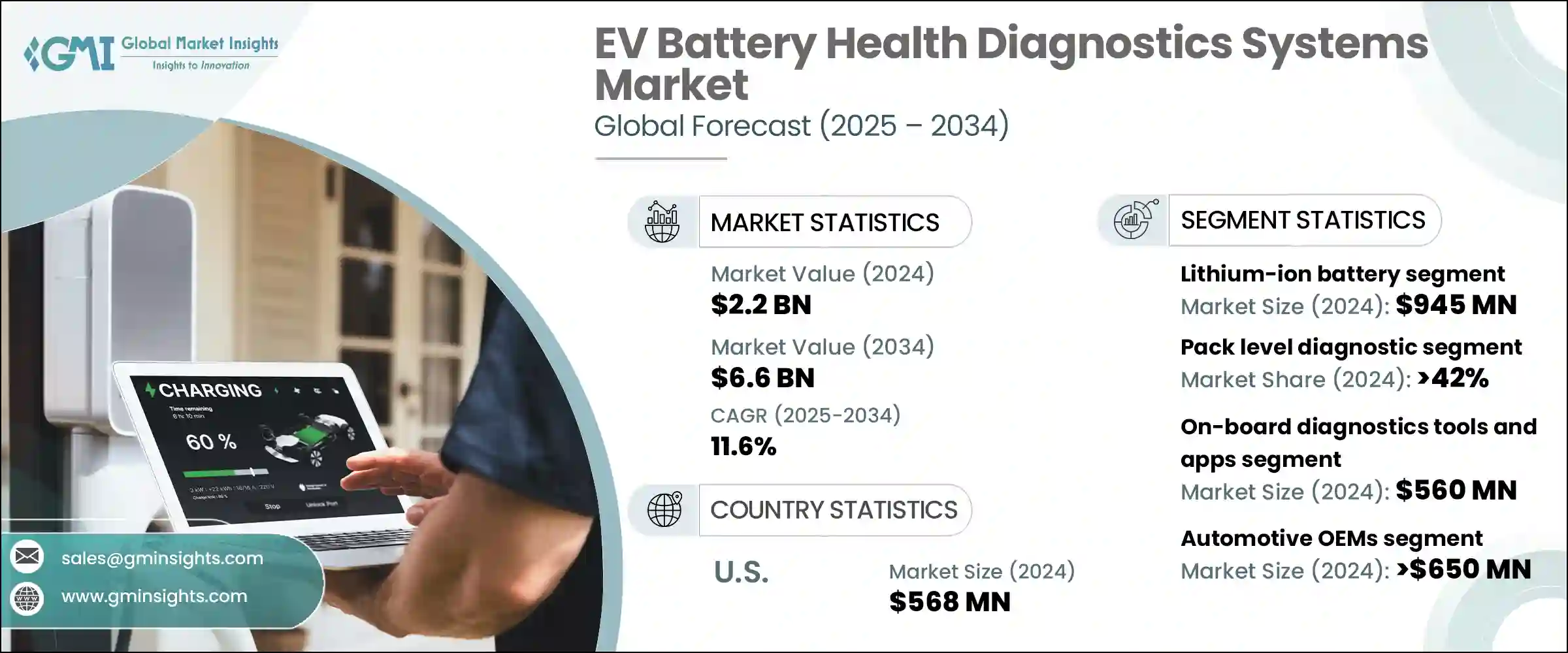

The Global EV Battery Health Diagnostics System Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 11.6% to reach USD 6.6 billion by 2034. This growth is primarily driven by the rapid expansion of electric vehicles (EVs) across personal and commercial transport sectors, alongside growing concerns about battery safety, performance, and longevity. As EV adoption accelerates, the importance of ensuring battery health has become critical for automotive manufacturers, fleet operators, and consumers alike.

With the high cost of batteries being a significant investment for EVs, real-time diagnostics to monitor battery health and performance is essential. Advanced diagnostic systems, powered by AI and IoT technologies, play a pivotal role in reducing the overall maintenance costs associated with electric vehicles (EVs). These systems enable real-time monitoring of battery health, performance, and efficiency, allowing for timely interventions and predictive maintenance. By detecting potential issues before they escalate into major problems, these diagnostic tools help optimize the longevity of EV batteries, thereby cutting down on expensive repairs and replacements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $6.6 Billion |

| CAGR | 11.6% |

Moreover, these smart diagnostics systems streamline warranty management by providing precise data on battery health and performance, making it easier for fleet operators and manufacturers to manage warranty claims effectively. The ability to track and diagnose potential issues remotely ensures faster response times and more accurate claim assessments.

The lithium-ion battery segment held a 40% share and was valued at USD 945 million in 2024. Lithium-ion batteries have gained widespread use due to their superior energy density, longer cycle life, and exceptional performance compared to other battery chemistries. This popularity has led to the increased adoption of advanced diagnostics technologies that monitor key performance metrics like state of charge (SOC), state of health (SOH), and thermal performance. Additionally, their compatibility with AI-based cloud platforms and over-the-air (OTA) diagnostics has strengthened their dominance in the market.

The pack-level diagnostics segment held a 42% share in 2024 and is expected to grow at a CAGR of 10.5% during 2025-2034, driven by the cost-effective and scalable diagnostic solutions for both mass-market and commercial EVs. Pack-level diagnostics track critical parameters such as voltage, temperature, and current flow, offering an overall view of the battery's condition. This approach is vital for detecting early-stage failures, such as thermal runaway, voltage imbalances, and energy misuse, all of which are crucial for vehicle safety, efficiency, and range.

U.S. EV Battery Health Diagnostics System Market held a 75% share and generated USD 568 million in 2024. With rapid developments in the EV ecosystem and federal support aimed at electrifying fleets, the U.S. market is poised for further growth. Consumer demand for transparency in battery performance, as well as safety and reliability, is driving the need for accurate and timely diagnostics. The U.S. government's incentives, such as The Inflation Reduction Act, combined with funding for battery production and secondary use applications, have further fueled the push for innovation in diagnostics systems, especially cloud-based and AI-powered technologies.

The top companies in the EV Battery Health Diagnostics System Market include AVL, Mahle, Exide Technologies, Forvia Hella, Cox Automotive, LG Energy Solutions, and Delphi. To strengthen their position in the EV battery diagnostics market, companies are focusing on integrating advanced technologies such as AI, IoT, and cloud-based platforms into their solutions. This helps to provide real-time, precise diagnostics that enhance battery performance and lifespan. Companies are also expanding their product offerings, including advanced pack-level and cell-level diagnostics, to meet the evolving needs of OEMs and fleet operators.

Partnerships with automakers and fleet management companies allow these players to develop customized solutions tailored to specific customer needs. Furthermore, companies are investing heavily in R&D to innovate in battery diagnostics and improve system accuracy, scalability, and efficiency. Finally, offering comprehensive after-sales services and building strong customer relationships through direct sales channels have become essential strategies for strengthening the market foothold.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Battery type

- 2.2.3 Diagnostic type

- 2.2.4 Service model

- 2.2.5 Diagnostic model

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Market Opportunities

- 3.3 Growth potential analysis

- 3.4 Porter's analysis

- 3.5 PESTEL analysis

- 3.6 Technology & innovation landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Regulatory landscape

- 3.8.1 North America

- 3.8.2 Europe

- 3.8.3 Asia Pacific

- 3.8.4 Latin America

- 3.8.5 Middle East & Africa

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Sustainability analysis

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New Product Launches

- 4.5.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Lithium-ion battery

- 5.3 Lead-acid battery

- 5.4 Nickel-metal hydride battery

- 5.5 Solid-state battery

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Diagnostic, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cell-level diagnostic

- 6.3 Module-level diagnostic

- 6.4 Pack-level diagnostic

Chapter 7 Market Estimates & Forecast, By Service Model, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 In-house diagnostic systems

- 7.3 Third-party lab testing services

- 7.4 Cloud-based platform/APIs

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Diagnostic Method, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Electrochemical impedance spectroscopy

- 8.3 Voltage and current monitoring

- 8.4 Thermal imaging/sensors

- 8.5 AI-based predictive analytics

- 8.6 On-board diagnostics tools and apps

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Automotive OEM

- 9.3 Battery manufacturers

- 9.4 Fleet operators

- 9.5 EV service stations

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 North America

- 10.1.1 U.S.

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Russia

- 10.2.7 Nordics

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 South Korea

- 10.3.5 Australia

- 10.3.6 Southeast Asia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Accure Battery Intelligence

- 11.2 Autel

- 11.3 Aviloo

- 11.4 AVL

- 11.5 Battery OK Technologies

- 11.6 Cellife Technologies

- 11.7 Cox Automotive

- 11.8 Delphi

- 11.9 Exide Technologies

- 11.10 Forvia Hella

- 11.11 HEI Corporation

- 11.12 Infinitev

- 11.13 LG Energy Solutions

- 11.14 Mahle

- 11.15 Midtronics

- 11.16 My Battery Health

- 11.17 SG Software GmbH

- 11.18 SK On

- 11.19 Twaice

- 11.20 Volytica Diagnostics